Finding Value In Munis

Infrastructure spending is back in vogue, and we've got a chance to grab a piece of it tax-free. That would be through municipal bonds; investments most people see as sleepy (though I have no idea why) but are poised to roll as President Biden's $2-trillion infrastructure package (or some version of it) becomes law.

That's because the law will usher in an explosion of new "muni" bonds — and there are select actively managed closed-end funds (CEFs) ready to pick up the best ones. By buying them now, we can nicely front run this muni-bond wave. The best part of buying muni bonds (which are issued by states, cities, and some non-profit entities, like hospitals, to fund infrastructure) is that the income they generate is 100% tax-free. This boosts the yield these funds offer considerably, especially if you're in a higher tax bracket.

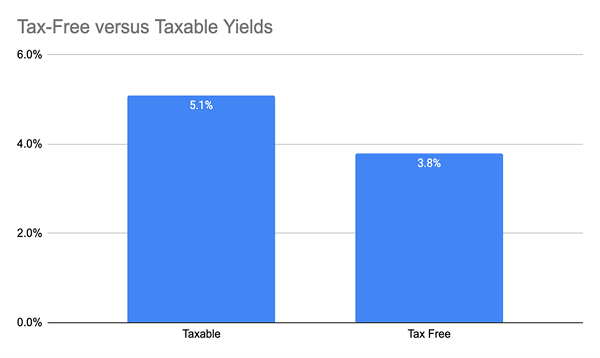

For instance, a municipal-bond yield of 3.8% may not sound like a lot (although in today's market, 3.8% is still generous since it's over twice what you'd get from the S&P 500), but it's the same as getting a 5.1% yield from dividend stocks if you earn $100,000 per year, thanks to their tax-free status.

Plus, municipal bonds are less volatile than almost all other assets, making them a great wealth protector in addition to an income generator. The good news is that there are still bargains to be had in muni-fund land; here are three worth your attention now.

The BlackRock California Municipal Income Trust (BFZ) is an ideal way to get a 3.6% tax-free yield and capital gains over the long haul, thanks to its 9.7% discount and the fact that it focuses on California muni bonds. Since Californians have one of the highest tax burdens in the country, a lot of them look for funds like BFZ (and yes, you can still get tax-free income from BFZ if you don't live in California).

And if you're worried an exodus from the highly taxed Golden State will hurt the value of California's bonds, don't be. Just 135,600 people left California in 2020, on a total population of 39.5 million. There are millions of Californians who can benefit from the tax-advantaged nature of California municipal bonds, leaving a big pool of buyers within the state itself for BFZ.

Our second fund boasts a slightly bigger discount (10.6%) and a slightly higher yield (3.7%) than BFZ: the Nuveen Ohio Quality Municipal Income Fund (NUO), so named because it invests 80% of its portfolio in highly rated muni-bonds issued by organizations ranging from the Ohio Turnpike to the Cincinnati water system.

That makes it safer than your average muni-bond fund (which is already pretty steady) and therefore ideal for adding stability to your portfolio. But you're not sacrificing performance to get this ultra-stable fund: it still easily beat the benchmark muni-bond ETF, the iShares National Muni Bond ETF (MUB), in the last decade.

NUO's prudent portfolio management and market outperformance make it a nice choice for stability, gains, and income - whether you live in Ohio or not.

Our final pick is the best: the Nuveen New Jersey Quality Municipal Income Fund (NXJ), which, like NUO, invests 80% of its assets in high-quality bonds while also trading at a whopping discount. But that isn't even the best thing about NXJ; its dividend is — its 4.7% yield is large for a tax-free muni-bond fund.

Nuveen New Jersey Quality Municipal Income has been on my radar for a long time — since back in 2018. Back then, muni-bonds were out of favor due to rising interest rates. But the fund has outperformed the broader muni-bond market, giving investors an outsized 8.9% total annualized return since then, with tax advantages to boot. That's a sign that this quality fund is mispriced at an 11.7% discount.

Disclaimer: © 2021 MoneyShow.com, LLC. All Rights Reserved.