Federal Reserve Preview: No Imminent Pressure, But Downside Growth Risks Point To 2H Rate Cuts

After 100bp of interest rate cuts in late 2024, Chair Powell suggests that the Fed aren’t in a hurry to ease policy further and a no change outcome is widely expected on 19 March. But President Trump’s spending cuts and trade protectionist policies are hurting growth prospects and will likely force the central bank’s hand in the second half of 2025.

The economy isn't living up to expectations

At the start of the year there was plenty of optimism around. The economy was in decent shape and the expectation was that President Trump would come in and turbo charge the growth story with tax cuts and deregulation. When combined with potentially inflation-boosting tariffs and immigration controls markets sensed the Federal Reserve would have less scope to cut rates. As recently as 12 February financial markets were pricing only one 25bp interest rate cut for the year ahead.

However, it turns out that President Trump’s initial priorities are government spending cuts and trade protectionism. This has heightened concerns about job cuts, not just for Federal government workers, but also potentially amongst millions of private sector contractors employed in the government sector.

The use of tariffs, which may escalate significantly as President Trump seeks to reshore manufacturing activity, is raising concerns about potential price hikes hurting consumer spending power and a fear amongst corporates that higher input costs could squeeze profit margins. Reciprocal tariffs from foreign governments and consumer boycotts would then compound the problems for US exporters. The result has been weaker sentiment and spending numbers.

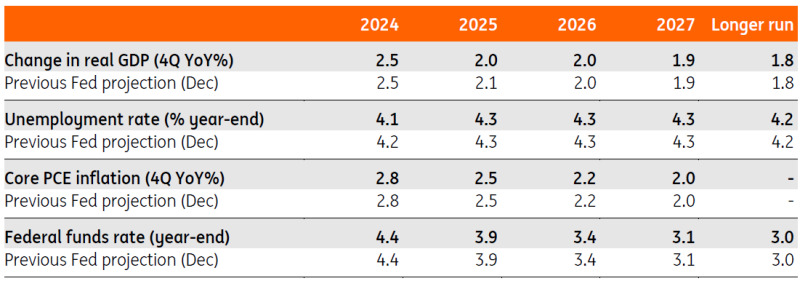

ING's expectations for updated Federal Reserve forecasts

(Click on image to enlarge)

Source: Federal Reserve, ING

But the Fed remains in no hurry to cut rates further

Disappointing economic data and President Trump showing no sign of wavering in his commitment to these policies has led equity markets to take a dimmer view on the prospects for the economy. While it isn’t our base case, recession talk is on the rise. Chair Powell will likely play down those fears in the post-meeting press conference. In a speech on 7 March, he stated that “despite elevated levels of uncertainty, the U.S. economy continues to be in a good place.” He described growth and labour market numbers as “solid” and while acknowledging weaker consumer confidence prints he argued that “sentiment readings have not been a good predictor of consumption growth in recent years”. As such “we do not need to be in a hurry [to alter monetary policy], and are well positioned to wait for greater clarity.”

We therefore expect the Fed to largely retain their forecasts from December and signal that their base case remains two 25bp rate cuts this year. There is no pressing need for additional rate cuts given that unemployment is low and inflation is still tracking hot and is likely to remain above target through the rest of the year given the impetus from tariffs. Nonetheless, the outlook for growth is cooling and the pressure for the Fed to offer more support to the economy will likely grow. We expect falling new tenant rents to translate into lower CPI housing inflation prints in late 2025 and this should mitigate much of the inflation threat from tariffs. This should give the Fed the room for interest rate cuts in September and December with a third 25bp move in March next year.

Treasuries will have a keen focus on the path for quantitative tightening

Following the last FOMC meeting, Chair Powell was asked one question on quantitative tightening (QT). He read out what seemed like a prepared statement, basically saying nothing of any materiality. But then the subsequent minutes showed that the path for QT was in fact a talking point among the committee members. And so it should be, as on our numbers, continued QT at the current pace would likely see bank reserves converge on US$3tn by mid-year 2025.

That US$3tn area approximates 10% of GDP and is deemed to be something of a floor that the Fed would prefer not to get too much through. The last time the Fed did QT they took bank reserves down to 7.5% of GDP, and had market liquidity issues then, as they had gone too far. There is an argument that say 9% of GDP might do, but either way we'd see the move into single-digit territory as a % of GDP as the point at which the Fed would be minded to wind down QT, completely.

For Treasuries this is important, as once QT comes to an end, the Fed would be a regular buyer of Treasuries. With US$50bn to US$100bn rolling off the curve on a monthly basis, the Federal Reserve would be buying that amount on the marketplace in order to keep their current holdings of Treasuries unchanged. At the last FOMC meeting they broadly agreed to invest according to the capitalisation distribution of debt outstanding. This means they will be buying right along the curve.

While impactful, we should not get too carried away. It won't be determinative for direction. Rather, it returns us to the 'norm' where the Fed is a constant 'market participant' as it manages its reserves obligations on an ongoing basis. This, the dots and Chair Powell's tone are the big issues for Treasuries. Keeping the two dots, plus a projected QT unwind, would be supportive. But likely balanced out by tariff projections on inflation.

FX: An upside event risk for the dollar

As above, should Fed Chair Powell succeed in reining in some recession fears and bring market pricing back towards just two 25bp Fed cuts this year, then the dollar could bounce. Whether the US stock market would like that remains to be seen, but overall we could see the dollar enjoy a modest recovery against the G10 outperformers this year – the Scandi currencies, the Japanese yen and even against the recently re-appraised euro.

Softer US activity and this year's 50bp dovish re-pricing in the 2025 Fed easing cycle have been major driving factors in the EUR/USD rally – as well of course as the prospects of looser fiscal policy in Europe. So let's see whether any less troubling US data or Fed confidence can help the dollar find some kind of floor.

More By This Author:

Italian Industry Bounces Right Back

FX Daily: EUR/USD Optimism Starts To Wane

The Commodities Feed: Risk-Off Trend Intensifies

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more