Black Candlesticks Are Bearish, But Buyers Are Building An Advantage

It was a day when markets closed below their open, but above yesterday's close; this setup is typically bearish and shows as a black candlestick in a chart. The problem is that buyers have been building a nice edge since the big bullish engulfing patterns from last week. The expectation for tomorrow is a day of selling - so if this doesn't happen then bulls can look to the rest of the week with optimism.

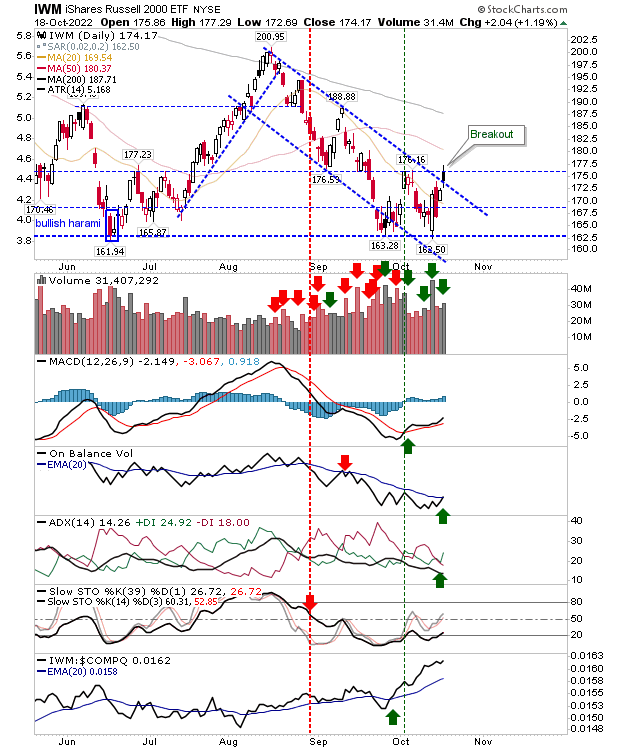

The Russell 2000 is the index to watch. In addition to today's gain it also managed a break from the declining channel on higher volume accumulation. Technicals have shifted more in favor of bulls with 'buy' signals in the MACD, On-Balance-Volume, and the ADX with sharp gains in relative performance to peer indices.

The Nasdaq was contained by channel resistance but it did manage a close above the 20-day MA. There was no confirmed accumulation as in the Russell 2000, but there was at least a close above June swing low support.

The S&P managed to recover June swing lows and a return above its 20-day MA, but it hasn't managed to make it too declining resistance. Technicals haven't changed from yesterday with only the MACD on a 'buy' trigger.

Tomorrow is an important day. Setups like today at the end of a rally - even a small rally - point to potential weakness, but if markets can defy this weakness despite the larger trend lower, then it could be the start of a much larger rallies toward 200-day MAs, and likely more.

More By This Author:

Selling Inevitable, But Russell 2000 Retains Support

Bullish Engulfing Patterns Across Russell 2000, S&P And Nasdaq

'Bear Traps' For The Nasdaq And S&P As Russell 2000 Holds Above Support

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more