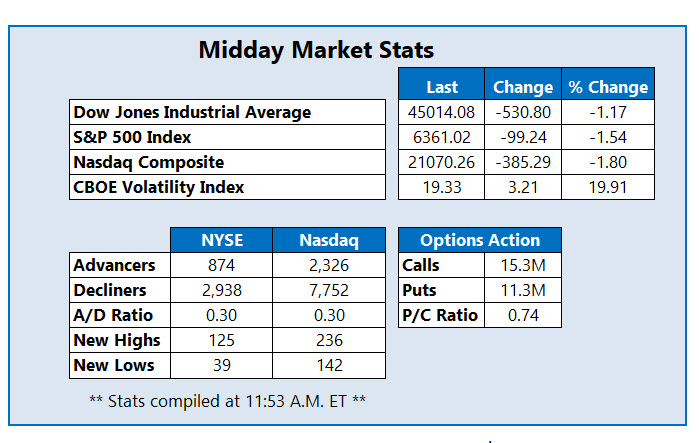

Dow Slides 530 Points Amid Tariff Tensions, Surging Yields

The Dow Jones Industrial Average (DJIA) and Nasdaq Composite (IXIC) are down triple digits as tariff uncertainty resurfaces, while the S&P 500 Index (SPX) sits firmly lower as well. President Donald Trump promised to approach the Supreme Court after the federal appeals court ruled that most of his global levies were illegal. The 10-year and 30-year Treasury yields jumped in response, as refund worries surface and investors brace for a month that historically runs bearish for investors.

Manchester United Inc (Nasdaq: MANU) stockis seeing an influx of options activity today, just after yesterday's closure of the English Football League's transfer window. So far 12,000 calls have been exchanged, 19 times the average intraday amount. Most popular are the September 24 and 30 calls. Today's pullback has put the equity back below its year-to-date breakeven mark, last seen trading off 5% at $16.97.

Mining name McEwen Inc (NYSE: MUX) is at the top stock on the New York Stock Exchange (NYSE) today, after the company's positive report for resource growth. The shares are 17% higher to trade at $13.51, eyeing a third-straight win and best daily pop since November 2022. The equity is also trading at a more than four-year high, breaking above last year's ceiling of $12.50.

Joby Aviation Inc (NYSE: JOBY) is one of the worst stocks on the NYSE today, last seen down 6.1% to trade at $13.27. While today's catalyst is unclear, the company said Friday that it completed its acquisition of Blade's Passenger Business. This will mark a fourth consecutive drop for JOBY, shaving a portion of the stock's 63% 2025 gain.

More By This Author:

What Seasonality? Stocks Finish August With Monthly Wins

Stocks Succumb To Profit-Taking As August Winds Down

S&P 500 Breaks Above 6,500 As AI Keeps Growing