Does An Independent Fed Raise Inflation?

Image Source: Pixabay

If Trump takes over the Fed will inflation get even worse?

Or is the Fed the heroic defender of hard money that its defenders claim?

Last week, Donald Trump fired Fed member Lisa Cook for alleged mortgage fraud — the first time in the Fed’s 112 years a member has been fired.

Cook apparently has zero expertise in monetary policy — her academic career consists of cooking data to claim racism. Still, she’s hired a lawyer and is suing to keep her job, so depending on how the Supremes swing, she could stick around.

This sent our mainstream Keynesian oligarchy into full panic mode at the prospect of the Fed coming under the control of the elected President instead of the unelected banker junta.

Voters. Running Countries. Insanity.

(Click on image to enlarge)

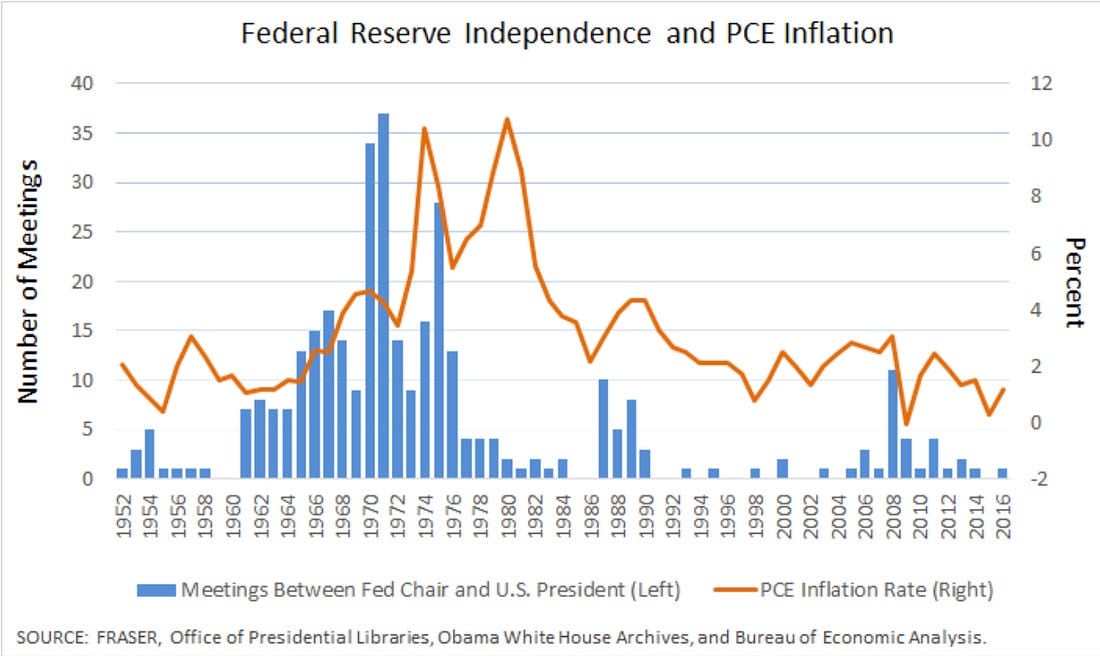

The Myth of Fed Independence

To hear Keynesians tell it, we’re going straight to Weimar, wheelbarrows of money and all.

To be fair, we’re going to Weimar anyway since Congress spends like a crackhead with a trillion-dollar visa. But they claim it’ll go faster once voters get a hold of the Fed.

Now, this debate's been around for decades, with people like Murray Rothbard and Ron Paul arguing fed independence is a myth, propaganda for an organization that will always serve the dark alliance of government and banks it was built to serve, while acting as an engineered scapegoat to insulate elected representatives from voters.

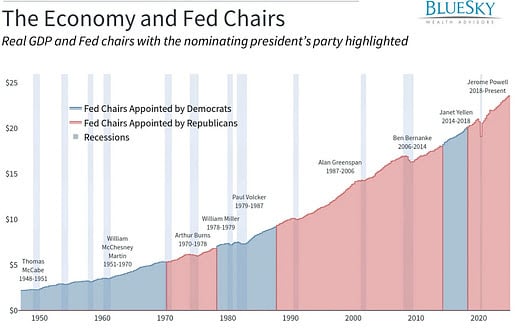

(Click on image to enlarge)

It’s actually worse; I tallied up monetary policy under Democrat and Republican presidents and found Democrats get much lower rates -- they get the cheap money boom. While Republicans get recession-inducing rates.

In case you wonder about those charts showing the economy does better under Democrats.

Still, Keynesian professors and financial journalists argue voters would make it even worse because they'll demand easy money booms that inevitably cause inflation.

Lisa Cook’s Natural Experiment

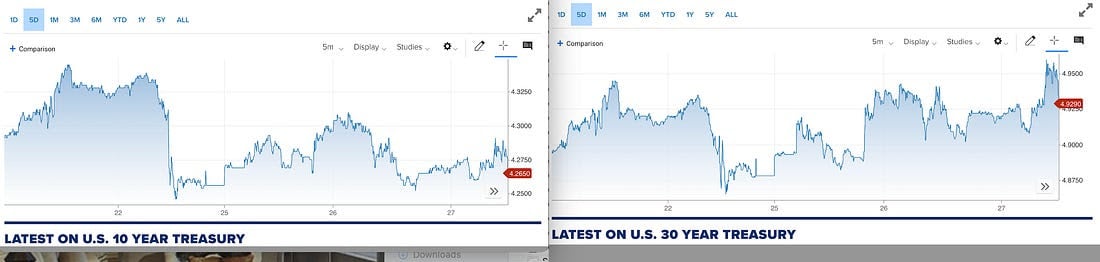

Well, we just had a fantastic natural experiment from Trump’s firing of Cook in the form of bond yields. Which tells us what markets -- not pundits -- think will happen to inflation.

So Trump floated firing Cook at 10 am on August 22nd, saying, "I'll fire her if she doesn't resign.".

(Click on image to enlarge)

The comments immediately sent 2-year bond yields plunging -- meaning markets expect lower short-term rates. This is what you'd expect, since Trump's been pretty clear that he wants rate cuts to goose the economy.

But what was interesting is that yields also plunged on both the 10-year and 30-year treasury bonds, which are key measures of inflation.

As in, inflation will be lower if Trump takes over the Fed.

In fact, the 10-year dropped almost 10 basis points in 90 minutes, which is close to what it normally moves in a month.

In other words, taking the data at face value, markets think an independent Fed raises long-term inflation.

This would be counter to the overwhelming consensus of monetary economists who claim the Fed lowers inflation. It’s worth noting that many are paid by the Fed in academic grants, so they would say that.

(Click on image to enlarge)

If I had to guess, what's driving the numbers is that the Fed has already lowered rates to print as much inflation as it can get away with -- what I call the Pitchfork Standard. As in, voter anger at high inflation or low jobs.

But greater Presidential control reduces the other half of Fed inflation, the trillions quietly flooded to bankers in so-called Quantitative Easing.

So rates don't change with Presidential control. But the automatic bailouts to Wall Street shrink since they’re unpopular.

What’s Next

Ideally, Trump can break the Fed and let the economy run itself. Like Andrew Jackson did in abolishing the central bank for manipulating the economy into booms and busts.

But the next best thing is to break the economic oligarchy and hand control -- and accountability -- back to the people.

At which point, politicians will actually have to answer for the inflation, the recessions, the bailouts, and the lost jobs.

More By This Author:

Central Bank Gold Buying Slowed In AugustWhat Is Driving This Silver Bull Run?

Silver Investment Demand Surges But U.S. Investors Still On The Sidelines