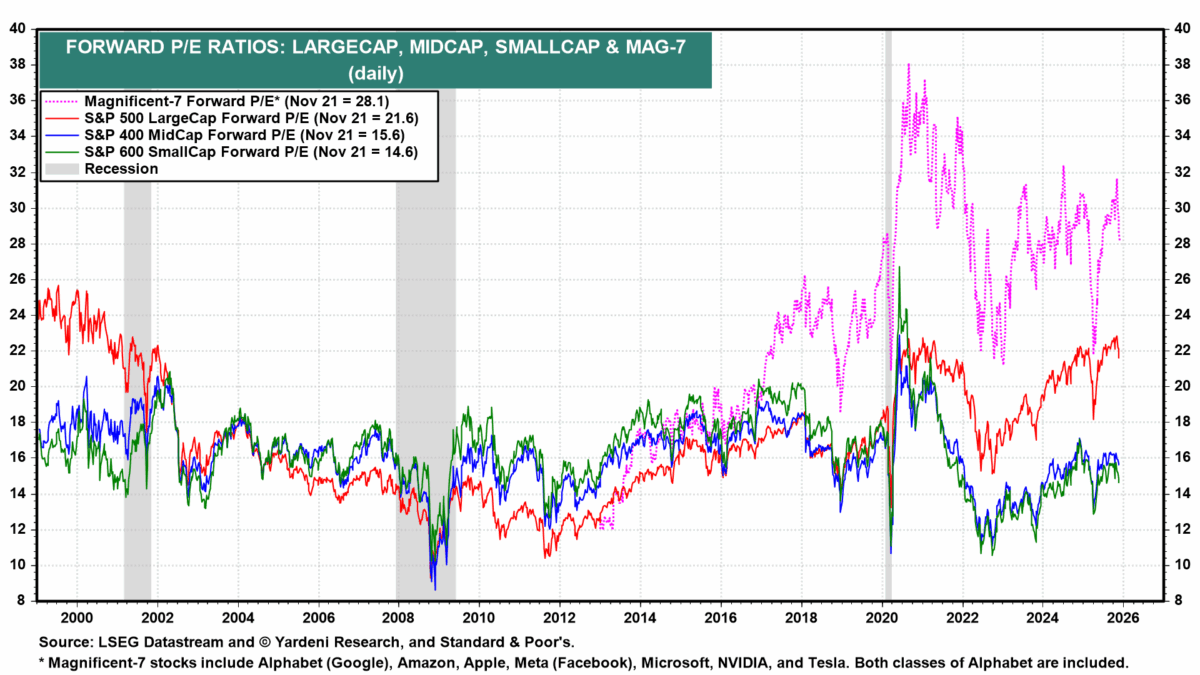

Forward P/E Ratios – Mag 7 And Others

Image Source: Pexels

From Ed Yardeni’s website:

(Click on image to enlarge)

Source: Ed Yardeni, Accessed 11/22.

The Magnificent 7 forward P/E ratio, using prices as of 11/20 (as far as I can tell) was 28.1. If the Mag 7 index rose 0.8% on Friday, then the ratio has risen to about 28.3. It’d be nice to compare to the aggregate trailing P/E ratios, but Yardeni doesn’t provide this graph.

It does seem that on an individual level, forward P/E ratios are below trailing for the individual stocks, but this doesn’t prove that the forward P/E ratios aren’t too optimistic (after all “forward” means using guesses about future earnings over the next year).

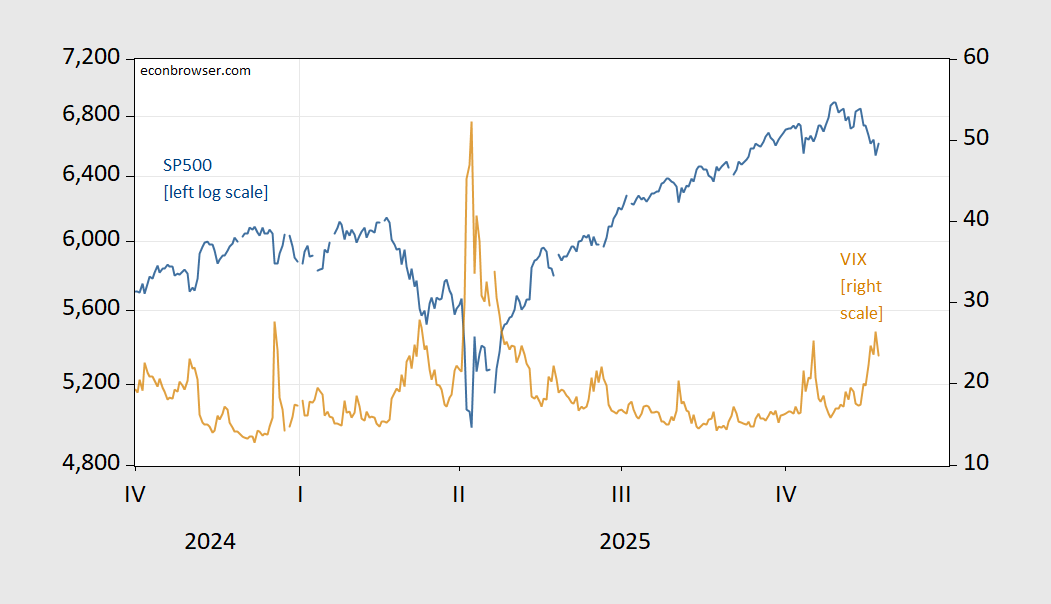

Here’s the S&P 500 and VIX through Friday’s action:

(Click on image to enlarge)

Figure 1: S&P 500 (blue, left log scale), VIX (tan, right scale). Source: Dow Jones, CBOE via FRED.

More By This Author:

Manufacturing In September 2025Raise The Yuan!

Bitcoin 34% Below Peak, 12.5% Below January 1st