CPI Vs. Fed

Both stock and bond market bulls are basking in the sun today as this morning's inflation data for May came in weaker than expected across the board. Headline CPI came in flat (0.0%) month-over-month (MoM) versus estimates for +0.1%, while core CPI came in at 0.2% MoM versus estimates for 0.3%.

Unfortunately for bulls, we still have the Fed to contend with this afternoon. At 2 PM ET, Fed Chair Powell and Co. will provide updates on interest rate policy and forecasts. Powell will then take the podium for a post-FOMC press conference around 2:30 PM ET.

Will the stock market manage to hang on to big intraday gains, or will we get another Fed-induced late-day sell-off?

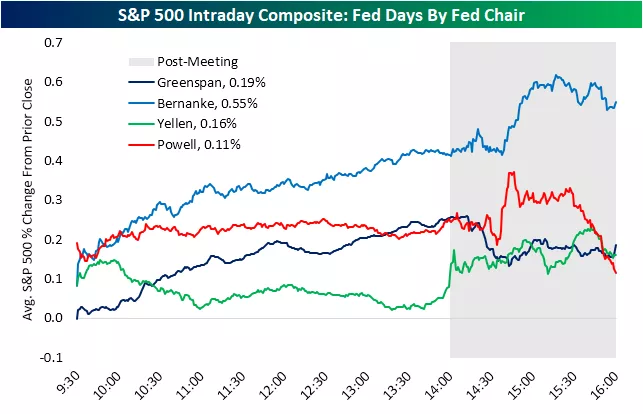

As shown below, Powell (red line) has so far had the weakest Fed-Day gains of any Fed Chair for the S&P. The typical (or average) Powell Fed Day sees intraday gains mostly erased with a last-hour selloff into the close.

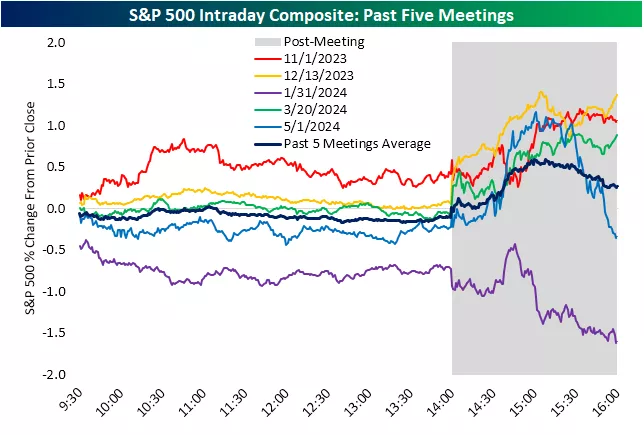

Of course, we don't ALWAYS see late-day selloffs on Powell Fed Days. As shown below, over the last five Fed Days, we've actually seen gains from 2 PM into the close three times and declines twice. The last meeting on May 1st was a doozy, though. Check out the intraday path for the S&P on May 1st in the chart (lighter blue line). Heading into the 5/1 FOMC announcement at 2 PM ET, the market was down slightly on the day. We then saw a big 1%+ rally from 2 PM to 3 PM, but then we fully reversed that rally in the final hour of trading to actually close down on the day.

Given today's better than expected news on the inflation front, Powell and the rest of the Fed have some ammo to take a more dovish tilt.Whether they want to actually do that or not, nobody yet knows.

More By This Author:

Record Gold Long Positioning

Small Business Bull Whips And Election Jitters

Politics Weighs On Sentiment

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more