USD/CAD Price Gathering Bullish Energy On Positive US Data

The USD/CAD price dropped earlier today as DXY’s sell-off forced the USD to lose ground versus its rivals. Surprisingly or not, the greenback depreciated even though the CB Consumer Confidence indicator came in better than expected.

The US dollar slumped ahead and after the FOMC as the FED is expected to Federal Funds Rate at 5.50% after yesterday’s hike.

As you already know, the Federal Reserve increased the Federal Funds Rate by 25 bps, matching expectations.

The ECB Monetary Policy Statement, Main Refinancing Rate, and ECB Press Conference moved the markets earlier. Still, the USD seems strongly bullish after the US reported positive economic data.

The Advance GDP rose by 2.4%, beating the 1.8% growth estimated and the 2.0% growth in the previous reporting period. Furthermore, the Unemployment Claims, Prelim Wholesale Inventories, Goods Trade Balance, Durable Goods Orders, and Core Durable Goods Orders came in better than expected as well, boosting the greenback.

Later, the US Pending Home Sales could report a 0.5% drop versus the 2.7% drop in the previous reporting period.

The Canadian GDP and the US Revised UoM Consumer Sentiment, Core PCE Price Index, and Employment Cost Index could move the rate tomorrow. Also, don’t forget that the BOJ could also have an impact.

USD/CAD Price Technical Analysis: Support Zone

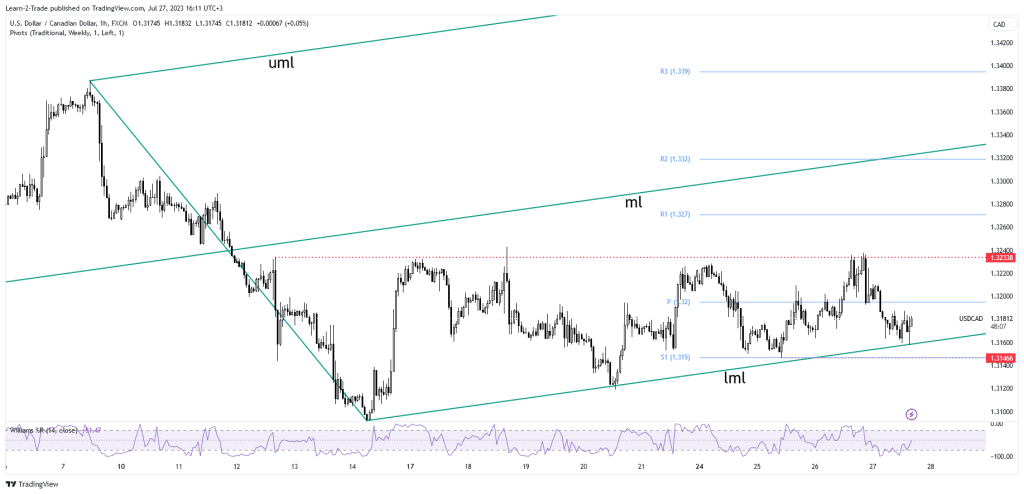

(Click on image to enlarge)

USD/CAD price hourly chart

Technically, the currency pair crashed in the short term after reaching the 1.3233 level. Now, it has turned to the upside again after reaching the lower median line (lml) of the ascending pitchfork.

This stands as dynamic support. 1.3233 stands as a potential target if the rate develops a new leg higher. Only a valid breakout through this obstacle, a new higher high, could really announce a larger growth towards the median line (ml) of the ascending pitchfork.

Technically, as long as it stays above the lower median line (ml), the median line (ml) could attract the price.

More By This Author:

EUR/USD Outlook: Bulls Dominating Above 1.11 Ahead Of ECBGold Price Rallied on Lower Australian Inflation, Eyes on FOMC

EUR/USD Outlook: Dismal Business Activity Data Weighs On Euro