Energy Stocks Breaking Out Or Down?

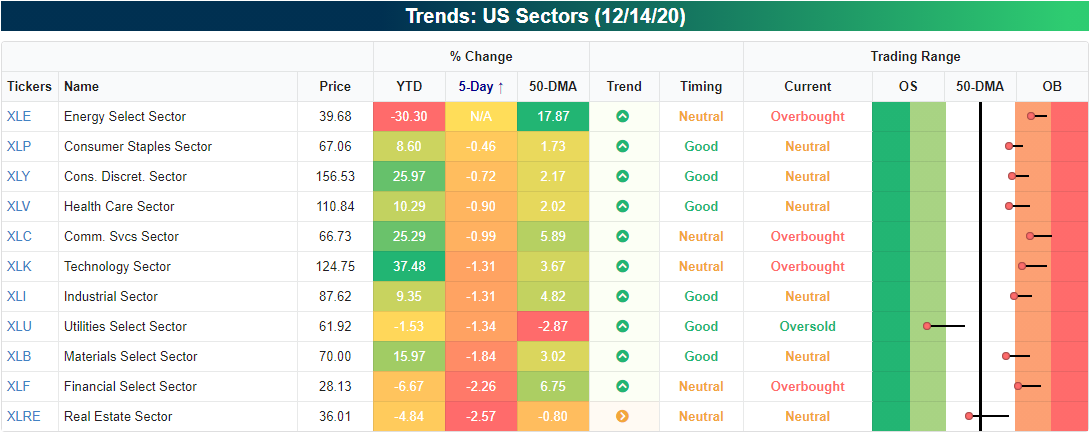

While every other sector is down over the past week, the Energy sector is unchanged as it sits further above its 50-DMA than any other sector as shown in the screenshot of our Trend Analyzer below. Of all the sector ETFs, the Energy sector (XLE) is 17.87% above its 50-DMA compared to the other sectors which are an average of just 2.64% above their 50-DMAs. While lower in its trading range relative to the last week, it is also one of the most overbought sectors.

Looking at the chart of XLE, the recent leg higher puts it smack dab in the middle of the range between the spike to the post-pandemic high in June and the high end of the range that had been in place for most of the spring and summer.

Across many individual stocks in the sector, it is the same picture. As shown in the snapshot of Energy sector stocks from our Chart Scanner tool below, a number of individual stocks are below their late spring highs but are also above more consistent highs from the spring and summer.

That is not the case for all stocks in the sector though. Some have in fact moved above those spring spikes. For example, Baker Hughes (BKR) and Haliburton (HAL) have moved well above those highs. Meanwhile, others like Marathon Petroleum (MPC), TechnipFMC (FTI), and Schlumberger (SLB) have been trading right around those highs, yet to make a significant break in any direction.

As previously mentioned, Energy has actually seen decent performance recently. As a result, 96% of the sector’s stocks currently trade above their 50-DMAs meaning there are only two stocks trading below: Cabot Oil and Gas (COG) and Noble Energy (NBL). That compares to a reading of 75% for the broader S&P 500, and only Communication Services has a stronger reading at 100%

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more