Featured Stocks In February’s Most Attractive/Most Dangerous Model Portfolios

16 new stocks make our Most Attractive list this month, and 15 new stocks fall onto the Most Dangerous list this month.

The successes of these model portfolios highlight the value of our machine learning and AI Robo-Analyst technology[1], which helps clients fulfill the fiduciary duty of care and make smarter investments[2].

Our Most Attractive stocks have high and rising returns on invested capital (ROIC) and low price to economic book value ratios. Most Dangerous Stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

Most Attractive Stocks Feature for February: Heidrick & Struggles International (HSII: $32/share)

Heidrick & Struggles International (HSII) is the featured stock from February’s Most Attractive Stocks Model Portfolio.

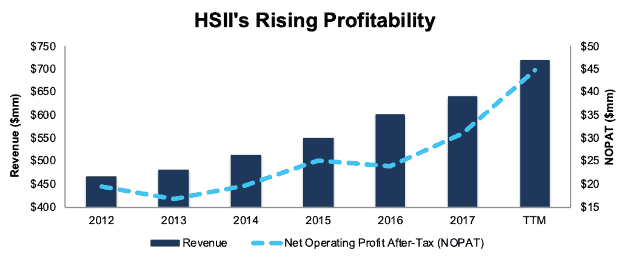

Since 2012, HSII has grown after-tax operating profit (NOPAT) by 10% compounded annually. HSII’s trailing twelve month NOPAT is up an impressive 44% over the prior TTM period. Profit growth has been fueled by rising NOPAT margins, which are up from 4% in 2013 to 6% TTM. HSII’s return on invested capital (ROIC) has improved from 6% to 11% over the same time.

Figure 1: HSII Revenue & NOPAT Since 2012

Sources: New Constructs, LLC and company filings

HSII Valuation Provides Significant Upside

At its current price of $32/share, HSII has a price-to-economic book value (PEBV) ratio of 0.9. This ratio means the market expects HSII’s NOPAT to permanently decline by 10%. This expectation seems overly pessimistic for a firm that has grown NOPAT by 10% compounded annually over the past five years.

If HSII can maintain TTM NOPAT margins (6%) and grow NOPAT by just 6% compounded annually for the next decade, the stock is worth $40/share today – a 25% upside. Click here to see the math behind this dynamic DCF scenario.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst findings in Heidrick & Struggles International’s 2017 10-K:

Income Statement: we made $82 million of adjustments, with a net effect of removing $81 million in non-operating expense (13% of revenue). See all adjustments to HSII’s income statement here.

Balance Sheet: we made $512 million of adjustments to calculate invested capital with a net increase of $18 million. One of the largest adjustments was $127 million due to operating leases. This adjustment represented 40% of reported net assets. You can see all the adjustments made to HSII’s balance sheet here.

Valuation: we made $302 million of adjustments with a net effect of decreasing shareholder value by $4 million. Apart from total debt, which includes the operating leases noted above, the largest adjustment to shareholder value was $149 million in excess cash. This adjustment represents 25% of HSII’s market cap.

Most Dangerous Stocks Feature: Alexander & Baldwin Holdings (ALEX: $24/share)

Alexander & Baldwin Holdings (ALEX) is the featured stock from February’s Most Dangerous Stocks Model Portfolio.

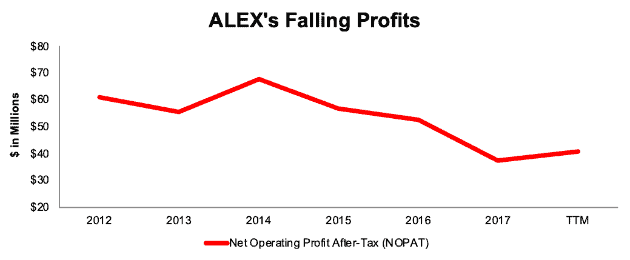

From 2012-2017, ALEX’s NOPAT fell 9% compounded annually. TTM NOPAT, despite being higher than 2017, is still down 56% from the prior TTM period. Deteriorating profits have been driven by shrinking NOPAT margins, which have fallen from 20% in 2012 to 9% TTM. ALEX’s ROIC has followed a similar path, falling from 4% to 2% over the same time.

Figure 2: ALEX NOPAT Since 2012

Sources: New Constructs, LLC and company filings

ALEX Provides Poor Risk/Reward

Despite the clear deterioration in fundamentals, ALEX has performed nearly as well as the market over the past year (up 3% vs. S&P +4%), which has left shares significantly overvalued.

To justify its current price of $24/share, ALEX must improve margins to 12% (average of last five years, compared to 9% TTM) and grow NOPAT by 15% compounded annually for the next 13 years. See the math behind this dynamic DCF scenario. This expectation seems lofty given ALEX’s inability to consistently grow NOPAT since 2012.

Even if the company can improve NOPAT margins to 12% and grow NOPAT by 10% compounded annually for the next 10 years, the stock is worth just $6/share today – a 75% downside. See the math behind this dynamic DCF scenario.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst findings in Alexander & Baldwin’s 201710-K:

Income Statement: we made $303 million of adjustments, with a net effect of removing $193 million in non-operating income (45% of revenue). You can see all the adjustments made to ALEX’s income statement here.

Balance Sheet: we made $601 million of adjustments to calculate invested capital with a net increase of $469 million. One of the most notable adjustments was $46 million in other comprehensive income. This adjustment represented 4% of reported net assets. You can see all the adjustments made to ALEX’s balance sheet here.

Valuation: we made $855 million of adjustments with a net effect of decreasing shareholder value by $855 million. There were no adjustments that increased shareholder value. The largest adjustment to shareholder value was $812 million in total debt, which includes $33 million in off-balance sheet operating leases. This lease adjustment represents 2% of ALEX’s market cap.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the superiority of our stock research and analytics.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.