CPI And CPI Core Surprise On Upside

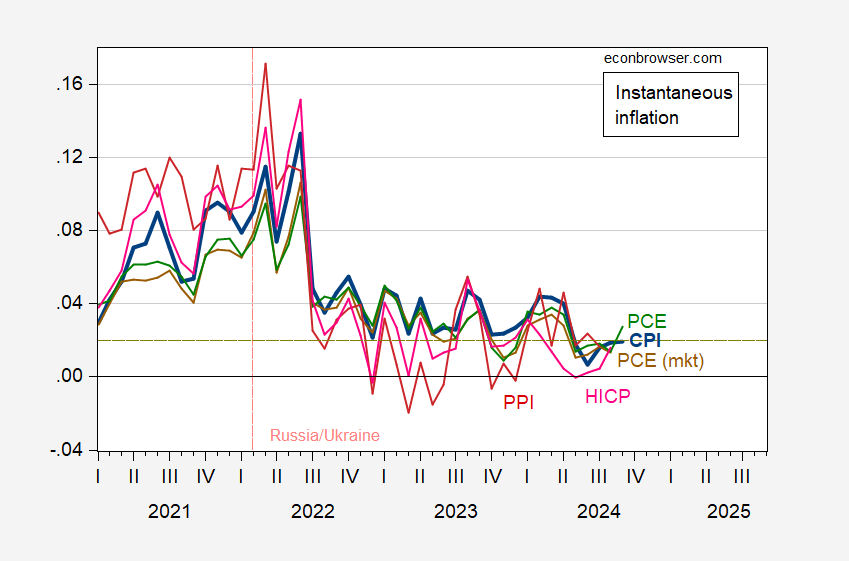

CPI m/m at 0.1% vs. 0.1% consensus (Core 0.3% vs. 0.2% consensus). Here are snapshots of instantaneous inflation rates for September headline, core, supercore, and services supercore CPI, headline and core PPI and HICP and headline and core PCE deflator for August.

(Click on image to enlarge)

Figure 1: Instantaneous inflation for CPI (bold blue), PCE deflator (green), PCE deflator – market based pries (brown), HICP (scarlet), PPI (red), per Eeckhout (2023), T=12, a=4. September observation based on PCE nowcasts from Cleveland Fed as of 10/10/2024. Horizontal chartreuse dashed line at 2% PCE inflation target (for CPI should be about 2.5%). Source: BLS, BEA, Eurostat via FRED, Cleveland Fed, and author’s calculations.

Note that the September observation for the PCE deflator is based on the September nowcast from the Cleveland Fed, as of today, and taking into account the CPI release.

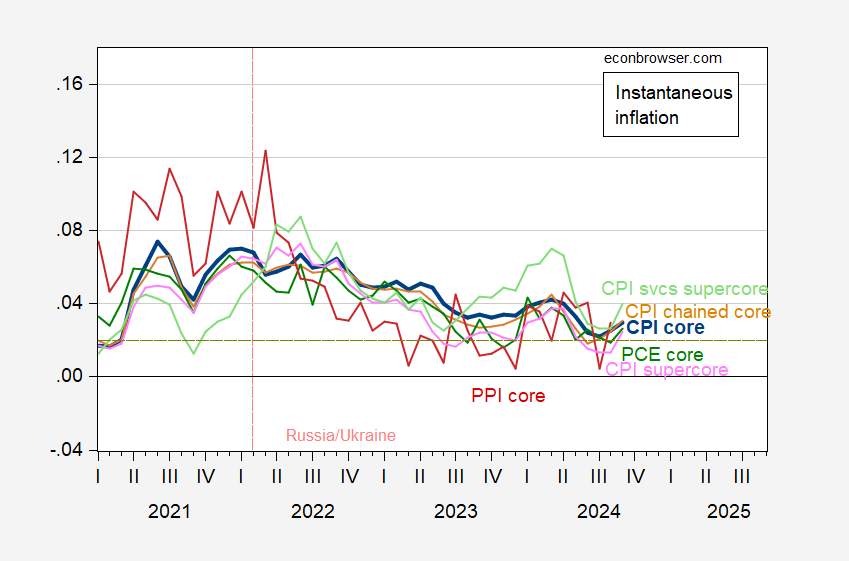

I plot below core measures, using the same vertical scale to retain comparability.

(Click on image to enlarge)

Figure 2: Instantaneous inflation for core CPI (blue), chained core CPI (tan), supercore CPI (pink), services supercore (light green), PPI core (red), and PCE core (green), per Eeckhout (2023), T=12, a=4. September observation based on PCE core nowcasts from Cleveland Fed as of 10/10/2024. Horizontal chartreuse dashed line at 2% PCE inflation target (for CPI should be about 2.5%). Source: BLS, BEA, Pawel Skrzypczynski, Cleveland Fed, and author’s calculations.

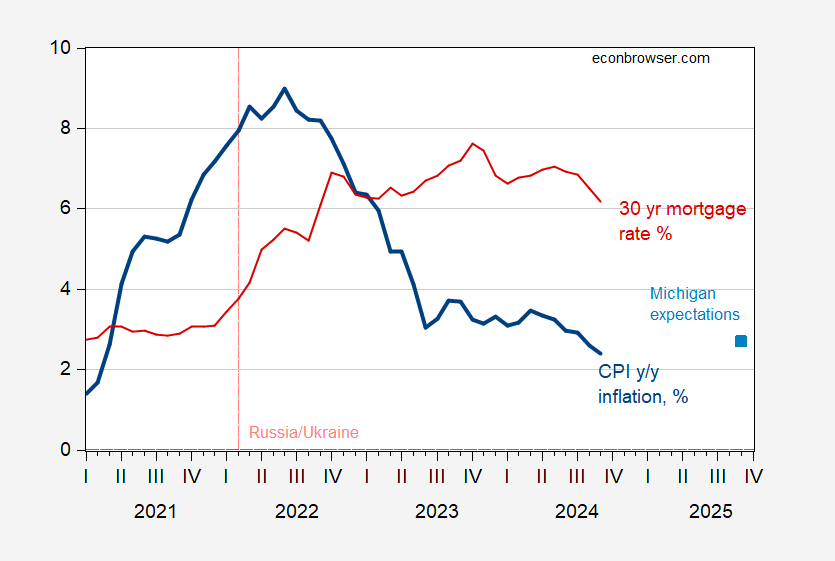

Note that the CPI is usually thought of as a cost of living index. Recently, Bolhuis et al. (2024) have argued that interest rates enter into people’s perceptions of the cost-of-living better than the owner equivalent measure used since 1983. Note that both CPI headline (year-on-year) inflation and mortgage rates have been declining in recent months.

(Click on image to enlarge)

Figure 3: CPI headline inflation (y/y) (blue), expected inflation rate for September 2025 from Michigan survey (light blue square), 30 year mortgage rate (red), all in %. Source: BLS, Freddie Mac, University of Michigan via FRED.

See more on the CPI release by Jan Groen here.

More By This Author:

No Recession In 2022H1: Edition MMMXXVIIGDPNow Up To 3.2% SAAR

EJ Antoni/Heritage Foundation (Aug 5): “I Would Not Be Surprised If A Recession Is Backdated To July Or The Current Month”