Coronavirus Update - Some Stock Picks For The Pandemic

The coronavirus pandemic is spreading exponentially…

Not only is it rocking world markets, but it’s now an existential threat to our way of life.

In this edition of the update, I’ll give you important news to share with friends and family. And I’ll show how I’m still trading while I stay in one place. Indoors. Away from other people.

If you’re not yet trading, now is the time to study. Prepare yourself for the future. Now, please pay attention…

URGENT: Coronavirus Update and What You Can Do

Our medical system is hugely underprepared for this pandemic. And people are behaving irresponsibly. Please do your part and STAY AT HOME. If we don’t all do the right thing NOW, our hospitals will get overwhelmed. The potential knock-on effect is disastrous.

My Strategy During the Coronavirus Lockdown

My strategy and life hasn’t changed that much. Normally I’m traveling — but I trade all the time. So while I’m stuck in one place for now, I’m busier than ever.

There are SO many coronavirus related plays right now. As the market is crashing (despite rebounding a bit today), coronavirus stocks are hot. Here are a few examples from Friday’s market close…

Tonix Pharmaceuticals Holdings Corp. (TNXP)

Tonix re-released news of a possible vaccine based on a modified horsepox vaccine. The news was first released at the end of February. The stock finished up 68% on Friday, March 20.

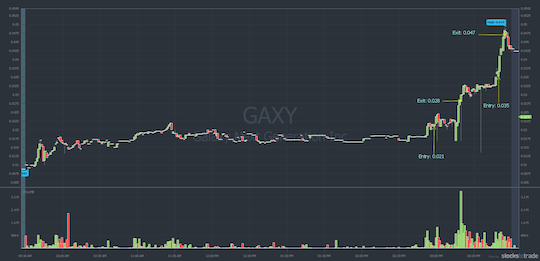

Galaxy Next Generation, Inc. (GAXY)

Galaxy operates cloud-based remote learning platforms. The company is “now providing remote virtual learning to students while the schools are closed due to […] the coronavirus outbreak.” It was one of Friday’s biggest plays and closed up 275%.

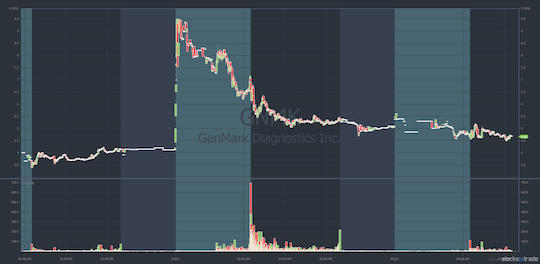

GenMark Diagnostics Inc. (GNMK)

GenMark spiked after hours on March 19 after receiving FDA Emergency Use Authorization for its ePlex SARS-CoV-2 test. It trended terribly all day but still finished up 20%.

And there are more…

No Borders Inc. (NBDR)

No Borders spiked last week on news of an at-home coronavirus test kit. It spiked again Friday. Its subsidiary, MediDent Supplies, is shipping medical equipment to the U.S. The stock finished the day up 48%.

Trxade Group Inc. (MEDS)

MEDS was up 104% in after-hours trading on Friday. Yesterday, in pre-market trading, the stock hit a new 52-week high at $13.25 per share. More on MEDS later in this post.

Other stocks on the move last week due to coronavirus related news…

Bellerophon Therapeutics Inc. (BLPH)

BLPH was one of Friday’s biggest winners. It spiked from the low $3s to $26 in premarket trading Friday. The catalyst was news the FDA approved emergency access to INOpulse® for treatment of SARS-CoV-2. The stock traded choppy and dropped but still finished up 386% on the day.

“The coronavirus is creating plays in new sectors. What should we look for besides food delivery and home exercise equipment stocks?”

One example is MEDS, which I mentioned above. The company announced a membership service for its integrated drug distribution platform. The company’s platform connects patients with consultants through teleconferencing and home visits.

So this kind of service is gonna be necessary. I guess you’ll still be able to go to pharmacies when everything else closes, but you shouldn’t if possible.

You shouldn’t go to hospitals or pharmacies unless you have no other choice. Why? Because that’s where the sick people are. Getting stuff delivered to your home is pretty useful.

MEDS had a really tough go until now. It’s a perfect example of the kind of company you could look for during this crisis.

Other types of businesses include food delivery and home exercise equipment. Also, any company working on potential vaccines, test kits, or potential test kits.

In summary, look for these kinds of companies:

- Mask makers

- Vaccine developers

- Food delivery stocks

- Most other delivery-related stocks

- Remote education stocks

Anything hot due to the coronavirus being global is in play. Be ready, as the potential gains can be insane.

“With all the misinformation and conspiracy theories flying around, it’s confusing. Has it changed the way you do research?”

There will always be conspiracy theories. And there will always be a lot of different strategies. Here’s what I do…

Focus on whatever works.

It’s not rocket science. I’ve been trading the same patterns for years. Of course, you have to adapt to the market and understand the nuances. But I still look for big percent gainers, look for a news catalyst, and watch price action. I still focus on big volume and volatility.

Right now, I’m seeing a lot of these stocks spike multiple times.

MEDS is a good example. I took my eye off it on Friday because there were just too many other plays. It wasn’t closing very well. Then, in after-hours trading it was trading in the $9s. Like I said, in premarket trading this morning it went to the $13s.

Another stock I mentioned above is GAXY. When MEDS spiked again I was focused on GAXY. Again, it’s in the at-home education space. The stock was up — I was buying in anticipation of the breakout over the morning spike highs.

This was a classic first green day big percent gainer. At the time I wasn’t sure if I’d be holding overnight. I decided to take profits as it met my goals with a possible rebuy on any big dip.

Check out the GAXY intraday chart from March 20:

GAXY chart: March 23 intraday, 1-minute candle,

I wanted it to come down for the rebuy, but as you can see from the chart, it kept going. So I decided to buy again with the intention of holding over the weekend for a morning gap up. It was madness. It hit all my goals even though the Dow was down roughly 900 points.

Rather than risk it, I sold into strength.

Based on these two trades, here are…

3 Important Tips for Trading This Market

- Recognize that these stocks can really move fast. Go with it — but also be careful. For me, I trade small to reduce my risk.

- Learn to take profits into strength.

- Don’t fall in love with any company. (See the example below.)

GNMK is another stock I mentioned from Friday. It had an amazing start — it gapped up from $4 to $8. But despite good news it trended terribly all day.

Take a look at the GNMK chart from March 20:

GNMK chart: March 19-23, 1-minute candle — courtesy of StocksToTrade.com

As you can see from the chart, GNMK price action was terrible. So focus on price action, too. A lot of the good news might already be priced in. Sometimes good news is actually bad news if you look at more details.

For example…

On March 19 I made a speculative buy on XspresSpa (XSPA). The company announced it would be doing coronavirus testing at 46 airport locations. Turns out it had only reached out to the CDC to offer the locations for testing.

XspresSpa usually runs spa services. But nobody really cares about getting a massage at the airport right now because they’re afraid of germs.

It sounded like good news. The stock spiked from 17 cents up to 30 cents but… the company snuck in an offering.

So its announcement was like “we need to do coronavirus testing.” (Because nobody cares about massages.) But the hidden message was…

… the company needs the testing on its premises. Otherwise, it could go bankrupt.

So the good news was just a smokescreen. You gotta be careful with penny stocks. Expect the worst out of all these companies and you’ll never be disappointed.

The Bottom Line

We all need to do the right thing to help end this pandemic. It is possible to win this war against the virus, but we need to take the right steps now. We need to make changes now. Do what you can do and be safe.

As for the stock market, there are so many opportunities right now if you’re prepared. I can’t emphasize this enough.

The stock market is a battlefield — so if you’re not prepared, use this down time to study.

Disclaimer: © 2016 Agora Financial, LLC. 808 Saint Paul Street, Baltimore MD 21202. Although our employees may answer your general customer service questions, they are not licensed under ...

more

Giving out the potential short/long term stock winners is the greatest service I received so far; thanks a lot; however, if you place your short/long-term stock picks to a separate web-link/web-address we can click everyday, that would be even greater; then we do not have to sift through articles to see the stock picks.

Best Regards

Agreed.