EUR/USD: Are Bulls Ready To Take Over? Not So Fast, As Three Dark Clouds Loom

The grand profit-taking has finally happened – but it may not be over so fast. While EUR/USD is off its highs and has the basic reasons to rise, three worries could extend its downward correction

1) Weak Nonfarm Payrolls ≠ more stimulus

The lapse of several federal programs and the increase in COVID-19 cases and related restrictions took its toll on America’s labor market. The US gained only 245,000 jobs in November, around half the early expectations – raising concerns of a loss of positions in December.

Investors saw this as “bad news is good news” – hoping that the weak data would push lawmakers to agree on a relief package worth around $1 trillion that senators from both parties suggested. However, Senate Majority Leader Mitch McConnell seems reluctant to agree on anything worth more than $500 billion. Ongoing uncertainty could weigh on sentiment and boost the safe-haven dollar.

2) New Sino-American tensions

President Donald Trump continues pounding China on the way out – and that is an area where there is little controversy with President-elect Joe Biden. He is reportedly backing a proposal to sanction an additional 14 senior Chinese officials.

The world’s largest economies signed a trade deal early in the year and further tensions could tear it apart.

3) Brexit talks in trouble

The EU and the UK continue clashing over a Brexit deal with only some three weeks to go until the transition period ends. UK Prime Minister Boris Johnson is reportedly ready to ditch talks “within hours” – a headline that exacerbated sterling’s falls and dragged the euro down.

If negotiations conclude on Monday, the common currency could further fall.

These three percolating issues will likely cap the currency pair, despite other factors to be optimistic – that had pushed it to current highs. The UK is set to begin vaccinating its population with the Pfizer/BioNTech jab on Tuesday and the US FDA is set to approve it on Thursday. The European Central Bank convenes on that day and will likely add more stimulus.

Overall, the trend remains to the upside, but a deeper correction cannot be ruled out.

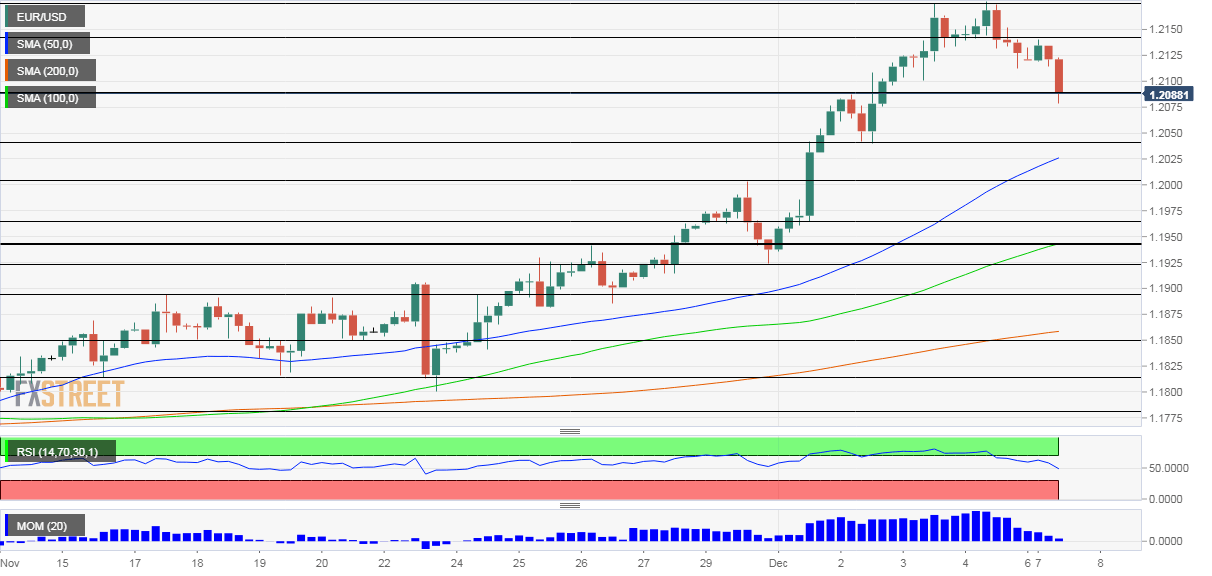

EUR/USD Technical Analysis

(Click on image to enlarge)

Euro/dollar is already some 100 pips from the 32-month highs and upside momentum on the four-hour chart has waned. However, it is still holding above the 50, 100 and 200 Simple Moving Averages and the Relative Strength Index is far from oversold conditions.

All in all, bulls are retreating but are still in play.

Some support awaits at 1.2080, which capped EUR/USD last week. It is followed by 1.2040, a cushion from the same time, and then by 1.20 and 1.1960.

Resistance is at 1.2140, the daily high, followed by 1.2177, the multi-year peak. Further above, 1.22 and 1.2250 await the bulls.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more

Longer term the euro has nowhere to go but down. James seekingalpha.com/.../4392374-assuming-euro-will-recover-is-suicidal