Russell 2000 Takes Monday's Plaudits

Image Source: Unsplash

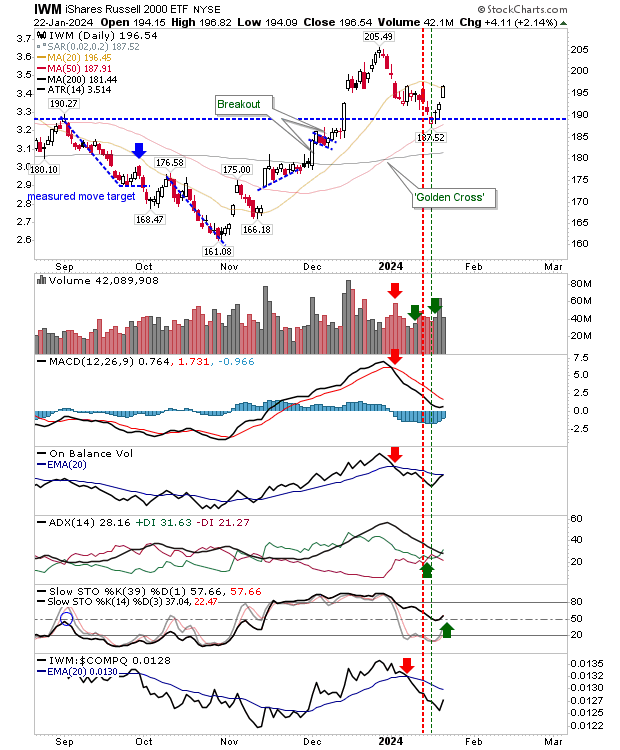

It was not a great day for my day-trading experiment as I got stopped out of my Russell 2000 long position, but it was the Russell 2000 that banked the best gain of the day. Buying volume was below Friday's but the index was able to close above its 20-day MA. Intermediate stochastics found support at the mid-line, and On-Balance-Volume is about to trigger a 'buy' signal, although it will be a few days before the MACD follows suit.

The Nasdaq finished with a bearish "shooting star" that was also a black candlestick; watch for a gap down tomorrow. While price action is bearish, technicals are firmly bullish, helped by the new 'buy' trigger in the MACD.

The S&P also finished with a black candlestick that went along with a new MACD trigger 'buy' following on from last week's 'buy' trigger in On-Balance-Volume. It's a 50:50 shot as to whether bulls or bears will win out; if you give the edge to bears, then watch for a gap down tomorrow.

For tomorrow, the Russell 2000 is the best index for bulls. The S&P and Nasdaq are the indices most likely to deliver for bears.

More By This Author:

Weekly Charts Got A Big Boost On Friday's Gains In MarketsStrong Finish May Have Come A Day Early For Indices

An Expected Weak Start Leaves Indices Primed For Further Selling

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more