EUR/USD Tested Fresh Six-Week Lows Below 1.0700 On Friday

Image Source: Pixabay

- The EUR/USD currency pair tilted lower on Friday as politicalk upheaval cut euro demand.

- US consumer sentiment survey figures dipped in June.

- Markets were grappling with odds of fewer Fed rat cuts than hoped.

The EUR/USD currency pair slipped into the low end on Friday, clipping into 1.0670 before recovering to the 1.0700 handle during the US market session. Political pressure was weighing down the euro after a wide shift in European voter sentiment tilted towards right-of-center political parties in European parliamentary elections recently, sparking a snap election in France.

On the US side, steepening negative data appeared to be reigniting possible concerns of an economic downturn, fueled by a worse-than-expected print in the University of Michigan’s (UoM) Consumer Sentiment Survey Index.

European Central Bank (ECB) officials have been working to reassure the market as the euro performed poorly this past week compared to other major currencies. French President Emmanuel Macron has dissolved the French government and called for a snap election in an effort to counter the rise of right-wing contender Marine Le Pen, who achieved a surprising victory in the European parliamentary elections.

With support for President Macron fading due to public discontent with unpopular fiscal policies, Le Pen, who has made several unsuccessful bids for the French Presidency since 2012, is trying for the fourth time. Financial markets were concerned about the political instability in France, as Le Pen's proposed tax cuts and reduced retirement age could lead to economic strain for the European Union.

The UoM Consumer Sentiment Index survey fell to 65.6 in June, missing the expected increase to 72.0 and dropping from the previous 69.1, reaching a six-month low. This decline reflects growing consumer concerns about the US economy. Additionally, five-year Consumer Inflation Expectations rose to 3.1% from the previous 3.0%, indicating persistent price growth that has been affecting consumers' economic outlook.

Market sentiment was negatively impacted this week by the Federal Reserve's latest Summary of Economic Projections (SEP), which showed that the market's expectations for multiple rate cuts are higher than what the Fed anticipates. The Fed's median interest rate expectations, represented in the "dot plot," were revised to only one rate cut in 2024, down from the three projected in March.

Despite the Fed's cautious stance, rate markets still anticipate a rate cut in September. According to the CME's FedWatch Tool, traders are pricing in nearly a 70% chance of at least a quarter-point rate reduction from the Fed at the Sept. 18 meeting.

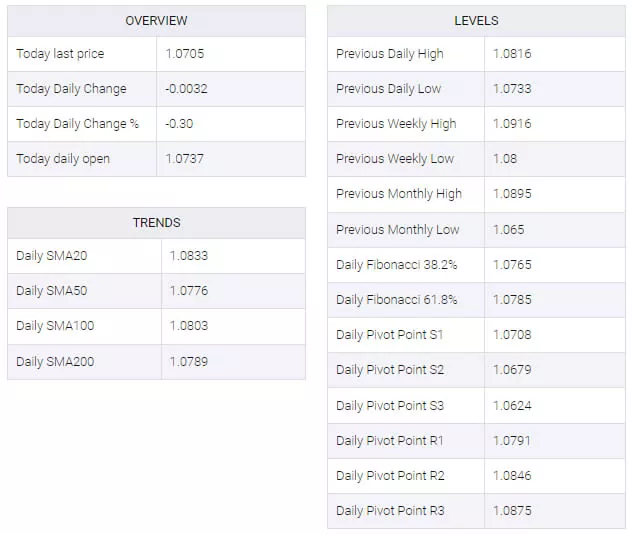

EUR/USD Technical Outlook

The EUR/USD currency pair slid to a six-week low of 1.0676 on Friday before a mild recovery was seen during the US market session, as it clawed back to the 1.0700 handle to wrap up the trading week. Fiber declined in near-term choppy trading, descending from the 1.0900 level through June.

Daily candlesticks tumbled back below the 200-day Exponential Moving Average (EMA) at 1.0804, and the way may be clear for an extended slide to April’s swing low near 1.0600.

EUR/USD Hourly Chart

(Click on image to enlarge)

EUR/USD Daily Chart

(Click on image to enlarge)

EUR/USD Technical Levels

More By This Author:

Canadian Dollar Fell Flat On Friday After Mild Miss In Canadian Sales Figures

EUR/USD Looks For Bullish Push Ahead Of Final EU GDP And US NFP Data Drops

EUR/USD Staggers Back From Recent Highs After Greenback Bids Resurface