Fed Hints At 'Slowdown' After Most Aggressive Tightening In Over 40 Years

Tl;dr: The Fed hiked 75bps as expected (Fed Funds at 4.00%, the highest since Dec 2007 and most aggressive monetary tightening since 1981) but surprised the market somewhat by hinting at a slow-down in the pace of rate-hikes ahead (due to the lagged effect of their cumulative monetary tightening).

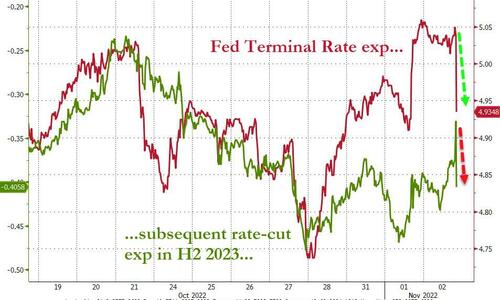

Market participants are describing this as a 'soft pivot' but we note that while terminal rate expectations have dropped (dovishly) but rate-cut expectations have also dropped (hawkishly) - market is pricing higher rates for longer.

Rate-hike expectations are sliding for Dec and Feb...

Eric Winograd, senior US economist at AllianceBernstein, has this to say:

“The statement is clear that they would like to slow the pace of hikes. In addition to looking at the data and looking at markets, they are also now considering the cumulative impact of what they have already done. And the lag with with that will hit the economy. Most estimates are that it takes 9-12 months for rate hikes to be felt, and 12-18 months for the maximum effect. We are only just now eight months past the first rate hike, so it makes sense to slow down.”

***

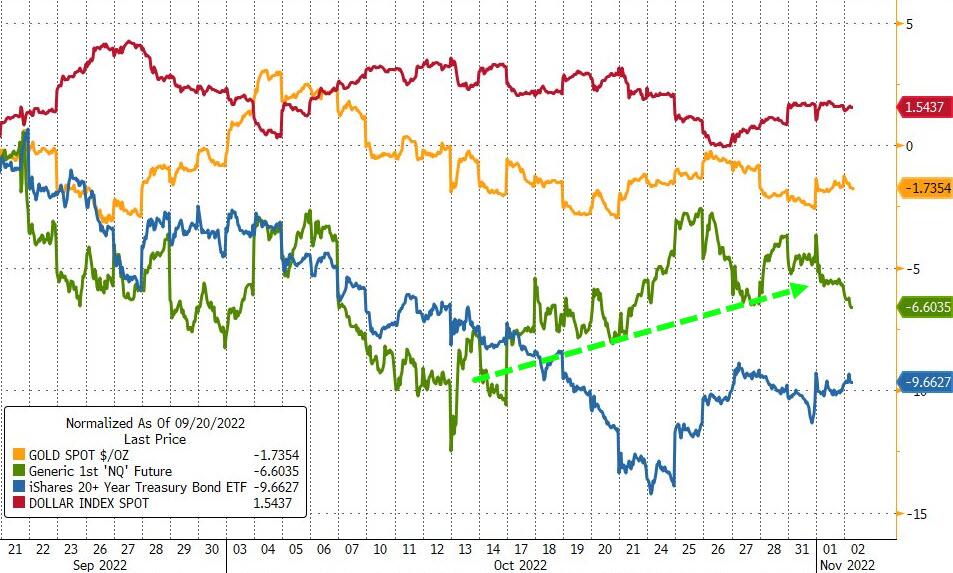

Since the last FOMC meeting on September 21st, where The Fed hiked rates by 75bps for the 3rd time in a row, stocks and bonds have suffered most (the latter more than the former) while the USD gained and gold mirrored the dollar's gains to the downside. Though we note that stocks have rallied for the last couple of weeks...

(Click on image to enlarge)

Source: Bloomberg

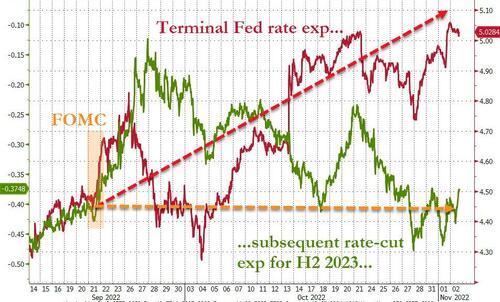

The market's expectation for The Fed's terminal rate has soared since the last FOMC meeting, now above 5.00% (in May 2023), but at the same time, subsequent rate-cut expectations have not changed (despite shifting notably dovishly in the last couple of weeks)...

Source: Bloomberg

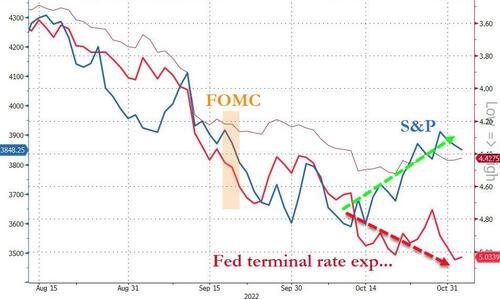

And stocks have decoupled from that tightening expectation...

Source: Bloomberg

While the market's expectations of The Fed's terminal rate have soared significantly since the last FOMC meeting, financial conditions have barely tightened thanks to the last few weeks of hope-fueled gains in risk assets...

Source: Bloomberg

That is not what The Fed wants to see, and neither is this - the labor market has done nothing but surprise to the upside in recent months, despite the massive monetary tightening...

Source: Bloomberg

The market was 100% pricing in a 75bps hike today but all eyes and ears will be any signals of an easing in the hawkishness. Ahead of the statement, the market priced the odds of a 75bps hike in December at 36%.

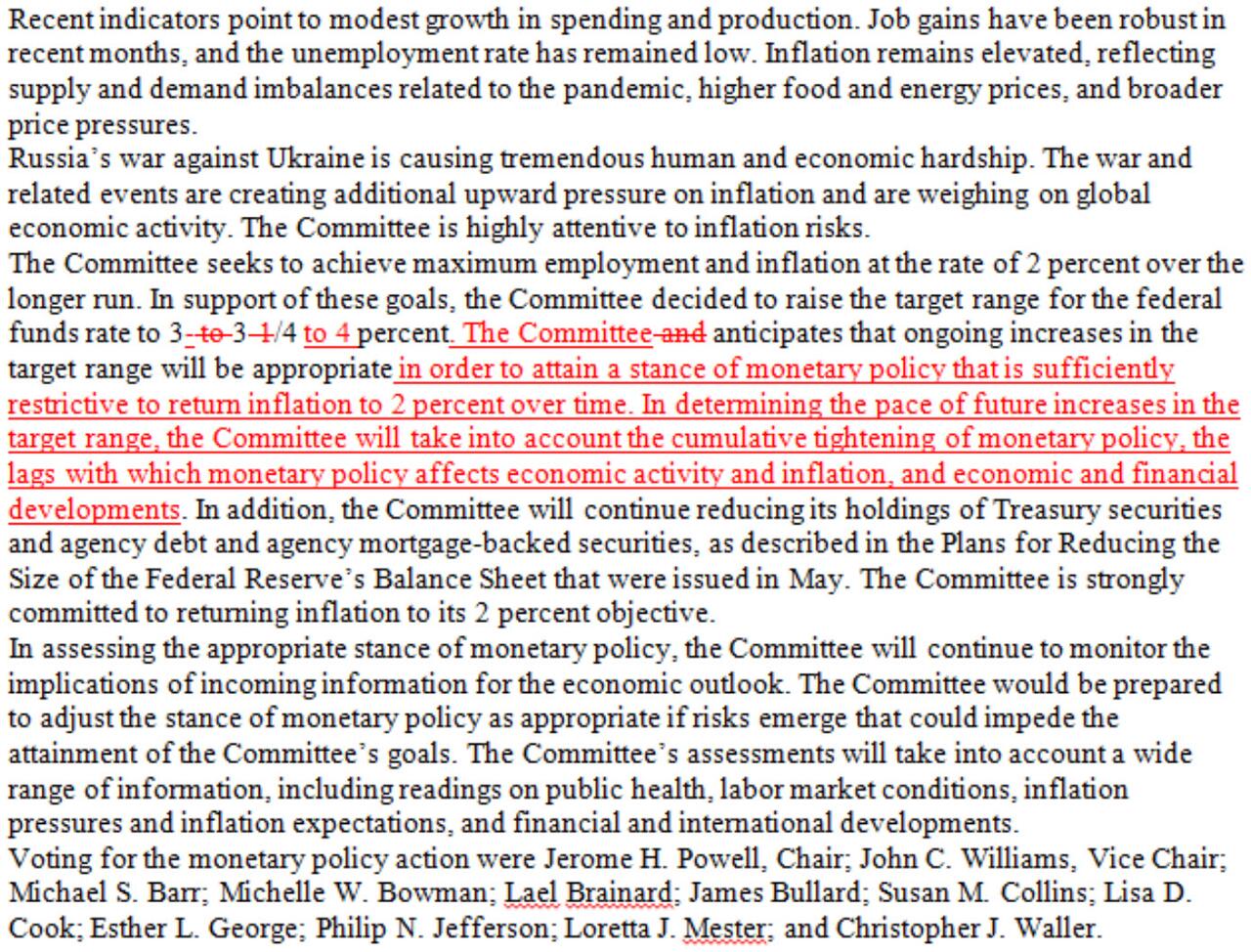

What The Fed Said...

The Fed raised the federal fund's target rate by 75 basis points, as expected. (The Fed's 4th 75bps hike in a row is the most aggressive monetary policy tightening since 1981.)

The Fed also reiterated that officials will keep hiking...

The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.

But The Fed made a big dovish change suggesting a slowdown in the pace of hikes:

In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments

So will Powell walk back the excitement?

***

Read the full redline below:

(Click on image to enlarge)

More By This Author:

ADP Employment Report Shows Labor Market Strengthened In October

Job Openings Unexpectedly Soar In 2nd Best Month Of 2022, Despite Plunge In Hiring, Quits

The Scariest Thing On Halloween - Inflation

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more