December 2022 CPI

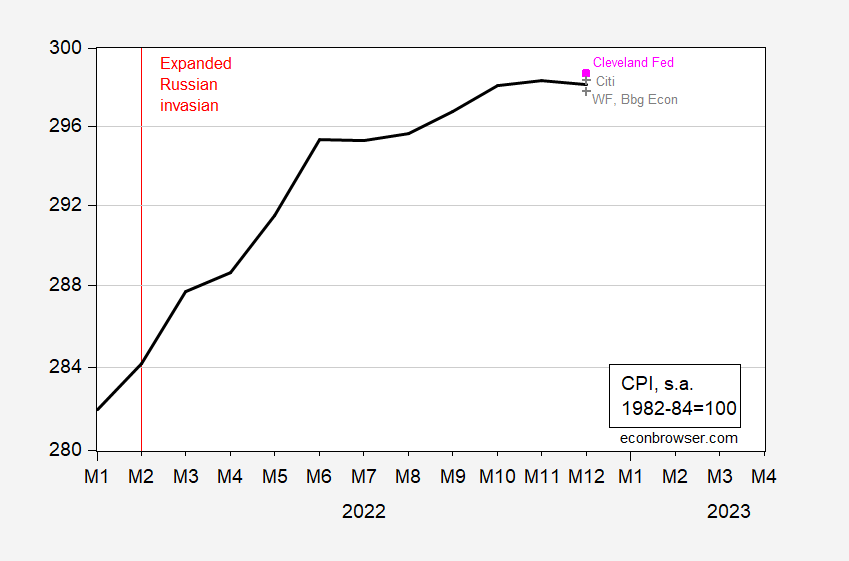

Here are the levels of headline and core CPI, versus forecasts and nowcasts.

Figure 1: CPI level, 1982-84=100 (black), Cleveland Fed nowcast as of 1/11/2023 (pink square), high and low forecasts (gray +). Source: BLS via FRED, Cleveland Fed, Bloomberg (1/11/23), author’s calculations.

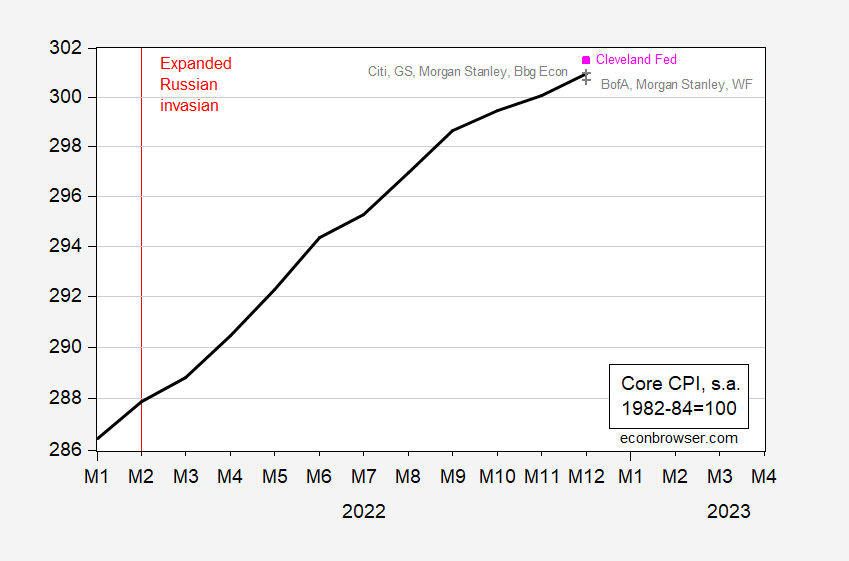

Figure 2: Core CPI level, 1982-84=100 (black), Cleveland Fed nowcast as of 1/11/2023 (pink square), high and low forecasts (gray +). Source: BLS via FRED, Cleveland Fed, Bloomberg (1/11/23), author’s calculations.

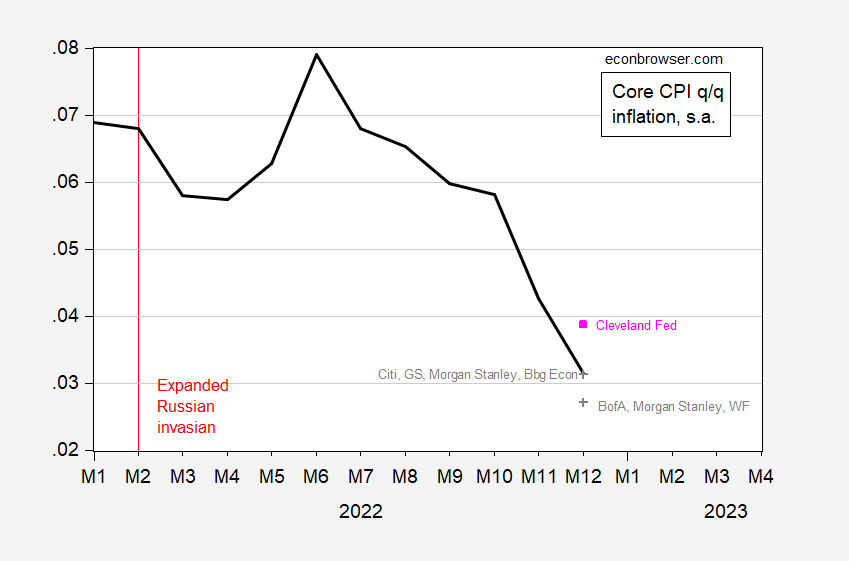

What does this mean for core inflation? In Figure 3 I plot the actual and implied inflation rates.

Figure 3: Quarter-on-quarter core CPI inflation rate, annualized (black), Cleveland Fed nowcast as of 1/11/2023 (pink square), high and low forecasts (gray +). Source: BLS via FRED, Cleveland Fed, Bloomberg (1/11/23), author’s calculations.

Actual q/q core inflation undershot the Cleveland Fed’s nowcast. In Figure 4, I show CPI vs. PCE q/q core inflation.

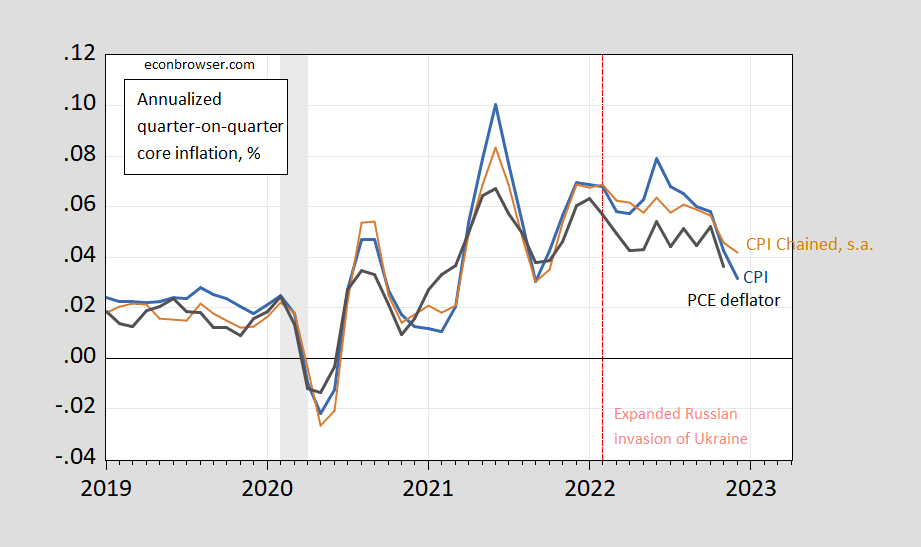

Figure 4: Quarter-on-quarter inflation of core CPI (blue), chained core CPI (brown), personal consumption expenditure core deflator inflation (black), all in decimal form (i.e., 0.05 means 5%).Chained CPI seasonally adjusted using geometric Census X13 (brown). NBER defined recession dates (peak-to-trough) shaded gray. Source: BLS, BEA, NBER, and author’s calculations.

This development seems to support the idea of a switch in the inflation regime (see this post). Although m/m CPI inflation rose, the Cleveland Fed’s nowcast for core PCE in December was little changed in response to the CPI release, and now stands at 0.32 ppts m/m.

More By This Author:

CPI Headline, Core Inflation Nowcasts And ForecastsNowcasts As Of January 10

How Far Off Is the Establishment Survey Nonfarm Payroll Employment Series?

Disclosure: None.