Day Trade In Nasdaq 100 Delivered; What Next?

Image Source: Unsplash

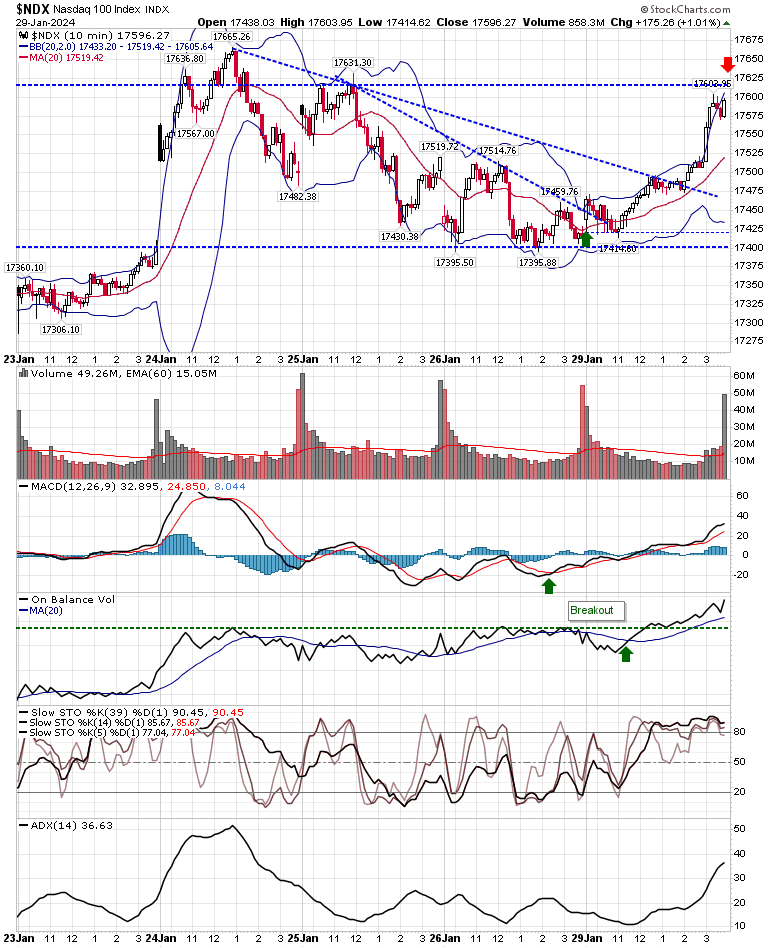

It was a nice trade if you banked it for the Nasdaq 100, although all indices did well. Harder to know what may come next, but a challenge of the January 24th high looks a good prospect for the former index.

Today offered a 'clean' trade for the indices. After a series of inside range-days in the Russell 2000 (IWM) there was a white bullish candlestick to offer a solid direction for the index. Buying volume was down on Friday, but there was a new MACD trigger 'buy' in the MACD and On-Balance-Volume, returning the index to a net bullish technical picture.

The Nasdaq closed at a high on heavier volume accumulation, and in doing so, negated what had been three days of scrappy action. Technicals are net positive. Look for a series of small gains, similar as to what's gone in November and December.

The S&P closed at a new high but without the higher volume accumulation of the Nasdaq. Again, the index could continue its run higher with a series of small gains; not enough to rock the boat, but over the course of the week could deliver a good return.

For tomorrow, what happens pre-market will likely determine how much gain there is to bank. A gap higher may leave markets with little wiggle room to add more, but I would be looking for this bullish run to continue.

More By This Author:

Profit Taking Strikes Indices

Russell 2000 Takes Monday's Plaudits

Weekly Charts Got A Big Boost On Friday's Gains In Markets

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more