EUR/USD: Will The ECB Deal A Third Blow To The Euro? Bears Are Gaining Strength

A three-course dinner failed to bring the UK and EU closer together to a Brexit deal – and a bipartisan proposal in Washington also falls short of sealing a fiscal stimulus deal. Both sets of negotiations remain stuck and have weighed on EUR/USD, ahead of a more-European specific event.

New Brexit deadline: After a long dinner and Brussels, European Commission President Ursula von der Leyen and UK Prime Minister Boris Johnson concluded that they are still “far apart.” They have instructed their teams to negotiate with a new deadline in sight – Sunday night.

Previous goals have come and gone. For EUR/USD traders, the weekend means that there is a good chance that Brexit would move somewhat out of the radar, as now there is more time to talk. The pound is still set to rock on every headline, but the euro will likely shrug off developments unless a deal is announced on Thursday – highly unlikely.

No white smoke on Capitol Hill: US Treasury Secretary Steven Mnuchin said Democrats and Republicans agreed on 90% of the relief package – but are still at odds over liability clauses and state aid. Contrary to Brexit, there is no deadline and there seems to be more for compromise.

However, Wednesday’s deadlock – coupled with a lawsuit against Facebook’s alleged monopoly powers – sent stocks down the dollar up. Looking forward, there is room for some upside from bipartisan talks.

After UK and US developments dominated euro/dollar, the focus shifts to the old continent. Christine Lagarde, President of the European Central Bank, is set to deliver on the pledge to add more stimulus via expanding the ECB’s bond-buying scheme.

The Frankfurt-based institution is forecast to add some €500 billion to the Pandemic Emergency Purchase Program (PEPP). In coronavirus times, printing more euros means more funds for governments to boost their economies – positive for the common currency. A half-trillion euro boost is mostly priced in and the bank would have to shock markets with a far larger expansion to send the common currency higher.

A surprise may come from comments on the exchange rate. Lagarde may note that the rise of the euro pushes inflation lower and that the ECB is monitoring its value closely. The Frankfurt-based institution does not officially target the exchange rate, but it could hint that its recent rise may trigger a rate cut – that would already shock markets and send the euro down, but the chances remain slim at the moment.

Euro/dollar may receive a boost from the US Food and Drugs Administration, which is set to approve the Pfizer/BioNTech coronavirus vaccine, following Canada’s and Britain’s footsteps. A shot in the arm could not come sooner – over 3,000 lives were lost to the virus in America on Wednesday, similar to the death toll in 9/11.

Apart from US fiscal stimulus, investors will also be watching America’s inflation figures, which are set to edge higher in November, and weekly jobless claims. Applications for unemployment benefits are set to rise after dropping last week.

Overall, a busy day awaits traders, with room to the downside.

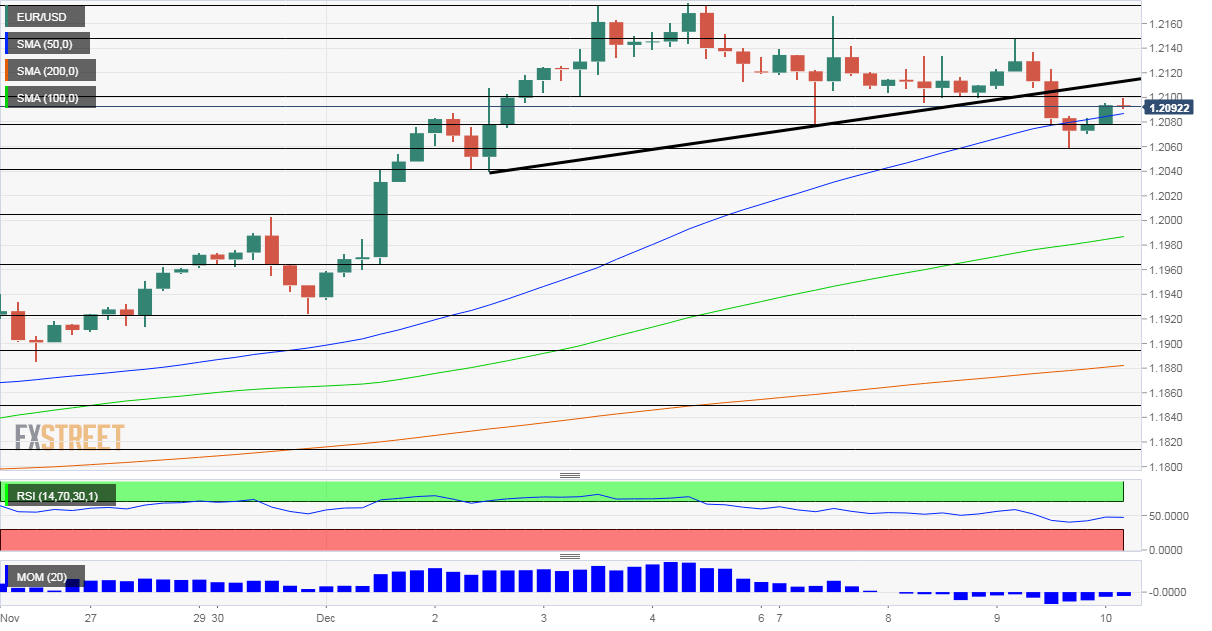

EUR/USD Technical Analysis

(Click on image to enlarge)

Euro/dollar has slipped below the uptrend support line that had accompanied it since early December. While the currency pair recaptured the 50 Simple Moving Average, it has yet to top the broken trendline. Momentum remains to the downside.

All in all, bears are in the lead.

Support awaits at 1.2080, which was a swing low on Monday. It is followed by Wednesday’s trough at 1.2060. Further down, 1.2040 and 1.2005 are eyed.

Some resistance is at the daily high of 1.21, followed by 1.2045, which capped EUR/USD on Wednesday. The next level to watch is the 2020 high of 1.2177.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more

My thoughts on the euro are here; seekingalpha.com/.../4392374-assuming-euro-will-recover-is-suicidal

Interesting thoughts James, thanks for sharing. But with Covid on the way out, I'm more hopeful.

Susan, I am an optimist and a one time fervent believer in the EU’s predecessor forms before it became politicised and thus dysfunctional. Covid has worsened things for many and I see no way out for them - they are trapped in permanent poverty. James

Going to add anything of value to the conversation here or just spam the comments to drive traffic to your own site?

Instead of rudeness why do you not add something of value of your own to the discussion. For the sake of the many driven into poverty I would like to be proven wrong.