Fed Policy In The Time Of Financial Cholera

Image source: Pixabay

It’s Fed Day and Chairman Powell has some splainin’ to do. Right now, the market feels like Ricky talking to Lucy about what she’s done - and what to do now.

We knew that Ricky loved Lucy just like Florentino loved Fermina in Gabriel García Márquez’s 1985 book, “Love in the Time of Cholera.”

I’ve never read the book but have always been intrigued by the title. The story is about an unrequited love that spanned 50 years. After Fermina’s father’s death (he was a doctor), Florentino expressed his love again for her.

Kinda like a Colombian version of Romeo and Juliet.

At the time of the novel’s setting (the late 19th and early 20th centuries), cholera was a flourishing bacterial disease that propagated because of contaminated water or food. While life-threatening, antibiotics and rehydration can nowadays cure it.

You may be asking, “What do cholera and romance have to do with the Fed and markets?”

Let me explain…

The Myth of the “Virtuous Cycle of Liquidity”

For far too long, the financial sector has romanticized Fed policy. I remember reading about the “virtuous cycle of liquidity” when studying Fed policy. The notion is that the Fed can lower interest rates and inject liquidity… but then remove the liquidity without any harm. They can impose themselves onto the marketplace without any distortions or misallocation, like magic. It’s a perfectly virtuous, centralized plan without any fallout. Somehow the plan removes the risk of the business cycle.

Among certain government officials, business executives, economists, and their ilk, the adherence to this policy and its impact is almost supernatural, even spiritual.

The reality is that printing money is a disease. Our infatuation and dependence on such measures is emblematic of centralized power and social decay. Those that advocate for a restoration of allowing the market to set interest rates and prefer decentralization have been waiting in the wings for over 100 years, just like Florentino. Our unrequited love of free markets has been cast aside by the Chairman of the Fed and its 12 voting members.

Here’s the Conundrum

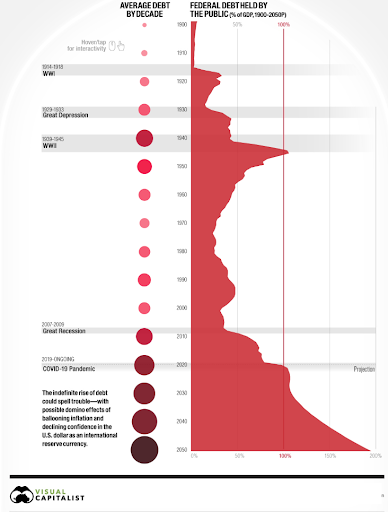

The Fed has been materially lowering the interest paid by the U.S. government for decades. This has led to more centralization of wealth and substantial debt. Over the next four years, the U.S. Treasury will need to roll over $24 trillion in debt, not to mention the current budget trajectory will add another $10 trillion over the same period.

I was always told that it will be Social Security and Medicare that will break us, but it looks like the rapid rise in discretionary spending and other measures have increased the debt so quickly that the interest on the debt is about to blow past the unfunded liabilities.

We’re at a crossroads where the trajectory of debt has created significant inflation and now rolling over the debt seems near impossible at a low enough interest rate that we can sustain the interest payments and maintain any standard of living.

The issue is that borrowing money removes available funds for investment from our economy. We’re siphoning off trillions of dollars for past expenditures.

In effect, we’re killing the goose that laid the golden egg.

How can the Fed keep rates low and continue to subsidize wayward spending and allow us to maintain any standard of living? Well, it can’t. Thus, the Fed conundrum.

The Way Forward

We’ve been operating under the Fed conundrum policy stance since Greenspan’s “Fed Put.” See, Greenspan jettisoned the policy stance of his youth for the inflationist policy agenda. The economic cycle, which the virtuous cycle of Fed liquidity supposedly eliminated, has transitioned to even greater down-cycles of a global scale. Pockets of correlation had been replaced by an “everything” market.

How does a system that has been so dependent on the contagion of money printing and financialization get back to one that saves, invests, and produces?

For those on the sidelines watching the centralized clown show that some try to call “capitalism” are finally seeing light at the end of the tunnel. Will there be a policy change of lower debt, less spending, less inflation, and more savings and investment?

For executives in the major public companies, the idea may sound good, but the timeline for increased savings for investment and the end spigot of production being unleashed may be too far down the road.

For institutional investors, the idea of the Fed not stepping in to bail them out of poor allocation based on social and other philosophies creates skittishness.

For the retail investor that helped create the “Trump Bump” after the election only to see institutions and insiders sell into their eager hands, the readiness to HODL into the next financial crisis may be limited. Looking at searches for “recession,” reflects the concern of retail with only a 10% move lower in the S&P 500.

Hopeful… But Not Optimistic

Back to the unrequited love of free markets and real capitalist policy. Those that understand that printing money and excessive government spending and debt isn’t a pathway to real prosperity, understand the difficulty of the transition. As we look at current policy, it creates a sense of hope, but not optimism.

Hope and optimism are closely related but differ in nuance:

- Hope is often seen as a more emotional or spiritual outlook. It's the belief or desire for a positive outcome, even when circumstances are uncertain or challenging. Hope can persist despite adversity, acting as a source of strength or comfort.

- Optimism, on the other hand, is more of a mindset or attitude. It reflects a general expectation that things will turn out well, often grounded in a belief that circumstances or actions will lead to favorable results. Optimism tends to be tied more to logic or a positive worldview.

For me, it’s a matter of trust. Can we trust that policymakers have the back of free markets, or do they really desire to wallow in the contaminated waters of choleretic monetary largesse?

I have more hope than I’ve had for a long time, but trust is based on real action being taken. If we’re about to enter a recession and if the stock market is about to see significant weakness by the removal of the cesspool of liquidity, what will the policy be to rectify the situation that could be painful?

Are we finally being hydrated and receiving antibiotics by a path toward sound monetary and fiscal policy, only to go back? That is where my optimism ends, and my hope begins.

More By This Author:

Here Are The Winners And Losers At This Turning Point

The Smart Way To Play China’s Big Week

Get Ready For The “Great Reflation” This Week

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more