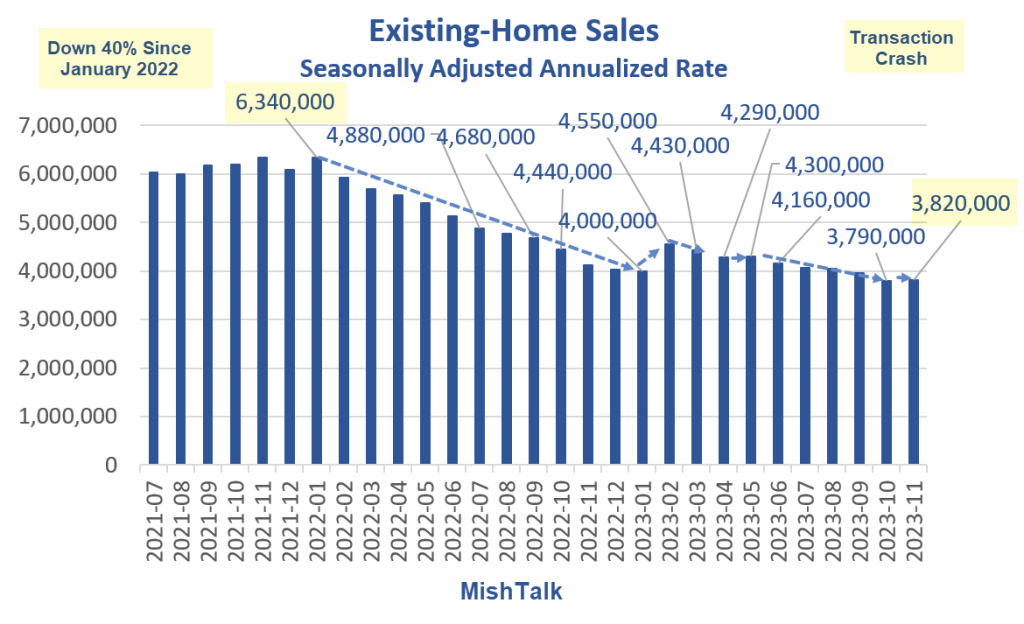

Existing Home Sales Rise 0.8 Percent, Only The Third Increase In 22 Months

(Click on image to enlarge)

Existing-home sales courtesy of the National Association of Realtors via the St. Louis Fed

The National Association of Realtors® NAR® reports Existing-Home Sales Expanded 0.8% in November, Ending Five-Month Slide.

- Existing-home sales edged higher by 0.8% in November to a seasonally adjusted annual rate of 3.82 million, finishing a five-month drop. Sales retreated 7.3% from one year ago.

- The median existing-home sales price rose 4.0% from November 2022 to $387,600 – the fifth consecutive month of year-over-year price increases.

- The inventory of unsold existing homes slid 1.7% from the previous month to 1.13 million at the end of November, or the equivalent of 3.5 months’ supply at the current monthly sales pace.

- All-cash sales accounted for 27% of transactions in November, down from 29% in October but up from 26% in November 2022.

- Individual investors or second-home buyers, who make up many cash sales, purchased 18% of homes in November, up from 15% in October and 14% one year ago.

- “The latest weakness in existing home sales still reflects the buyer bidding process in most of October when mortgage rates were at a two-decade high before the actual closings in November,” said NAR Chief Economist Lawrence Yun. “A marked turn can be expected as mortgage rates have plunged in recent weeks.“

- “Home prices keep marching higher,” Yun added. “Only a dramatic rise in supply will dampen price appreciation.”

Existing-Home Sales Percent Change From Last Month

(Click on image to enlarge)

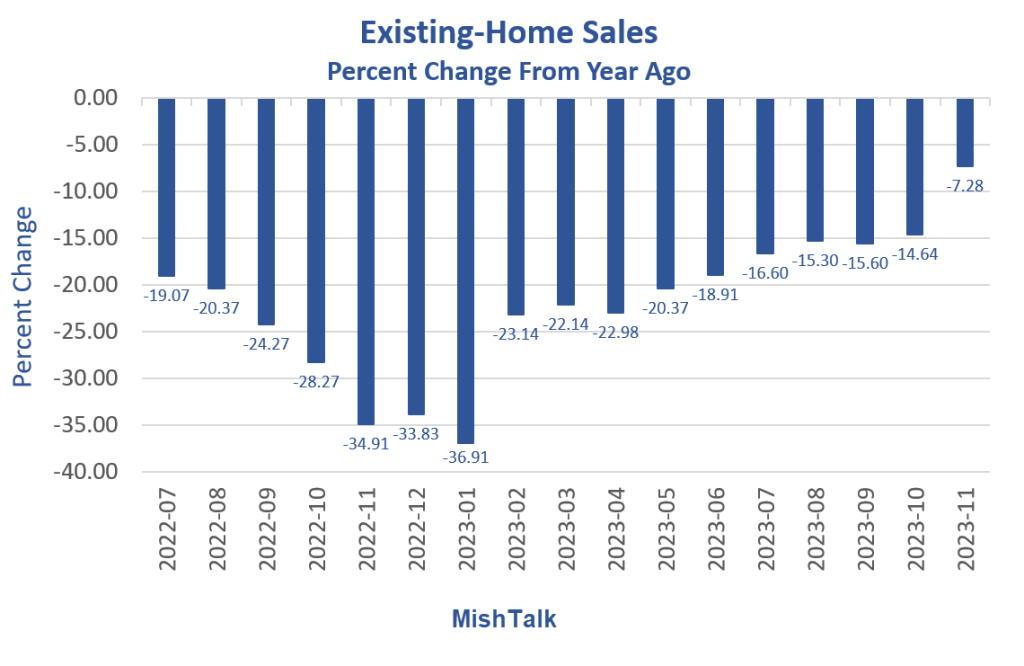

Existing-Home Sales Percent Year Ago

(Click on image to enlarge)

The dramatic improvement is due to a slight rise coupled with very easy year-over-year numbers to beat from November of 2022.

Transactions are down over 40 percent from January of 2022, the same as last month.

Existing-Home Sales Supply

(Click on image to enlarge)

For all the moaning about supply, it is nearly double what it was ten months ago. Of course, transactions have plunged, boosting supply.

Yun Expects Marked Turn

NAR cheerleader Laurence Yun expects a “marked turn” as mortgage rates drop.

Mortgage rates are down from a peak of 7.9 percent to 6.65 percent. This may entice some buyers, but for how long?

Home prices are still going up. Yun says ““Only a dramatic rise in supply will dampen price appreciation.”

Housing Starts Jump 14.8 Percent but Permits Sink 2.5 Percent

Housing starts jumped 14.8 percent in November led by single family construction, up 18 percent. Revisions were negative.

(Click on image to enlarge)

Housing data from Commerce Department, chart by Mish

Yesterday, I noted Housing Starts Jump 14.8 Percent but Permits Sink 2.5 Percent

Via incentives, mortgage write downs, and limited availability of existing homes to buy, the builders are holding up much better than real estate agents.

Major Boom-Bust Swings

(Click on image to enlarge)

The major boom-bust cycles are largely a result of Fed policy. The results you see from 2020-present are almost entirely due to Fed QE then QT policy.

How the Fed Destroyed the Housing Market and Created Inflation in Pictures

For discussion of the Fed’s role in this mess, please see How the Fed Destroyed the Housing Market and Created Inflation in Pictures

Housing starts are a bit less than they were in 1959.

Seldom a Worse Time to Buy

(Click on image to enlarge)

National and 10-city prices from Case-Shiller, BLS for other data, chart by Mish

Existing home prices hit a new record high in September. Even with the decline in mortgage rates, there has seldom been a worse time to buy.

Case-Shiller is a far better measure of home prices than median or average prices which do not factor in the number of rooms, location, lot size, or amenities. However, the data lags by 4 months or so.

For discussion, please see Home Prices Hit a New Record High According to Case-Shiller, Thank the Fed

More By This Author:

U.S. Steel Bought By A Japanese Company, Thank Tariffs

Shippers Avoid The Suez Canal, US Sends Warships, Costly Disruptions

Housing Starts Jump 14.8 Percent But Permits Sink 2.5 Percent

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more