Euro Clings Above 1.1600 As Dollar Softens Amid Quiet Data Lull

Image Source: Pixabay

EUR/USD clings to the 1.1600 mark posting modest gains of over 0.15% on Monday as the Greenback tumbles following hawkish remarks by Kazuo Ueda, Bank of Japan Governor. A light economic docket in both sides of the Atlantic boosted the Euro’s prospects.

Euro edges higher as USD weakens on BoJ-driven risk shifts, speculation over future Fed leadership

The US schedule featured Purchasing Managers’ Indices for November, which showed a deceleration of manufacturing activity. Comments of the Institute for Supply Management (ISM) revealed that manufacturers of transportation equipment industry linked layoffs to Trump’s tariffs.

Aside from this, the Dollar extended its losses as rumors increase that the White House National Economic Advisor Kevin Hassett could succeed the Fed Chair Jerome Powell, once he finishes his period in May 2026.

In Europe, HCOB Manufacturing PMIs were released for the bloc, with Germany and the Eurozone Missing. While France was aligned with forecasts while Spain and Italy topped forecasts. The data barely influenced the EUR/USD, which could be underpinned on a positive resolution of the Ukraine-Russia conflict.

Ahead this week, the EU economic docket will feature the Harmonized Index of Consumer Prices (HICP). In the US, the schedule will feature the ADP Employment Change, the ISM Services PMI, Initial Jobless Claims and the Fed’s preferred inflation gauge release, the Core PCE.

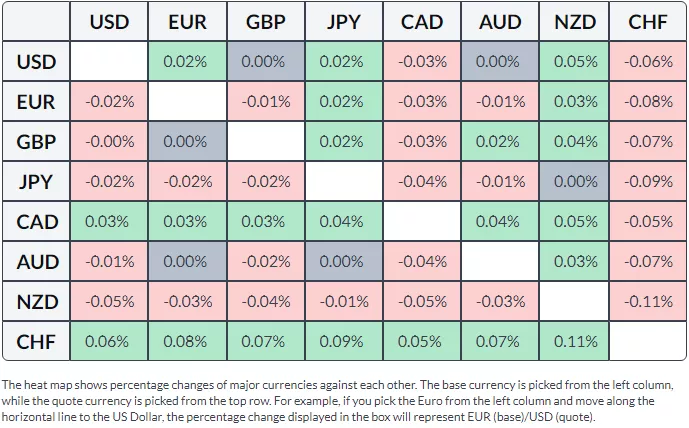

EURO PRICE THIS WEEK

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the New Zealand Dollar.

Daily market movers: EUR/USD holds firms above 1.1600

- On Monday, BoJ Governor Ueda said that “The BOJ is at the stage where it should examine whether firms' active wage-setting behavior will continue.” He added that “We will examine and discuss economic and price developments at home and abroad, as well as market moves ... and consider the pros and cons of raising interest rates.”

- The ISM Manufacturing PMI dipped from 48.7 in October to 48.2 last month. The sub-component of employment dropped from 46 to 44, while Prices Paid jumped to 58.5 from 58, below forecasts of 59.5.

- Expectations that the Fed will cut rates remain high as depicted by the CME FedWatch Tool showing that the chance for a 25-basis points rate cut in December, are 87.4% up from 86% last Friday

- HCOB Flash Manufacturing PMIs for Germany fell to 48.2 in November from 49.6 in October. The fall was largely due to a renewed drop in new orders, with exports plunging the most amid weaker demand from Asia, Europe an North America.

- European Central Bank (ECB) member Martin Kocher said that the ECB should keep its powder dry on rates as he said, “I believe slight deviations above or below the 2% target should not yet trigger any need to act now, because we cannot and do not want to engage in that kind of micro-management of monetary policy.”

Technical analysis: Euro consolidates at around 1.1600 waiting for catalyst

The EUR/USD remains capped by the confluence of the 50- and 100-day Simple Moving Averages (SMAs) at 1.1612/42, with bulls unable to clear the latter to challenge 1.1700. Although the Relative Strength Index (RSI) shows that momentum is bullish, in the short term, it could remain sideways.

For a bearish continuation, the EUR/USD first support is 1.1600 followed by the 20-day SMA at 1.1571. A breach of the latter will expose the November 21 low of 1.1491 ahead of the 200-day SMA at 1.1443.

(Click on image to enlarge)

EUR/USD daily chart

More By This Author:

Gold Hits Five-Week High Toward $4,264 Fueled By Fed Cut Frenzy

Euro Stays Firm Above 1.1600 As Dovish December Bets Rise To 87%

Gold Firm Above $4,200 On Broad Dovish Repricing For December