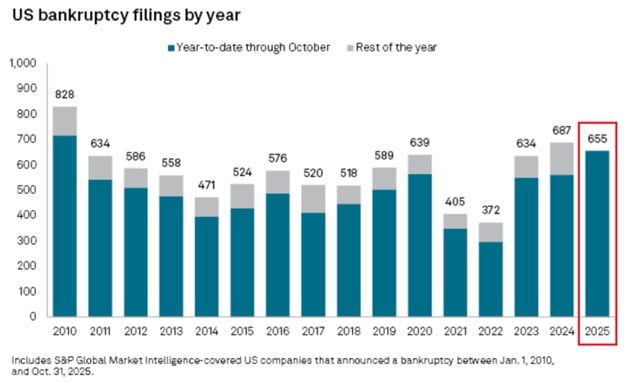

Debt Black Hole: Corporate Bankruptcies On Pace For 15-Year High

As the Debt Black Hole continues to impact the economy, corporate bankruptcies are on pace to hit the highest level in 15 years.

According to the latest data by S&P Global, 655 U.S. corporations had filed for bankruptcy through October. That compares to 687 for the entirety of 2024.

The last time we saw corporate bankruptcies at this level was in 2010, the height of the Great Recession.

There were 68 bankruptcy filings in October alone.

The Economic Times of India reported, “The rapid pace of failures underscores how much pressure is building across corporate America.”

S&P Global data includes companies with public debt and assets or liabilities of at least $2 million or private companies with assets or liabilities of at least $10 million at the time of filing.

The industrial sector leads bankruptcy filings so far this year with 98. Consumer discretionary companies accounted for 80 filings.

Consumer discretionary is a category of businesses that sell goods and services considered non-essential. According to S&P Global, this sector “has been particularly susceptible to economic headwinds, even with strong overall U.S. retail sales activity, as consumer buying trends have shifted and budgets have tightened due to inflation.”

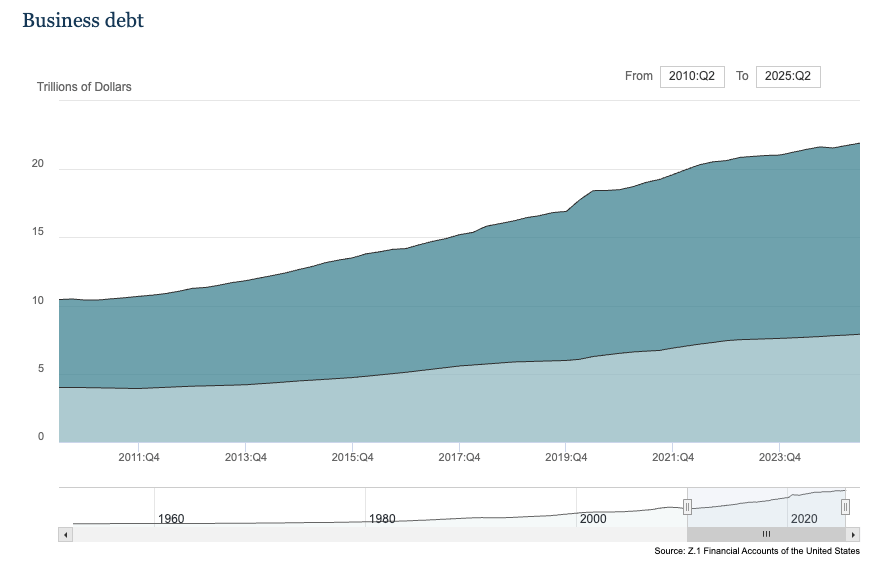

U.S. businesses are buried under a massive debt load totaling $21.9 trillion as of the end of the second quarter, according to Federal Reserve data.

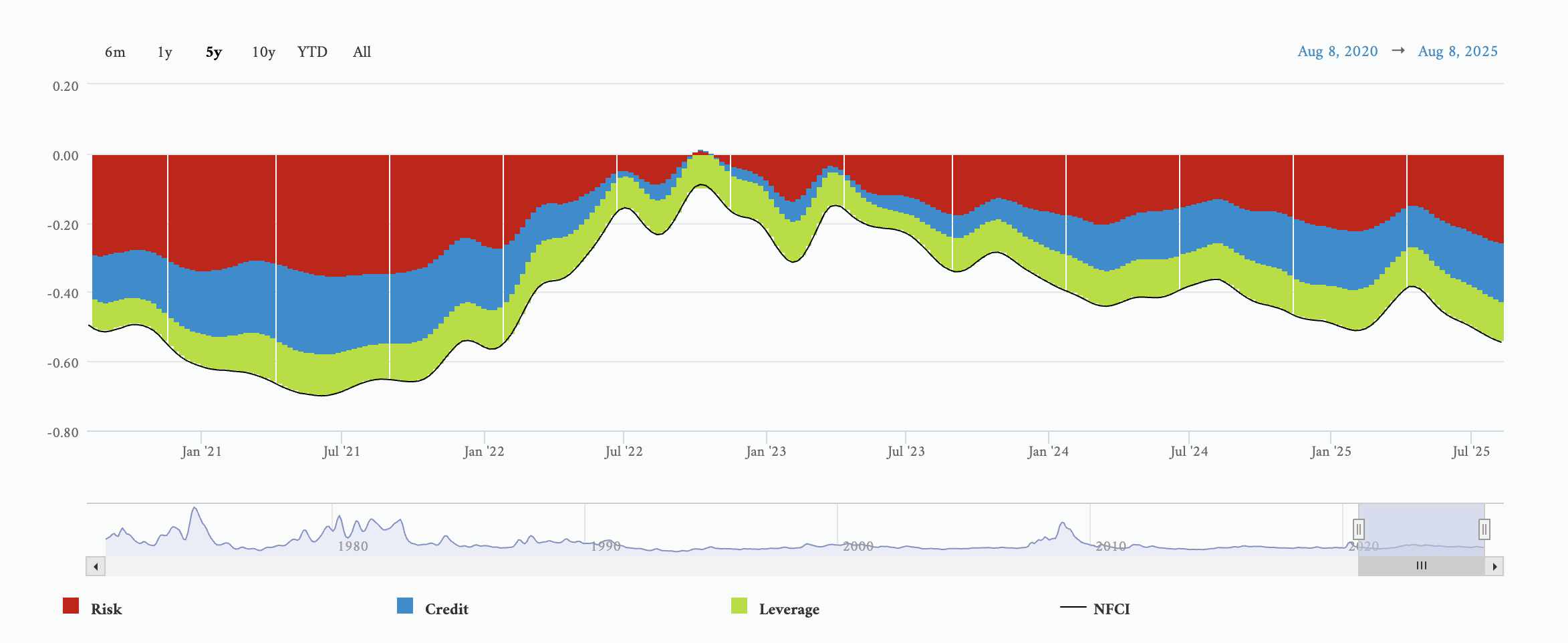

The deteriorating corporate credit landscape has broader ramifications. Reuters reported, “A wave of recent credit concerns has put the multi-trillion-dollar global credit market under the spotlight, with risks extending to several high-profile financial institutions, including major Wall Street banks and regional lenders.”

Auto parts manufacturer First Brands filed for bankruptcy in September after disclosing more than $10 billion in liabilities and failing to refinance some $6 billion in debt it ran up acquiring other companies.

Subprime auto lender Tricolor also went under in September, forcing JPMorgan Chase to take a $170 million charge-off. JPMorgan CEO Jamie Dimon said these cases reflect more general stress in the private lending sector and among regional banks. “When you see one cockroach, there are probably more,” Dimon said during an earnings call. “Everyone should be forewarned on this one.”

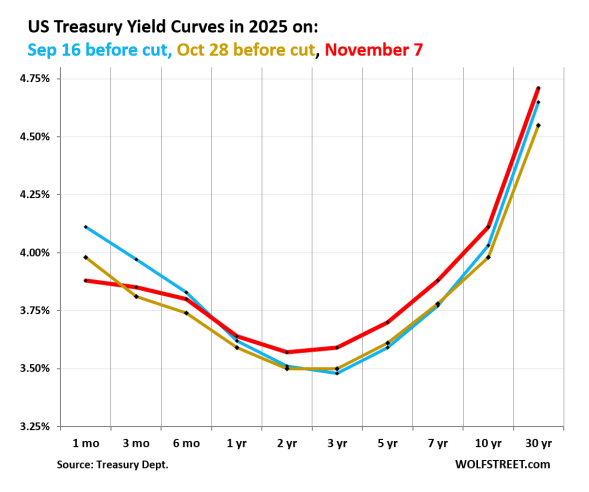

High levels of corporate debt are just one contributor to the Debt Black Hole. Governments and consumers are also leveraged to the hilt. This is one of the reasons the markets are desperate for interest rate cuts. However, it’s not altogether clear that the Fed’s monetary heroin will relieve corporate strain. While the central bank can push the short end of the yield curve down, the longer end is a different story, as pointed out by BCA Research bond strategist Ryan Swift.

"Yields at the front-end of the Treasury curve would almost certainly come down in any reasonable scenario where the Fed is cutting rates, but the very long end for the 10-year or 30-year is more in doubt. If yields don't come down, then there is no economic benefit to borrowers from the rate cuts. But rate cuts could ignite animal spirits and send risk assets higher in the near term."

In fact, the entire Treasury yield curve has increased since the October Fed rate cut.

The Fed is between a rock and a hard place. The debt strain (not only on corporations, but also on consumers and the U.S. government) provides a strong argument for rate cuts. However, inflation clearly isn't dead.

Ironically, the Fed is a primary reason businesses are saddled with so much debt to begin with. The central bank held interest rates at zero for nearly a decade after the 2008 Financial Crisis and dropped them back to that level during the pandemic. Even at the height of the Fed’s tightening cycle, monetary policy remains historically loose.

This incentivized borrowing, blowing up this massive debt bubble.

The Federal Reserve is in an impossible situation - a Catch-22, if you will. It simultaneously needs to hold rates steady to keep price inflation at bay and lower rates to keep the air in the debt bubble.

It can’t do both, so it picked the bubble -- inflation be damned.

More By This Author:

Dramatic Year For Silver: Market On Pace For Fifth Straight Supply Shortfall

Debt Black Hole Putting Increasing Stress On American Consumers

What If You Had Bought Gold Or Silver With Your Pandemic Stimulus?