EUR/USD Forecast: Dollar Unfazed By Fitch’s Downgrade

Today’s EUR/USD forecast is slightly bearish. On Wednesday, the dollar showed minimal movement as investors disregarded Fitch’s downgrade of the US credit rating. Notably, Fitch downgraded the United States to AA+ from AAA on Tuesday. This downgrade came despite the resolution of a debt ceiling crisis two months ago.

Moreover, Fitch cited the likelihood of fiscal deterioration over the next three years. Additionally, the recurring down-to-the-wire debt ceiling negotiations threaten the government’s ability to pay its bills.

The dollar’s reaction was limited, with the euro remaining unchanged at around $1.098. Although US job openings in June reached their lowest level in over two years, they remained consistent with tight labor market conditions. This could lead to the Fed maintaining elevated interest rates for some time.

Moreover, the third consecutive monthly layoff decline showed the labor market’s resilience. Employers held onto workers following labor shortages during the COVID-19 pandemic. There were 1.61 job openings for every unemployed person in June, up from 1.58 in May.

Meanwhile, an ISM survey provided a challenging evaluation of US manufacturing conditions. However, concrete data indicated that the sector is progressing slowly. Federal Reserve data for June revealed a rebound in factory production during the second quarter.

Additionally, US construction spending substantially increased last month, with May’s data being revised higher. The boost was driven by expenditures on single and multifamily housing projects, as reported by the Commerce Department.

EUR/USD Key Events Today

Investors will receive private employment data from the US today. This report comes before the all-important non-farm payrolls report and will likely show a drop in employment.

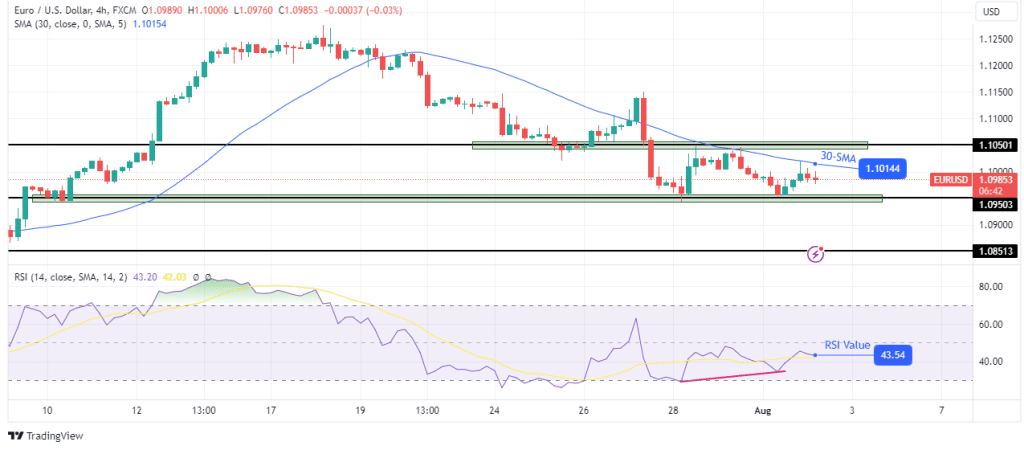

EUR/USD Technical Forecast: RSI Divergence Points To A Shift In Sentiment.

EUR/USD 4-hour chart

On the charts, the EUR/USD is in a downtrend, with the price trading below the 30-SMA and the RSI under 50. Moreover, the price has made a double bottom at the 1.0950 support level. At the same time, the RSI has made a bullish divergence, indicating weaker momentum in the downtrend.

If the RSI divergence plays out, we might see a shift in sentiment from bearish to bullish. The price would likely break above the 30-SMA and the 1.1050 resistance level. However, if bears regain momentum, the price will go below 1.0950.

More By This Author:

AUD/USD Price Analysis: Slides As RBA Holds Cash Rates Steady

Gold Price Forms Flag Pattern, US ISM Data Eyed

GBP/USD Weekly Forecast: Traders Dial Back on Jumbo Hike Bets