Get Ready For The “Great Reflation” This Week

Image Source: Unsplash

Stocks bounced from an oversold level late last week. As I settled back into my desk over the weekend, I was able to take full stock of the situation.

It’s important to realize that some of the biggest rallies in stocks often occur during bear trends. These come from short squeezes. Remember, every current short seller is a future buyer, by definition.

We have another important week ahead, especially with the Fed meeting. It seems as though the White House is trying to force the central bank’s hand into rate cuts, but let’s not pretend like the market is innocent here.

I think the rate cuts will come, but not this week. That said, it looks like some money is flowing into a certain area of the market that could benefit from a dovish Fed. Here’s what I mean…

Still Missing the Right Leaders

Last week, we saw a big bid come in beneath the energy sector. This caused me to run a deep screen into the space, and I must say, I am impressed with some of the setups I’m seeing.

I’m going to be dissecting these setups more in the Trinity Trade in the coming weeks, but what this tells me is that a Great Reflation is likely upon us.

Keep in mind that when the Fed lowers rates, they are effectively printing money. Some of this new money will surely find its way into commodities, and one of the top sectors to benefit will be energy.

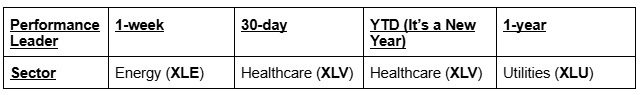

Is this good news for stocks overall? At some point, probably. But near-term, seeing energy, healthcare, and utilities as the top-performing sectors is hardly an encouraging sign.

Once we start seeing tech or consumer discretionary pop back into leadership positions, I’ll change my tune.

More By This Author:

Fade The Rip: The Market Says There’s More Trouble ComingThe Truth About Tariffs, Inflation And Markets

Inflation Isn’t Going Away, But These Sectors Don’t Care

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more