Friday's Gains Return Challenge On Tuesday's Reversal

There was a solid finish on Friday across all lead indices which did much to undo the prior two days of selling and push indices into a challenge of Tuesday's topping patterns. The accompanying higher volume was the result of options expiration, but for recent days where we have see higher volume, it has come from the buy side.

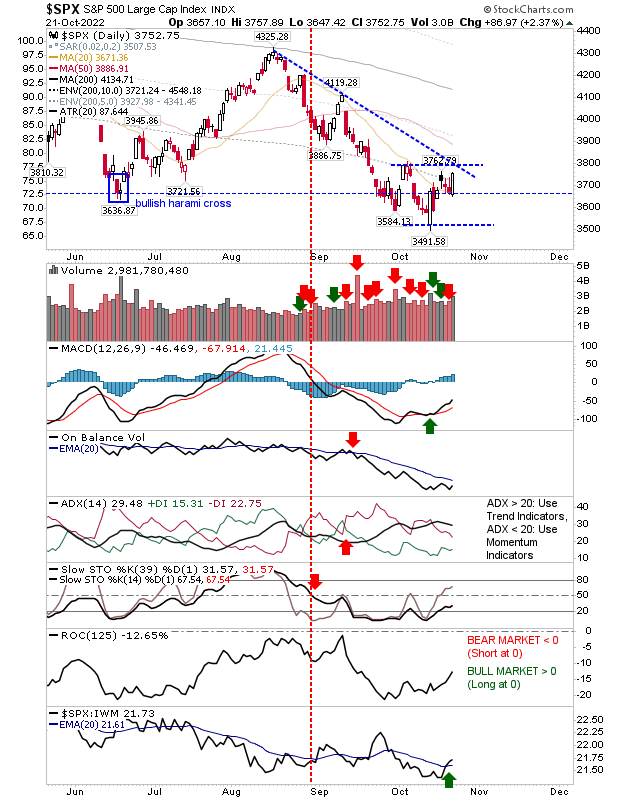

The S&P was able to initiate its gain from its 20-day MA, but the real fun will come if it's able to close above 3,800. There is a MACD trigger 'buy' to work with - although it's a weak signal because it's below the bullish zero line. Other technicals are negative, including a sharp drop in the On-Balance-Volume trend.

The Nasdaq is doing a little better as its clears the downward channel with an 'edge' breakout. It has a MACD trigger 'buy' like the S&P, and while On-Balance-Volume is also trending lower it's not far from a new 'buy' trigger.

The Russell 2000 also edged a breakout from its declining channel. Thursday's weak close had opened up the possibility for a fresh challenge (and likely break below) $162.50 (IWM), but instead we are now looking for a move above $177, which would effectively confirm the trading we have seen since late September as a bullish consolidation breakout. Technicals are in better shape than the other indices, with 'buy' signals in the MACD, On-Balance-Volume and ADX, plus a rising trend in relative performance to peer indices.

For the coming week we will want to see indices build on Friday's gain. It will be important that the 'black' candlesticks we saw earlier in the week, which signalled a reversal for the initial move off the bottom, are negated by a close above their high. Then, we will want to see a close above the last swing high. This will set up the required sequence of higher highs and higher lows. Let's see what happens.

More By This Author:

Russell 2000 Feels The Heat

Black Candlesticks Are Bearish, But Buyers Are Building An Advantage

Selling Inevitable, But Russell 2000 Retains Support

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more