Fed Keeps The Party Going With Rate Cut But Threatens To Cool The Shindig Down

Image source: Wikipedia

Daddy poured more punch into the punch bowl even as he threatened to cool the party down. Whether Papa Powell follows through on the threat remains to be seen.

The Federal Reserve delivered another interest rate cut at its December meeting, trimming the federal funds rate 25 basis points to between 4.25 and 4.5 percent, as expected.

However, the rhetoric coming out of the FOMC meeting was much more hawkish than last month, as officials expressed concern that price inflation remains sticky well above the mythical 2 percent target.

Federal Reserve Chairman Jerome Powell said the central bank will be “cautious” on rate cuts moving forward, noting, “We have been moving sideways on 12-month inflation.”

The official FOMC statement changed very little from the one issued at the November meeting. The committee continued to insist that economic activity is expanding at a “solid pace” and that “inflation has made progress toward” the 2 percent target.

“In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.”

Powell noted that the Fed has lowered rates a full percentage point since it began easing monetary policy in September and called the current policy stance “significantly less restrictive.”

“We can, therefore, be more cautious as we consider further adjustments to our policy rate.”

Despite stubbornly high price inflation and rumblings in the underbelly of the economy, Powell insisted, “We think the economy is in [a] really good place. We think policy is in a really good place.”

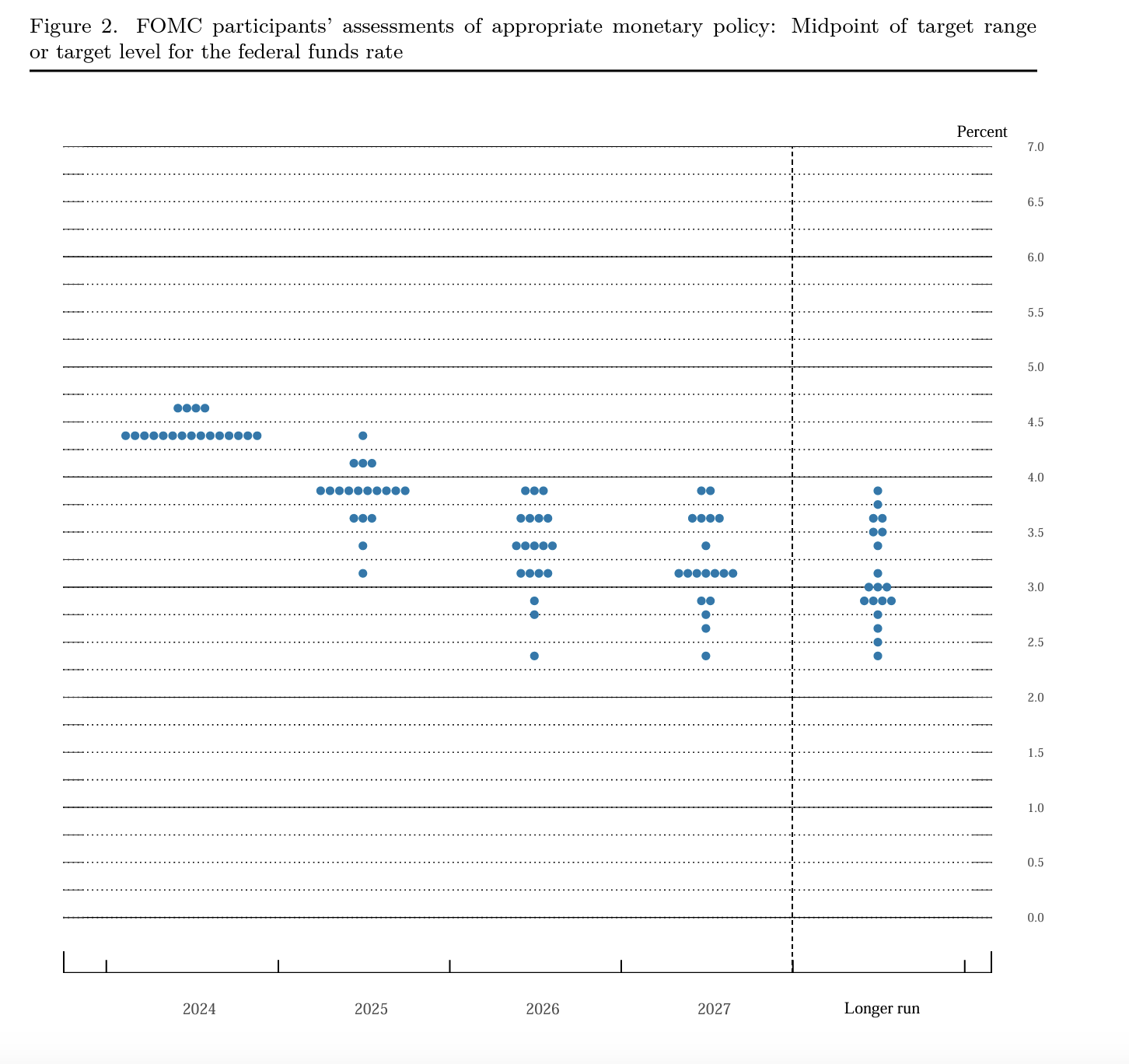

Dot Plots

The FOMC released its much-scrutinized dot plots projecting the trajectory of monetary policy moving forward.

The majority of committee members now only see two rate cuts in 2025. That was down from a projection of four cuts when the committee last issued dot plots in September.

Fed members anticipate cutting rates two more times in 2026 and once in 2027.

The committee views the “neutral” rate at 3 percent, a 10th of a percentage point higher than the September update.

I should note that these dot plot projections are notoriously bad.

How bad?

Fund manager David Hay analyzed past dot plots and found the FOMC only got interest rate projections right 37 percent of the time. And as Hay pointed out, “They control interest rates!”

For instance, in March 2021, the FOMC projected the interest rate would still be zero in 2022. The actual 2022 rate was 1.75 percent. And in 2023, the vast majority of FOMC members thought the rate would still be at zero. The actual rate was over 5 percent.

Markets Throw a Tantrum

The Fed has addicted the economy to artificially low interest rates, and markets are drunk on easy money.

Despite getting more booze in the punch bowl, the partygoers went ballistic at the thought that the flow of easy-money moonshine may slow down next year.

The Dow Jones shed over 1,100 points, dropping by 2.6 percent. The S&P 500 was down nearly 3 percent, and the Nasdaq plunged nearly 3.6 percent.

Gold also sold off, dropping by 2 percent, and closed below $2,600 an ounce as investors anticipated the Fed keeping rates higher for longer. Because gold is a non-yielding asset, it tends to face headwinds in a higher interest rate environment. But mainstream investors seem to be forgetting that gold is also an inflation hedge, and the reason the central bank is threatening to slow easing is because inflation remains hot.

Bonds also sold off, spiking yields. The 10-year Treasury yield surged over 4.5 percent.

This reveals the tightrope Powell & Company are walking. It needs to keep monetary policy tight in order to tamp down price inflation, but the debt-riddled economy can’t function in a high-rate environment. Everybody knows this, and that's why the markets threw a fit.

The federal government shelled out over $1 trillion in interest expense last year. It paid more in interest than it did for national defense ($882 billion) or Medicare ($874 billion). The only spending category larger than interest on the debt was Social Security ($1.46 trillion).

Uncle Sam can’t afford higher rates. And he’s not alone. Corporations and consumers are also up to their eyeballs in debt. This is why the markets are desperate for the easy money punch to keep flowing.

Looking Ahead: Can the Party Keep Going?

It’s important to keep your eye on what the Fed actually does. Powell & Company says all kinds of things, and their actions often diverge significantly from their rhetoric.

For whatever hawkish messaging came out of the FOMC meeting yesterday, it’s important to remember that the central bank slashed rates again, despite signs that the inflation monster continues to lurk under the bed. Given the persistent price inflation problem, you might think the Fed would have held steady or even nudged rates higher.

The fact that the partygoers got a bit rowdy after Daddy threatened to cool off the soirée. That tells me that he’s going to have a hard time following through and keeping the party under control.

The economy is an alcoholic, and we all know what happens when you cut addicts off from their drugs. If the Fed doesn’t keep the easy money booze flowing, the addicts may slip into DTs. Of course, keeping an alcoholic drunk isn’t exactly a recipe for long-term health, either.

There is also a big elephant standing in the party hall. The Fed broke the economy with well over a decade of easy money. It pumped nearly $9 trillion in new money (inflation) into the economy through quantitative easing alone from the onset of the Great Recession through the pandemic. That’s on top of the inflation it created with nearly a decade of zero percent interest rates.

That’s a lot of booze.

And that drunken binge has consequences that haven’t manifested yet.

When the economy visibly cracks, the Fed will be forced to get even more aggressive in loosening monetary policy. If history is any indication, it will cut rates to zero again, and it will launch more rounds of QE. That means even more inflation.

The worst-case scenario is a protracted period of stagflation.

For now, everything seems fine. Most analysts seem to think the Fed is gliding the economy to a “soft landing.” But people were saying the same thing at the end of 2007.

Remember: things happen slowly and then all at once.

More By This Author:

Is Selling Gold Right Now A Mistake?

Biden Kicks Of Fiscal 2025 With Biggest Deficit Ever

Consumer Debt Surged In October