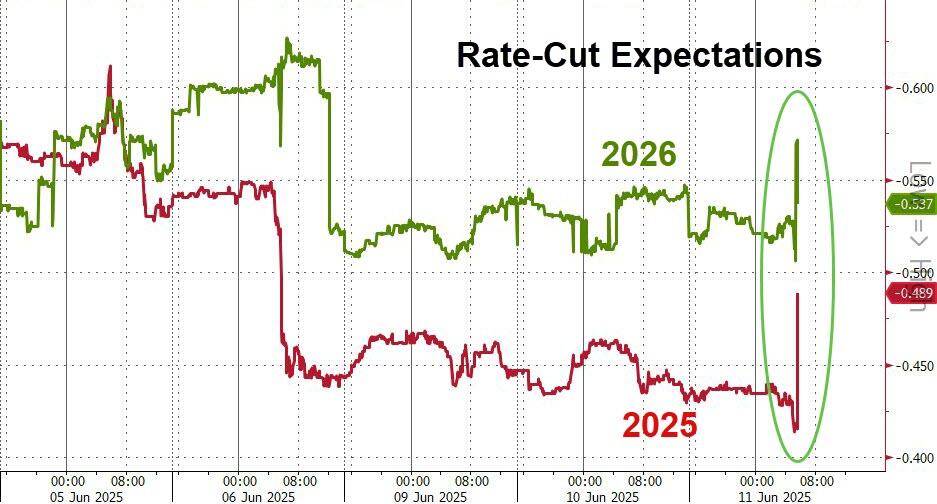

Everything Soars Higher As Rate-Cut Odds Jump After CPI 'Miss'

A 'disappointing' CPI print (cooler than expected) has promoted a surge higher in the market's expectation for rate-cut...

Source: Bloomberg

Prompting a surge higher in EVERYTHING.

Stocks spiked...

Treasuries were aggressively bid with 10Y yields sdown 5bps...

Source: Bloomberg

The dollar fell...

Source: Bloomberg

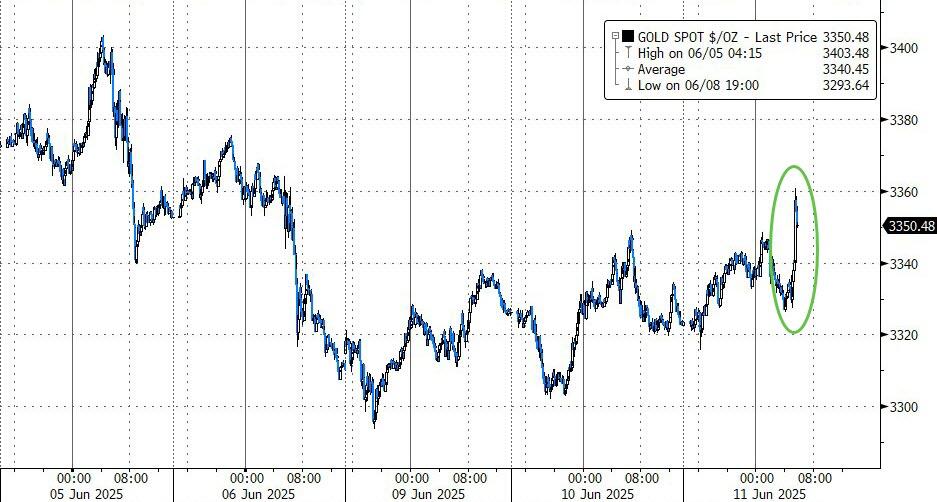

Helping gold to accelerate...

Source: Bloomberg

Goldman said that this would be a materially dovish print (<0.25% MoM for Core CPI) would prompt the bond market to add back at least 2x 25bp rate cuts (it already has) and for Equities to react positively (up 2-2.5%) to the bull steepening that likely ensues.

What excuse will Powell come up with next to NOT cut?

More By This Author:

China Taps $1.5 Trillion Fund To Offer Cheap Mortgages, Boost Housing Demand

Steel Stocks Slide After U.S. Nears Deal With Mexico To Cut Steel Duties, Cap Imports

Tailing 3Y Auction Kicks Off Week Of Closely-Watched Supply

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more