Free Speech

Talk is supposed to be cheap but the words and time used to understand such are dear. The price of freedom is not free. Last night was about the Trump State of the Union Address and the RBA Governor Lowe Year Ahead speech. Both moved markets. Economic data was light but grim with the surprise drop in German factory orders suggesting even more weakness in Europe and elsewhere. Political news was more mixed. The hope for a US/China trade deal rose a bit with the US sending Lighthizer and Mnuchin to Beijing again and India led the rally up in Asia shares. OPEC wants to have a formal deal with Russia to shift the cartel – and Oil is 1% lower as API shows US crude supply rose 2.5mb last week. Trump sets Feb 27-28 meeting with North Korea’s Kim in Vietnam. NATO sets a summit in London for December. The focus on the day ahead will be linked to US foreign policy and trade with the hope for a better 2019 permeating all positions right now. The Australian RBA speech overnight maybe a foreshadowing of trouble for others with Poland and Brazil rate decisions ahead. Shifting from a hawkish bias to neutral isn’t that extraordinary but the price action in the AUD is worth watching as the bellwether for trade and rates colliding. The US 10-year bond sale today and the USD marching towards 1.13 EUR are both linked again. AUD weakness plays into the AUD/JPY carry trade, which is highly correlated to selling the VIX or buying EM equities. AUD/JPY maybe telling us 2800 in the S&P500 is less likely than a revisit to 2600.

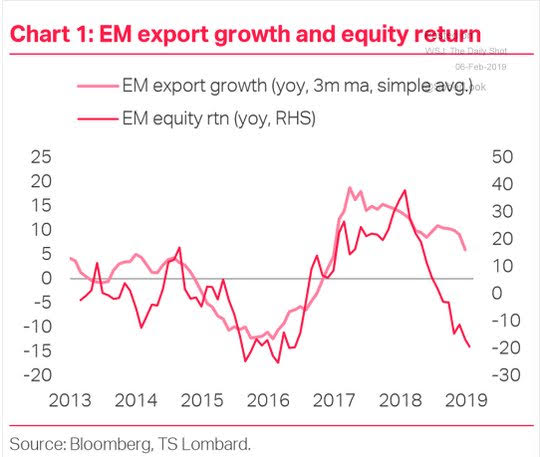

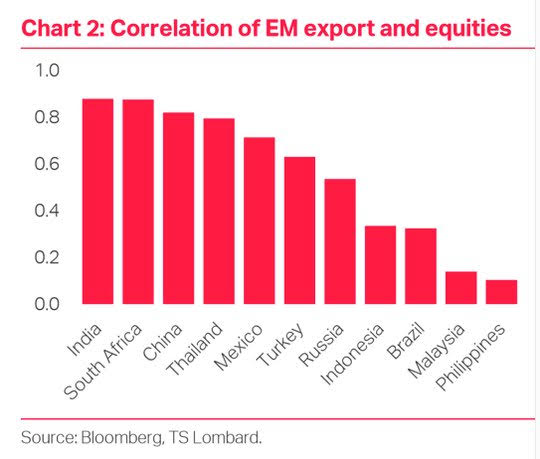

Question for the Day: Are we setting up Emerging Markets for trouble again? The weaker outlook for China and German economies in 2019 sets the tone for the day. Markets are reversing some of the feel-good calm from extended rally up in equities. The place to watch for larger trouble maybe in emerging markets.

The bounce back in many EM positions has been notable – witness the 7% gain in South Africa. Yet, the forecasts are turning, a new Reuters poll suggests that ZAR is expected to lose 3.5%over the year. The larger issue is about global trade where a US/China deal continues to be the baseline assumption and a return to “normal” for growth.

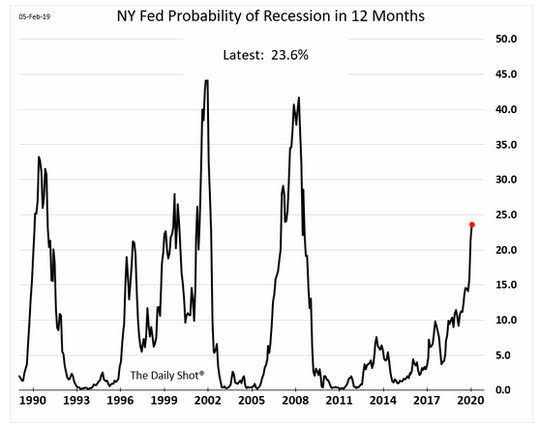

One of the biggest problems for emerging markets in 2019 continues to revolve around the US economy and the FOMC. The risk for 1-2 more rate hikes remains in play – but is now priced out – but should financial conditions normalize and 1Q growth remain 2% watch out. The equity rally up and the recent economic data in the US support this. The FOMC balance sheet plays a role in this as well as the shape of the curve remains part of the recession fear and their lack of bill buying only exacerbates the front-end squeezes.

What Happened?

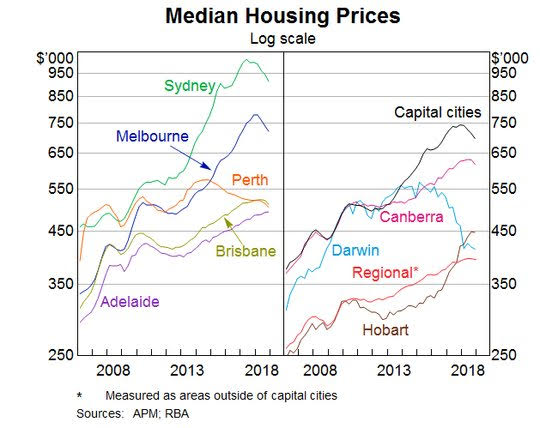

- RBA Lowe: Shifts policy outlook to neutral. Markets reacted to the Governor’s 2019 year ahead speech. “This is the key paragraph: Looking forward, there are scenarios where the next move in the cash rate is up and other scenarios where it is down. Over the past year, the next-move-is-up scenarios were more likely than the next-move-is-down scenarios. Today, the probabilities appear to be more evenly balanced.” A key part of the RBA thinking for 2019 is that the housing market weakness will be offset by wage growth. This puts employment and housing data into the top tier for data.

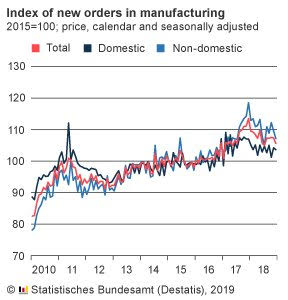

- German December factory orders drop 1.6% m/m, -7% y/y after revised -0.2% m/m, -3.4% y/y – weaker than +0.3% m/m bounce expected. November revised from -1% m/m. For December, domestic orders fell -0.6% and foreign orders -2.3% m/m with Eurozone orders up 3.2% and outside that -5.5% m/m. By type, capital goods -2.5% m/m, intermediate goods -1.2% and consumer goods up 4.2% m/m.

Market Recap:

Equities: The US S&P500 futures are off 0.1% after a 0.47% gain yesterday. The Stoxx Europe 600 is up 0.1% recovering from down 0.2% near the open led by oil and banks. The MSCI Asia Pacific rose 0.2% in thin holiday markets.

- Japan Nikkei up 0.14% to 20,874.06

- Korea Kospi closed for holiday

- Hong Kong Hang Seng closed for holiday

- China Shanghai Composite closed for holiday

- Australia ASX up 0.39% to 6,091.80

- India NSE50 up 1.17% to 11,062.45

- UK FTSE so far flat at 7,175

- German DAX so far off 0.45% to 11,315

- French CAC40 so far off 0.2% to 5,072

- Italian FTSE so far up 0.4% to 19,917

Fixed Income: Risk mood is shifting – bonds are bid – German data worrying. German 10-year Bund yields flat at 0.17%, French OATs flat at 0.58%, UK Gilts off 1bps to 1.23%. Periphery mixed with growth doubts rising – Italy up 2bps to 2.82%, Spain off 1bps to 1.25%, Portugal off 1bps to 1.67%, Greece up 1bps to 3.90%.

- US Bonds see curve flatter, waiting for supply, more data. 2Y flat at 2.52%, 5Y off 1bp to 2.51%, 10Y off 1bp to 2.69%, 30Y off 1bp to 3.03%.

- Japan JGBs fall with equities bid, BOJ – 2Y up 1bps to -0.16%, 5Y flat at -0.16%, 10Y flat at -0.01%, 30Y up 1bps to 0.60%.

- Australian bonds rally sharply, reflect the RBA shift– 3Y off 14bps to 1.64%, 10Y off 9bps to 2.15%.

Foreign Exchange: The US dollar index up 0.15% to 96.25. In EM, USD is also bid - EMEA: RUB off 0.2% to 65.777, ZAR of 0.8% 13.483, TRY off 0.45% to 5.2150; ASIA:INR off 0.1% to 71.569, KRW off 0.2% to 1118.25.

- EUR: 1.1385 off 0.15%.Range 1.1380-1.1410 the 1.13-1.15 zone is still in the prison. German factory orders the driver today with 1.1320-80 bumps.

- JPY: 109.75 off 0.2%.Range 109.56-110.05. The drop in USD despite equities is important. EUR/JPY 124.95 off 0.4%.

- GBP: 1.2950 flat. Range 1.2925-1.2974 with EUR/GBP .8795 off 0.15% with May and Irish visit key on day with 1.2850-1.3050 keys.

- AUD: .7130 off 1.4%.Range .7123-.7246. RBA Lowe speech. NZD off 0.7% to 0.6850.

- CAD: 1.3200 up 0.55%.Range 1.3124-1.3202 with oil and rates driving. 1.3050 base for 1.33.

- CHF: 1.0005 up 0.1%.Range .9985-1.0015 with EUR/CHF 1.1395 off 0.1% - flashing yellow on risk means 1.00 pivot important.

Commodities: Oil lower, Gold lower, Copper is up 0.1% to $2.8025.

- Oil: $53.36 off 0.55%.Range $52.86-$53.85 with API driving and $52.75 looking important; Brent off 0.65% to $61.60.

- Gold: $1316.70 off 0.2%.Range $1315.70-$1319.90. USD is bid, but risk signals are supportive - $1305 base key. Silver $15.74 off 0.65%, Platinum off 0.15% to $818.50, Palladium $1337.50 off 0.3%.

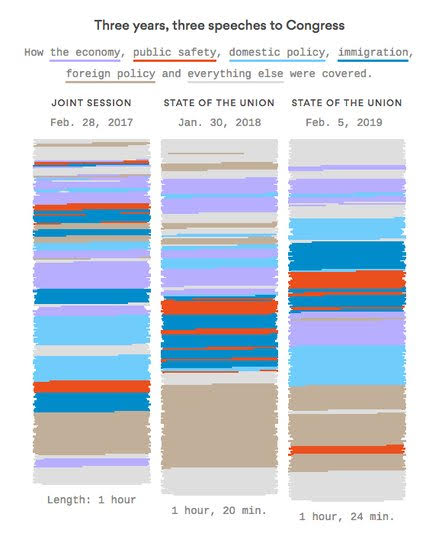

Conclusions: Did the US SOTU address matter? The political gridlock in Washington has been part of the 2019 market consensus. The Trump State of the Union address is worth analyzing to see what changed over the last 3 years in his agenda. As expected he renewed his call for a wall on the Mexico border but he didn’t repeat the threat of a national emergency to get it. He railed against the investigations but didn’t push the idea of forcibly ending them. This is a more moderate tone. This chart from Axios is worth reviewing. Take-away the following points – 1) The Trump agenda is pointing less to foreign policy and more to domestic issues. 2) While immigration remains important in his speech, the economy gets top billing. 3) There was a throw-back to the 1940s and the everything else category of the speech was much larger – with pointed references to D-Day and to vows that the US would never be a socialist country.

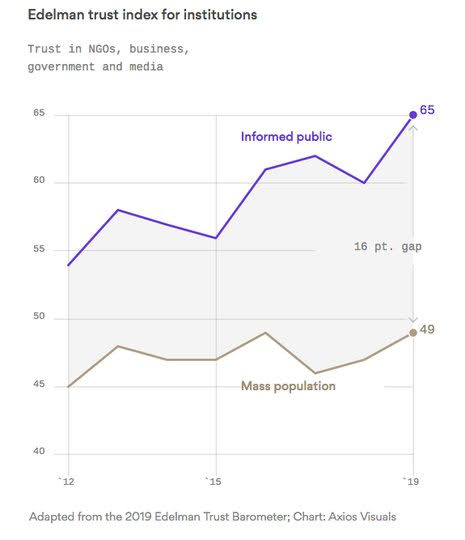

The biggest takeaway of the SOTU speech maybe in the moderation and rebuilding of the institutional framework for Trump as he approaches a divided Congress. The faith in global institutions is part of the political divide globally and its getting worse. Any shift in the US matters.

Economic Calendar:

- 0830 am US Nov trade deficit $55.5bn p $54bn e

- 0830 am US 4Q productivity 2.3%p 1.6%e / ULC 0.9%p 1.7%e

- 1000 am Canada Jan Ivey PMI 59.7p 60.2e

- 1030 am US weekly EIA oil inventory 0.919mb p 0.5mb e

- 0100 pm US sells $27bn 10Y notes

- 0300 pm Brazil COPOM rate decision – no change from 6.5% expected

- 0700 pm FOMC Powell speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

Can anyone really believe that Trump will turn into Mr nice guy? I can't. Nice information here about Germany. Amazing how sentiment is so cheery about a trade deal with substance. That is a real long shot.