Deposits On The Move

Rashad Ahmed brings my attention to the following:

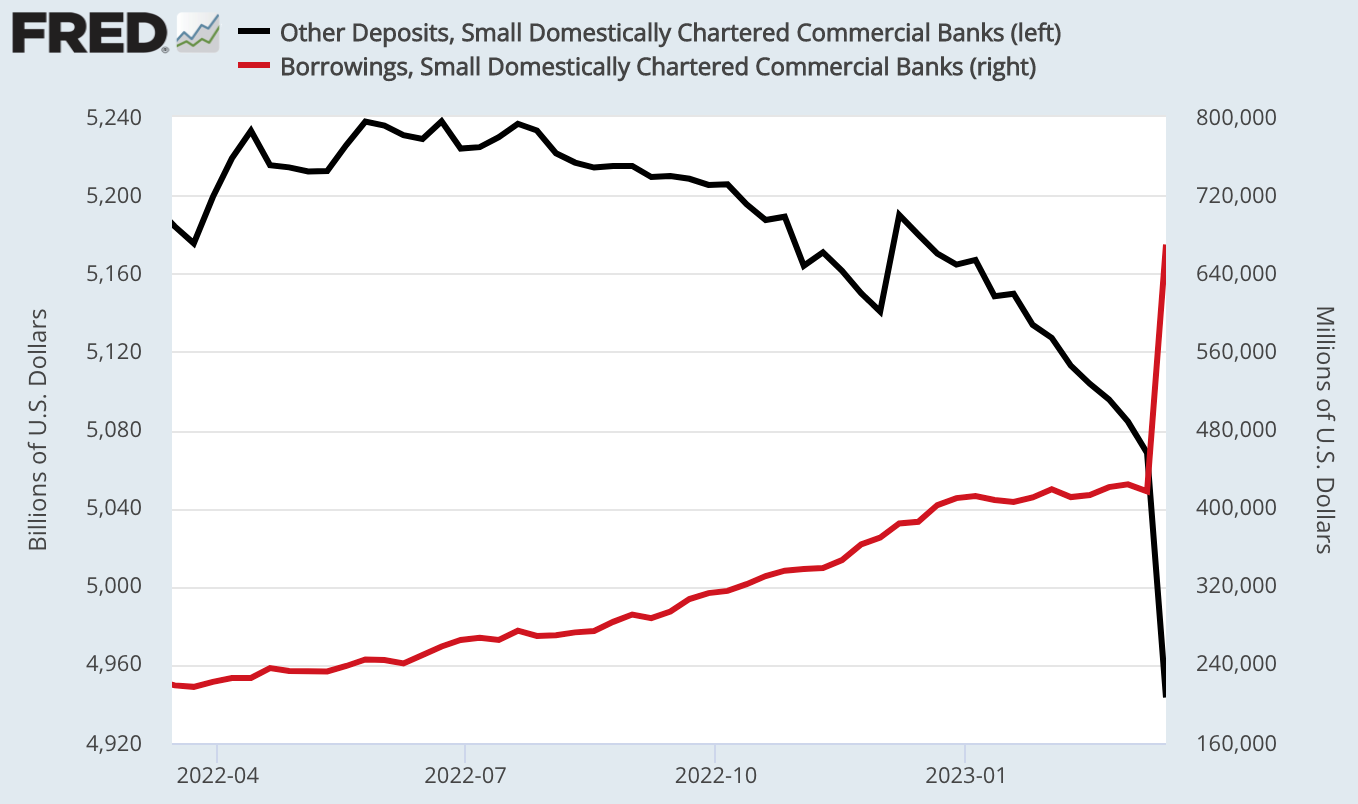

Source: Ahmed via FRED.

“The H.8 data is updated through March 15 and the data shows quite starkly the “run” on small banks in black. “Other deposits” are basically proxying liquid demand deposits (total deposits less large time-deposits). “Borrowings” proxies for banks drawing credit from the likes of FHLB and Fed.”

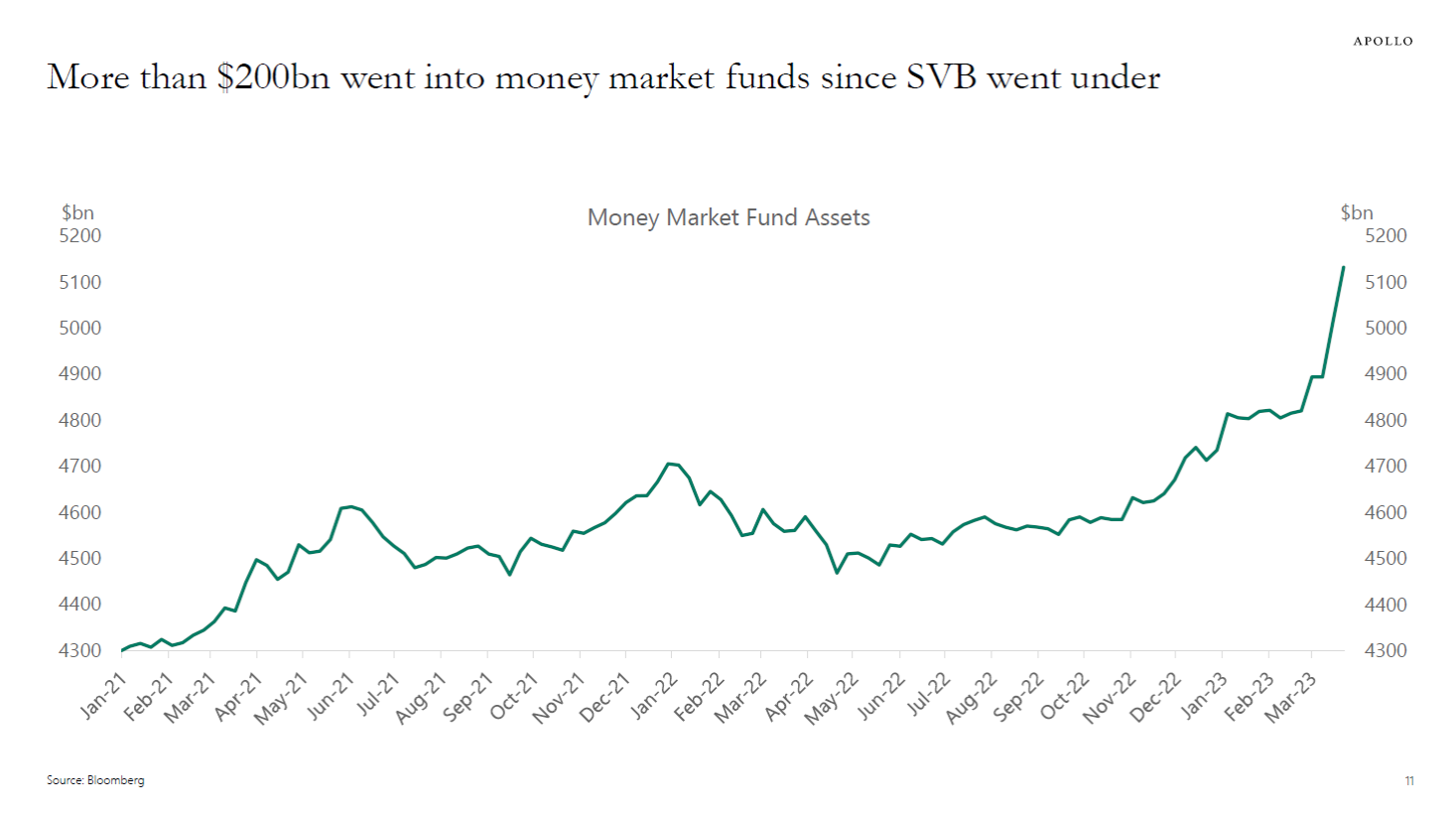

Not only are funds shifting locations, they are shifting out of deposits, as pointed out by Torsten Slok at Apollo today.

“The divergence between the Fed funds rate and interest rates on checking accounts is the fundamental reason why money is being moved out of bank deposits and into higher-yielding investments, including money market accounts, see charts below. Higher rates as a source of instability for deposits and Treasury holdings is highly unusual compared to previous banking crises, where the source of instability has typically been credit losses putting downward pressure on the illiquid side of banks’ balance sheets.”

More By This Author:

StressWeekly Macro Indicators, Thru March 18

Swedish Inflation: Blame It On Biden!