Do Trade Deficits Matter?

Image Source: Unsplash

Financial market news has seemingly become all tariffs, all the time. The president’s plan, whatever it is, seems to spring from his belief that trade deficits are bad and must be eliminated. Tariffs are just a means to that end.

I have a somewhat different view. I think the US trade deficit, in itself, is neither good nor bad. It’s the natural result of our position in the global economic order and it has both positive and a few negative aspects.

At the same time, it’s also important for the US (or any other country) to have some degree of self-sufficiency, and to support its own workers and manufacturers. But different segments of the economy require different approaches. Tariffs may be the right answer in some (fewer than you think) situations, but every policy solution has trade-offs.

Juggling all this is hideously complicated. That’s why trade agreements take years to negotiate. Today I’ll try to cut through some of this fog and look at why the US has a trade deficit. As you’ll see, it is a built-in, necessary feature of our money. Plus, it is time to start watching for a recession. Let’s jump in.

A Deficit Powerhouse

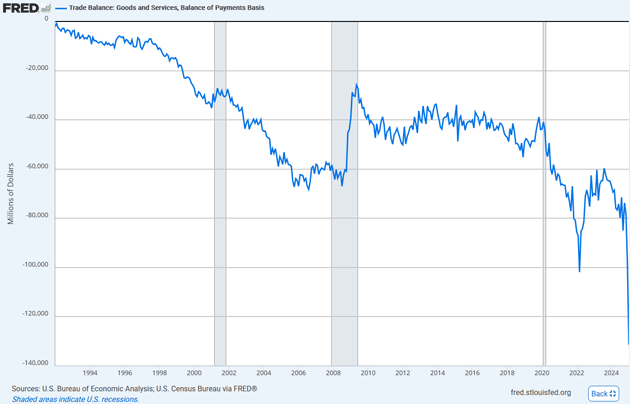

Let’s start with some data. The US buys a lot more “stuff” from the rest of the world than the rest of the world buys from the US. The difference is called the trade deficit, and we have had one almost every year since the 1970s. The trade deficit tends to shrink a little bit when consumer spending drops during recessions, but we have not had a significant trade surplus in many decades.

Source: FRED

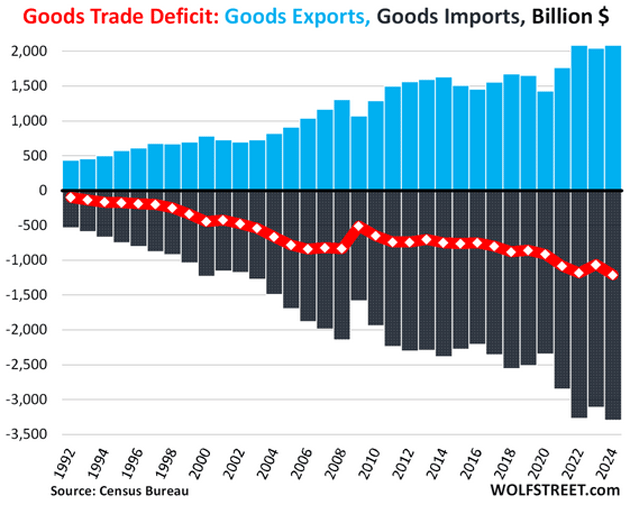

However, it is not the case that US exports are falling. They have actually grown quite a lot. Here’s another chart showing trade in goods. The blue bars are US exports, the black bars are imports, and the red line is the difference, i.e. the goods trade deficit.

Source: Wolf Richter

We export a lot of goods—over $2 trillion worth in 2024. This amount has grown almost every year, making the US an export powerhouse by any definition. The deficit exists only because our imports have grown faster than exports.

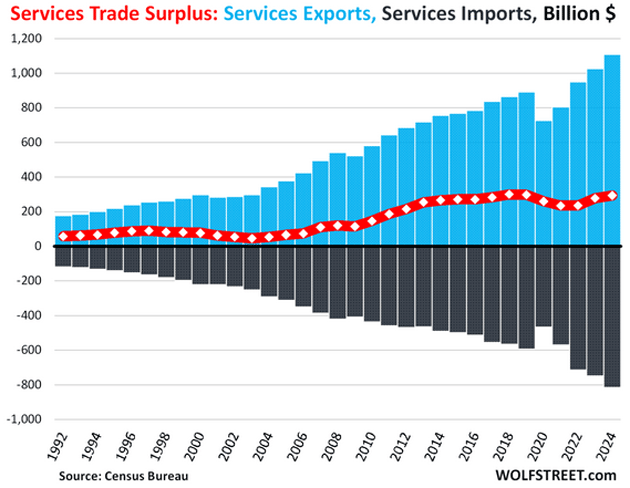

If you look at services rather than goods, the US exports more than we import. This has serious implications if we get into a tit-for-tat trade war. Do we really want Europe and the rest of the world to put tariffs on our services as some now threaten? Think Smoot-Hawley. $1 trillion in service exports is a big deal and we don’t want to screw with it.

Source: Wolf Richter

Combining goods and services shows the US runs an overall trade deficit, but we are still a major exporter—more so in services than goods. This is, to use the classic term, our “comparative advantage.” American companies and workers are good at making nontangible things: software, movies, TV shows, music, and all kinds of business services. The world wants these things and happily buys them from us. Everyone wins as long as it is voluntary.

The process looks like this: We buy stuff from foreigners and give them our dollars. We sell stuff to foreigners and dollars come back. Sometimes more, sometimes less, but the flow never stops. The speed of that flow helps drive exchange rates up and down.

This is why trade policy and currency values are so closely linked. To understand trade, you have to understand money.

Exorbitant Burden

What is money? The simplest definition I know: Money is the most liquid asset, which becomes the medium of exchange because it is widely owned and recognized.

Most sovereign states issue their own currencies, but among those it’s normal for one currency to reign supreme over others. We call this the “global reserve currency” and since 1944 it has been the US dollar. Central banks hold dollars in reserve. Most international transactions settle in dollars. As a result, the non-US world needs a lot of dollars. It is the grease that keeps the global economy turning.

This means the US must constantly export more dollars to meet world demand. This demand for our currency makes it stronger, which in turn makes imports cheaper and exports more expensive. This has been called an “exorbitant privilege” but in some ways it is also a burden. Americans are incentivized to save less money and spend more of it on imported goods.

Our trade deficit is really just a side effect of having the reserve currency. If we were to somehow start running a trade surplus, the rest of the world would become starved for dollars. That would have side effects, too. For one, the dollar would strengthen sharply enough to make our exports unaffordable to others. That wouldn’t be good for American manufacturers and their workers. Moreover, if this persisted then some other currency would take on the reserve role. I assume that’s not what President Trump wants, but it is where his zero-sum trade policy would ultimately lead.

There’s a better way to think about all this. The US imports goods and exports an equal amount of dollars. The dollar is our top export. We can make them cheaply and trade them for all kinds of other useful things on very attractive terms.

More By This Author:

When Valuations Collide…The Bull’s Eye Matrix: Updated

Revenue Thoughts