GBP/USD Weekly Forecast: Traders Dial Back On Jumbo Hike Bets

Central bank decisions this week strengthened the belief that the Bank of England won’t implement another significant rate hike next week.

However, investors remain confident in a stronger pound. Moreover, they have maintained their most valuable bullish position on sterling since 2014.

Notably, data from the US highlighted the strength of the economy. As a result, the dollar strengthened, leading to a decline in GBP/USD.

Additionally, the FOMC meeting during the week resulted in a rate hike, further bolstering the dollar.

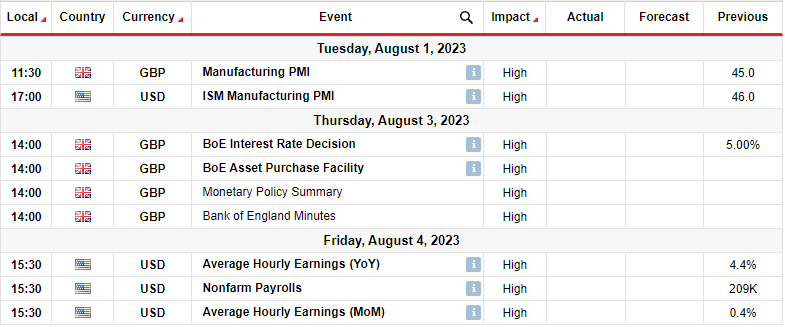

Next Week’s Key Events For GBP/USD

Next week will see the release of major economic reports from the US and the UK. These will likely cause massive price swings for the pair. Investors will focus on two major events. US employment data and the BOE policy meeting.

On August 3, the Bank of England will likely raise rates by a quarter-point to 5.25%. However, there is a risk of a repeat of June’s surprise half-point hike due to inflation remaining higher than in other major economies.

Notably, the Fed and the European Central Bank raised interest rates by a quarter of a percentage point this week.

GBP/USD Weekly Technical Forecast: Bulls Vs. Bears As Price Dips Below 22-SMA

GBP/USD daily chart

GBP/USD is trading at a pivotal level in the daily chart. The price has broken below the 22-SMA, but the RSI is slightly above 50. This indicates a struggle for dominance between bulls and bears.

Bears entered the market at the 1.3127 resistance level, pushing the price down to the 1.2801 support. Although they broke below the 22-SMA, they still face strong support at 1.2801.

In the coming week, bears will break below this support or fail, allowing bulls to continue the previous trend. A win for bears would mean a retest of the 1.2603 support. On the other hand, a victory for the bulls would mean a retest of the 1.3127 resistance level.

More By This Author:

EUR/USD Price Analysis: ECB’s Rate Hike Commitment Doubtful

Gold Price Struggling Around $1,950 Before US PCE Data

USD/CAD Price Gathering Bullish Energy On Positive US Data