Canadian Dollar Fell Flat On Friday After Mild Miss In Canadian Sales Figures

Image Source: Unsplash

- The Canadian dollar was higher on Friday, but only by a slight amount.

- Canada missed forecasts on manufacturing and wholesale figures.

- The US Consumer Sentiment survey dominated the news flow in the American session.

The Canadian dollar managed a thin recovery on Friday, as it gained ground against most of its currency peers and clawed back a scant tenth of a percent against the US dollar. Market sentiment continued to drag throughout Friday's US session, pulling the Canadian dollar into middling bids against the greenback.

A missed forecast in Canadian Manufacturing Sales was broadly brushed off, and an unexpected backslide in the University of Michigan’s (UoM) Consumer Sentiment threw a cautionary wrench in market sentiment to wrap up the trading week.

Manufacturing and Wholesale Sales in Canada saw a milder recovery from recent contractions than expected, but market sentiment was largely focused elsewhere after the UoM Consumer Sentiment Index fell to a six-month low, and five-year Consumer Inflation Expectations ticked higher in June.

Market Movers: Canadian Dollar Ground Out Thin Gains Despite Forecast Miss

- Canadian Manufacturing Sales rebounded 1.1% month-over-month in April, slightly missing the forecast 1.2% and recovering from the previous month’s revised -1.8%.

- Wholesale Sales recovered 2.4% over the same period, but missed the expected 2.8%. Wholesale Sales provided a firmer recovery from the previous -1.3%, which was also revised slightly lower from -1.1%.

- The UoM Consumer Sentiment Index unexpectedly declined in June, falling to 65.6 after markets expected a climb to 72.0 from the previous 69.1. The backslide represents the key sentiment indicator’s worst print in six months.

- UoM five-year Consumer Inflation Expectations also rose in June, climbing to 3.1% from the previous 3.0%. According to the UoM’s consumer survey, spender expectations of future inflation have climbed to their second-highest level since the COVID-19 pandemic era.

- Coming up next week, Canadian data continues to play second fiddle, restricted to mid-tier releases at best throughout the week. US Retail Sales will be a key print on Tuesday.

Canadian Dollar Price on Friday

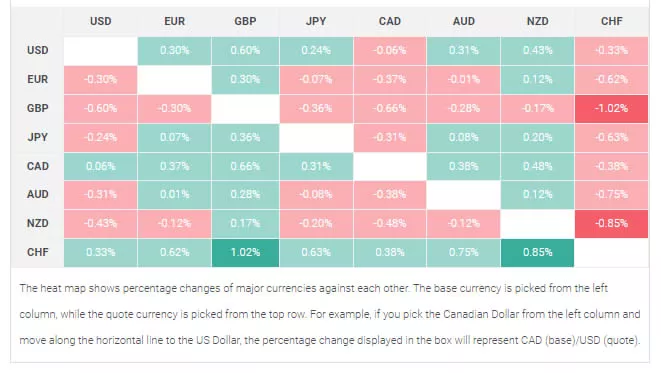

The table below shows the percentage change of the Canadian dollar against listed major currencies. The Canadian dollar was the strongest against the British pound.

Technical Analysis: Choppy Trading Continued to Plague the Canadian Dollar

The Canadian dollar was broadly higher on Friday, brushing off a half-percent decline against the Swiss franc to rise six-tenths of one percent against the pound and four-tenths of a percent against the euro and New Zealand dollar. The Canadian dollar appeared to be scrambling to hold onto near-term gains against the US dollar, as it was seen trading within a tenth of a percent of Friday’s opening bids.

The USD/CAD currency cross climbed to the 1.3780 region on Friday before slipping back to familiar territory below 1.3740. The pair continued to trade above the 200-hour Exponential Moving Average (EMA), but volatility remained high. Consolidation continued to weigh on daily candlesticks, though the USD/CAD pair has managed to trade on the north side of the 200-day EMA at 1.3575 since early April.

Near-term momentum may lean in favor of the bears as sellers looked set to drag the USD/CAD duo back down to the 50-day EMA at 1.3670 -- that is, unless renewed buying pressure in the coming days pushes the pair back above June’s peak bids near 1.3790.

USD/CAD Hourly Chart

(Click on image to enlarge)

USD/CAD Daily Chart

(Click on image to enlarge)

More By This Author:

EUR/USD Looks For Bullish Push Ahead Of Final EU GDP And US NFP Data DropsEUR/USD Staggers Back From Recent Highs After Greenback Bids Resurface

Canadian Dollar Rebounds As Market Sentiment Recovers, Greenback Softens