Don't Be Afraid Of The Fed. The Modern Family Will Guide You

Wall Street sold off dramatically on Friday after the jobs report.

While the economy is stagnating, many investors are concerned that the Fed will raise rates too quickly, pushing the U.S. economy into a deep recession.

It is good to stay current on the unemployment rate and Fed policy. However, Mish's Modern Economic Family, composed of a few stock symbols, can serve as a valuable guide to market conditions and the next potential trend.

This weekend, we are looking at the weekly Modern Family charts to gain insight and KRE displayed above is one of the family members.

What is the Modern Family telling us about trading next week?

(Click on image to enlarge)

The Modern Family consists of the small-cap Russell 2000 index (IWM), Transportation (IYT), Retail (XRT), Regional Banking (KRE), Biotech (IBB), and Semiconductors (SMH).

Each family member is in a bearish phase on the daily charts.

Looking at the weekly charts, the Russell 2000 (Grandpa) touched the 50-week moving average in the middle of August and then broke down through the 200-week moving average.

The 200-WMA, past support, looks like critical resistance for Grandpa. A move over the 200-WMA of 178 would be a bullish sign.

Just like Grandad, Granny Retail (XRT) also closed at a higher weekly low on Friday. Granny also outperformed the broader market and ended up 3.22%. She is at 58.05 and needs to clear 61.79, the 200-week moving average, to regain shopping strength.

Granny (XRT) has unfavorable macro and micro headwinds against her, making a swift recovery difficult.

(Click on image to enlarge)

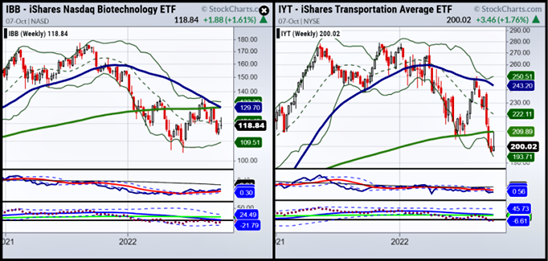

Transportation (Trans) IYT has followed a similar weekly pattern, but once the 200-week moving average was crossed in late September, IYT put in a much lower low and only a slightly higher low for the first week of October at 200, below the 200-WMA at 214.

Biotechnology (Big Bro, IBB) dropped considerably in late August and broke its 200-WMA. IBB has since closed at higher weekly lows. IBB outperformed the broader market, up 1.61% for the week.

The FDA's approval of medications and encouraging clinical data have helped the industry. IBB must surpass the 200-WMA at 130 at its current price of 118 to keep gaining strength and momentum.

(Click on image to enlarge)

Semiconductor Sister (SMH) is hugging the 200-week moving average and could have found a bottom or a temporary rest stop. Semis are a critical industry for decades to come, but considerable downside risk exists today.

Monitor SMH's price closely for a clearer indication of further market declines or for a potential mini-recovery next week.

Regional Banks (Prodigal Son, KRE) closed at a significant higher weekly low and is the only family member who is decisively far above the 200-week moving average.

KRE finished up 2.48% for the week. A rising rate environment should provide continued uplift and strong support for regional banks.

Due to the weakening economy, inflation, rising energy costs, higher rates, and a modest decline in employment, the stock market is incredibly vulnerable.

More By This Author:

Gasoline Prices Matter To The Stock Market3 Technical Lessons On Whether Or Not Semiconductors Bottomed

Step Back To The Monthly Chart On Transportation

Disclaimer: The information provided by us is for educational and informational purposes. This information is based on our trading experience and beliefs. The information on this website is not ...

more