Job Openings Unexpectedly Soar In 2nd Best Month Of 2022, Despite Plunge In Hiring, Quits

Less than a month after the most recent JOLTS report (for the month of August, recall JOLTS is 2-months delayed) showed a near record plunge in job openings - in line with Fed hopes for a slowing economy and the reality of the slowing labor market - moments ago the BLS, perhaps carried away by next week's midterms and the relentless taps on the shoulder from various Biden apparatchiks, reported that in September - some two months before the midterms - job openings shockingly soared by 437K from an (upward revised) 10.280MM in August (10.053MM pre-revision) to 10.717MM. This was the second-highest monthly increase of 2022 and the highest since the 511K added in March!

And with expectations of a notable drop back under 10MM, this was the third biggest beat of expectations on record!

According to the BLS, the largest increases in job openings were in accommodation and food services (+215,000); health care and social assistance (+115,000); and transportation, warehousing, and utilities (+111,000). The number of job openings decreased in wholesale trade (-104,000) and in finance and insurance (-83,000

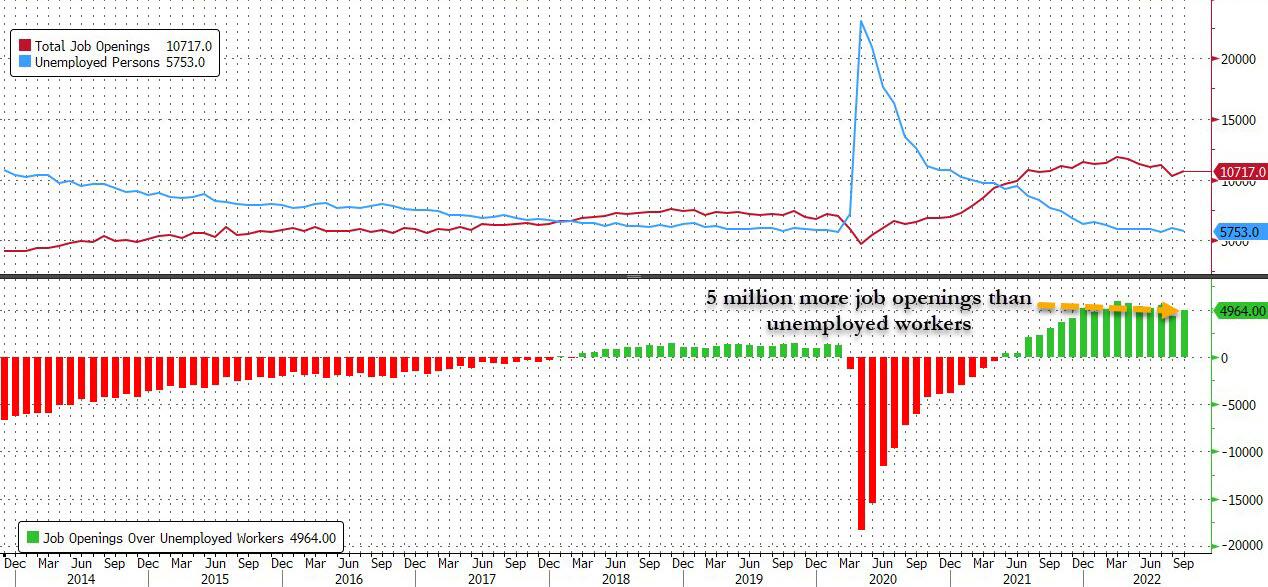

Coming at a time when the number of unemployed workers allegedly continues to shrink, the surge in job openings meant that we are back to 5 million more job openings (10.717MM) than unemployed people (5.753MM), just shy of the all-time high of 5.9 million hits in March of 2022.

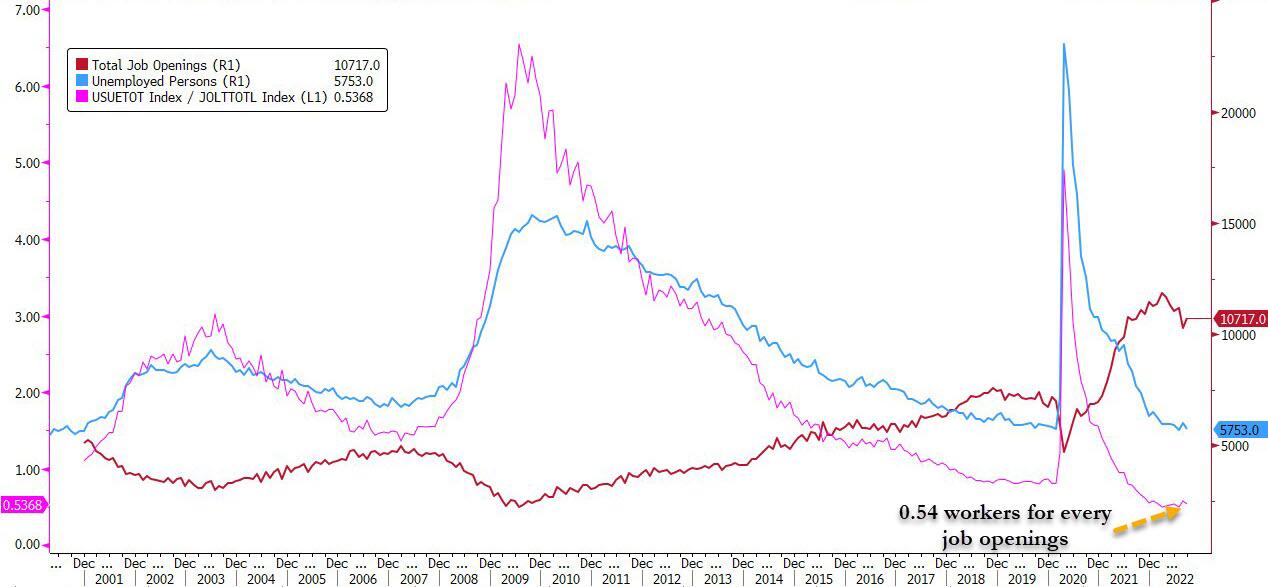

This means that there were almost 2 job openings for every unemployed worker, or - alternatively - the number of workers competing for every job opening slumped again, and was down to just shy of record lows, at 0.54.

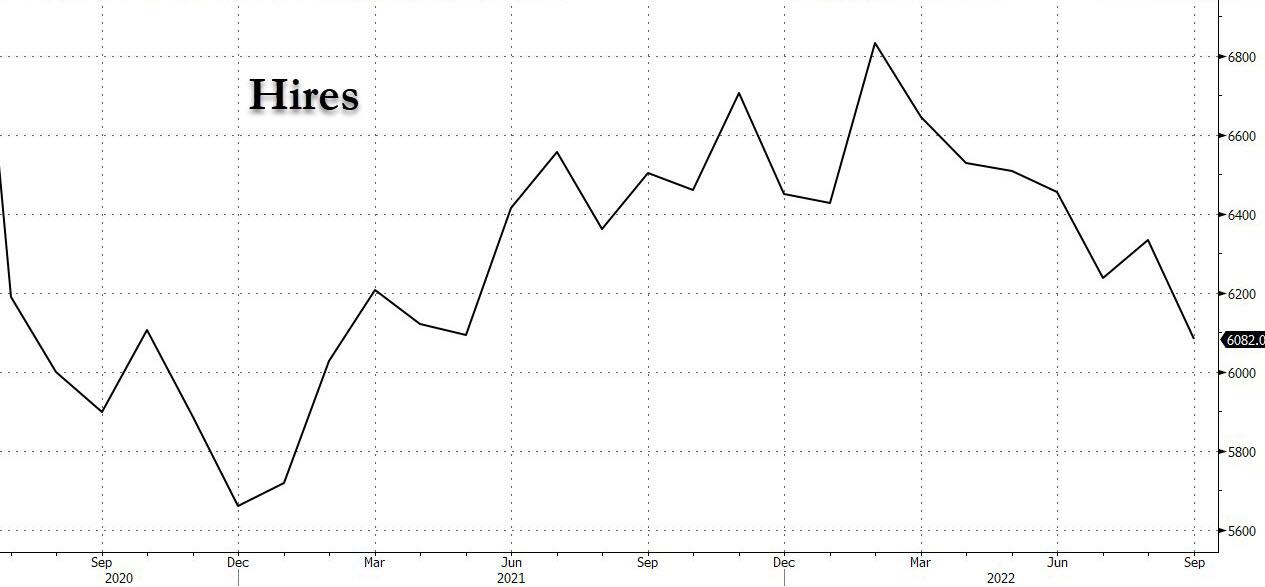

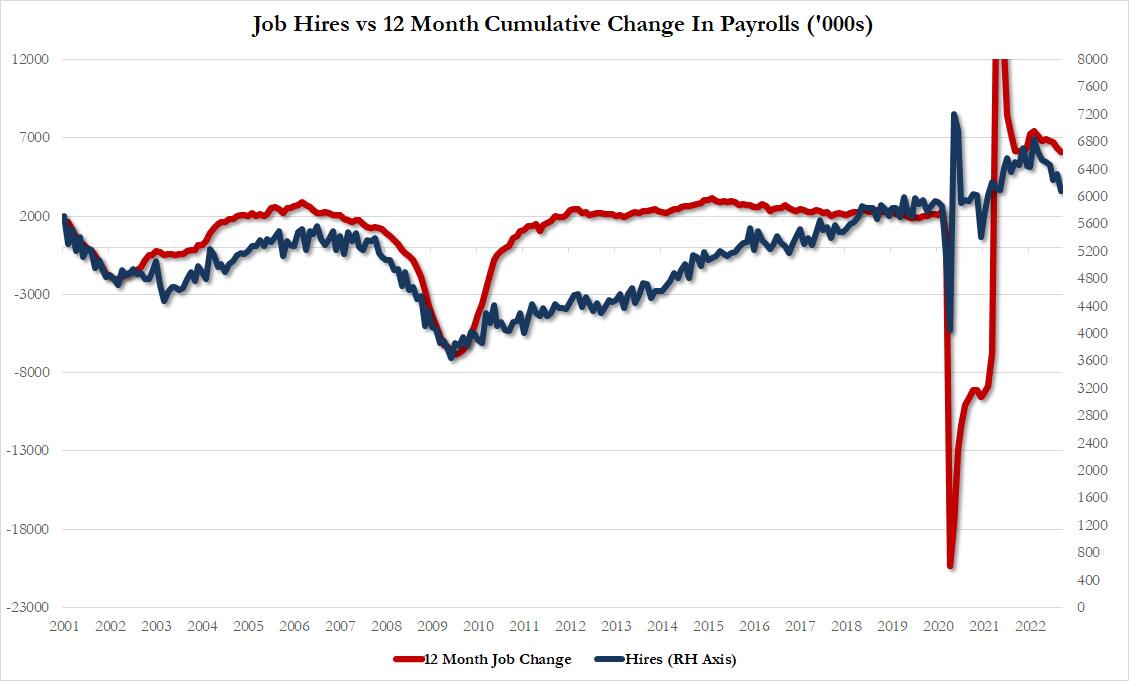

Curiously, while job openings soared, hiring tumbled and in September the BLS reported that total hires dipped to 6.082 million which was the lowest since Feb 2021.

The trend here is clear: down and to the right. According to the BLS, hires decreased in durable goods manufacturing (-57,000) and in state and local government education (-40,000).

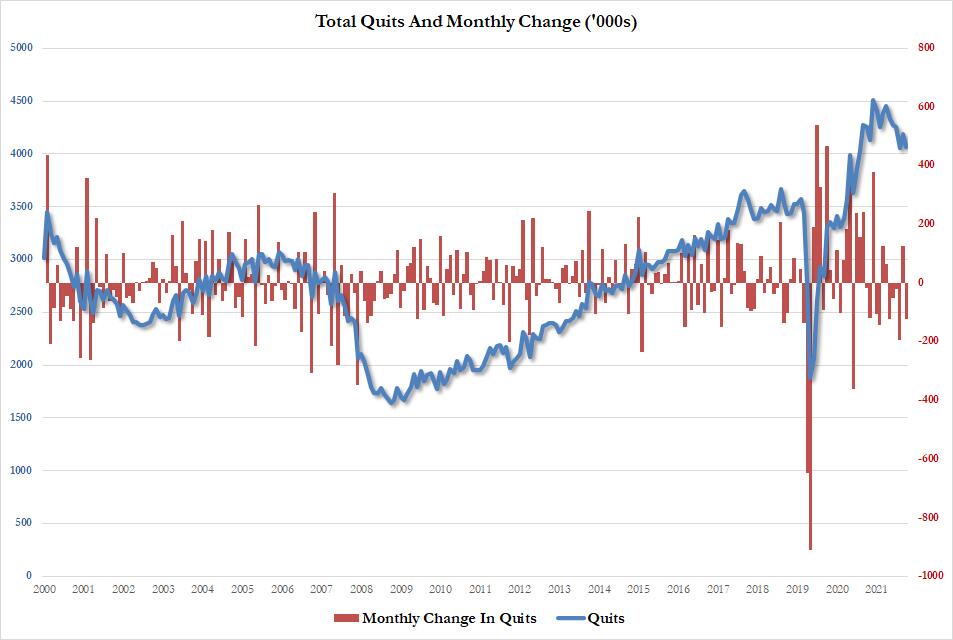

And more bad news: the number of quits - or the "take this job and shove it" indicator - continued to deteriorate, and in Sept dropped by 123K to 4,061MM, the second lowest since July 2021.

Yet despite these two clear disappointments, the market will be focused primarily on the sharp reversal in job opening trends, and needless to say, while last month's huge JOLTS miss sparked a frenzied rally, today's shocking beat is not helping risk sentiment because if anything, the Fed will have to once again come out as hawkish, as the Fed's WSJ mouthpiece was quick to remind us.

The number of job openings in September rose by 437,000 to 10.7 million (and the August figure was revised up by 200,000).

— Nick Timiraos (@NickTimiraos) November 1, 2022

The Fed would like to see the ratio of vacancies to unemployed workers decline, and it ticked up in September to 1.86 from 1.68.https://t.co/RwwwVqBmFp

More By This Author:

The Scariest Thing On Halloween - Inflation

Friday's "Sucker-Punch" Rally & Wednesday's 'Elephant In The Room' Event Risk

What Happens When Inflation Hits 8% ... And What Must Happen For Inflation To Fall

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more