Do Not Look To Wage Gains To Contribute To Inflation

All eyes are on the opening of the US economy and the potential for inflation. Bond yields spiked recently in anticipation of rising consumer prices. We are constantly reminded that there are numerous supply bottlenecks affecting domestic industries as well as off-shore producers; that commodity prices are in a cyclical upswing in response to growing demand to support an industrial revival; and, that consumers are just itching to open out their wallets and release all that supposed pent-up demand. Macro-economists are debating whether the stimulus packages would fuel inflation as the economy returns to a more traditional growth path. Lost in much of the discussion about the prospects for overheating is any analysis in the recent trends in wages and salaries. Should we not look to the behavior of labor costs, which constitute as much as 70% of the business expenses, to gain some insight into the prospects for kindling inflation down the road?

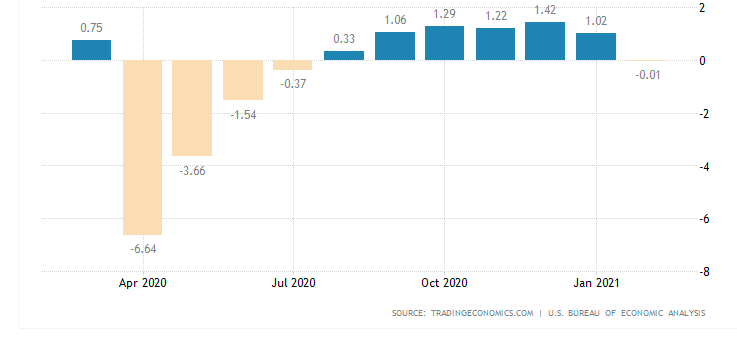

Granted, there are sectors that face specific labor shortages which will push up wages and costs in general. However, if we look at the labor market, as a whole, and track the changes in the growth in average wages and salaries, we can conclude that the labor market will not be a source of sustained price increases. Initially, when the pandemic struck in March 2020, the severe downturn led to a decline in the rate of wage growth. Since mid-2020, wage and salary increases have been muted, barely over 1%, and in the most recent survey, the rate turned slightly negative.

(Click on image to enlarge)

Wage and Salary Growth, United States, 2020-2021 (Feb)

In the Pre-COVID-19 years, labor’s share of national income was on the decline. Since the recovery from the 2008 financial crisis, nominal wages and salaries never really fully recovered and have remained weak ever since. Efforts to increase the minimum wage have failed. Employers, on average, did not need to raise wage rates to attract workers. Enter the COVID-19 year of 2020 and labor’s share weakened further. The business continues to operate under conditions of great uncertainty, as subsequent new waves of COVID-19 play havoc with many sectors struggling with re-opening fully. In every industry there are permanent closures or scaling back, thus releasing workers who must find new jobs, but have little bargaining power. In short, the virus continues to dictate economic conditions that will restrain wage increases.

My first thoughts are that while some areas are seeing pay increases there are others that do not see such increases, and thus those folks WILL BE HURT when inflation raises the prices that they must pay for basic things like food. And the liberal push for a higher minimum wage ignores the fact that many are simply not willing or not skilled enough to provide service worth that much. And most businesses hire people to proved some worthwhile service, and not because the people need money. That is a basic reality. Most businesses also are started with a goal of making a profit, not a goal of paying lots of people very well.

The issue is even deeper. Labour's share of national income has been on steep decline for about two decades. Labour costs are held in check by cheap imports and declining domestic production in conjunction. This is ongoing --- just look what happened to Amazon workers in the recent vote to unionize.

The loss of jobs during the height of the pandemic were mostly in lower wage industries ( food +beverage) tourism, So many of these workers have no skills that are needed in the labour short industries.

Totally correct.