Fed Concerns Pressure Dow, Nasdaq Down Triple Digits

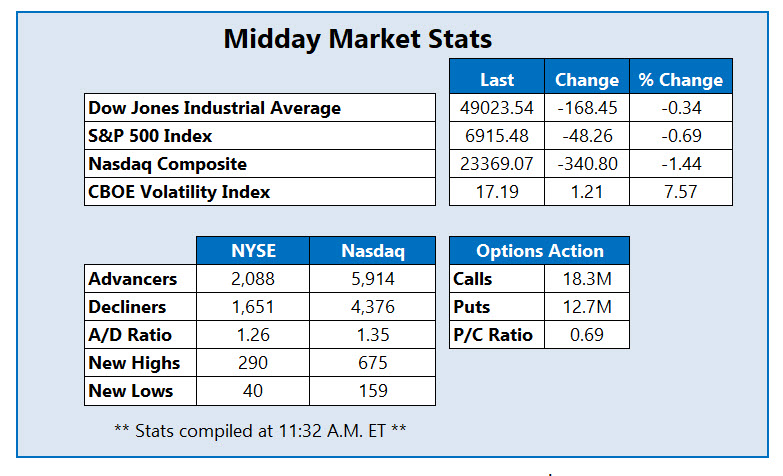

Heavy post-earnings fatigue is encapsulating Wall Street this afternoon, as Wells Fargo (WFC) and Bank of America (BAC) struggle to brush off disappointing reports. The Dow Jones Industrial Average (DJI) and Nasdaq Composite Index (IXIC) are both nursing triple-digit deficits in response, while the S&P 500 pulls back to the 6,900 mark. The bank earnings deluge is overshadowing an otherwise solid dose of November producer price index (PPI) and retail sales data, though rising tensions between President Donald Trump and Fed Chair Jerome Powell continue to feed Fed independence concerns

Grocery chain Kroger Co (NYSE: KR) is up 1.6% to trade at $62.42, after the company yesterday announced several key C-suite updates. Looking to shave down its 13.1% six-month deficit, KR is eyeing a third-straight daily pop. Call options are red-hot as well, with 25,000 across the tape so far -- seven times the average daily pace. Most popular is the January 2026 64-strike call with new positions opening and set to expire Friday.

India-based software firm Infosys Ltd (NYSE: INFY) is up 7.3% at $18.81 at last glance, one of the best performers on the New York Stock Exchange (NYSE) today, after the company gave an impressive Q4 revenue forecast alongside a fiscal third-quarter earnings beat. INFY has jumped 13.3% over the past nine months and tapped a record high of $30.00 on Dec. 19.

Pure Storage Inc (NYSE: PSTG), is one of the worst names on the NYSE, last seen off 6% at $70.85. While the catalyst for today's shift is unclear, the shares could be correcting from yesterday's multi-month peak of $77.40. PSTG has climbed 71% over the past nine months, with the 200-day moving average keeping pullbacks in check over the long term.

More By This Author:

Dow Snaps Win Streak As U.S.-Iran Tensions Rise

S&P 500, Nasdaq Turn Lower On Big Bank Burnout

Dow, S&P 500 Notch Record Closes After Market Rebound