Conflicting Signals For Coincident Macro Indicators At End-May

Monthly indicators of employment, consumption, personal income (ex-transfers) are all rising in April. But GDO and GDP+ show a decline for 2022Q4 and 2023Q1.

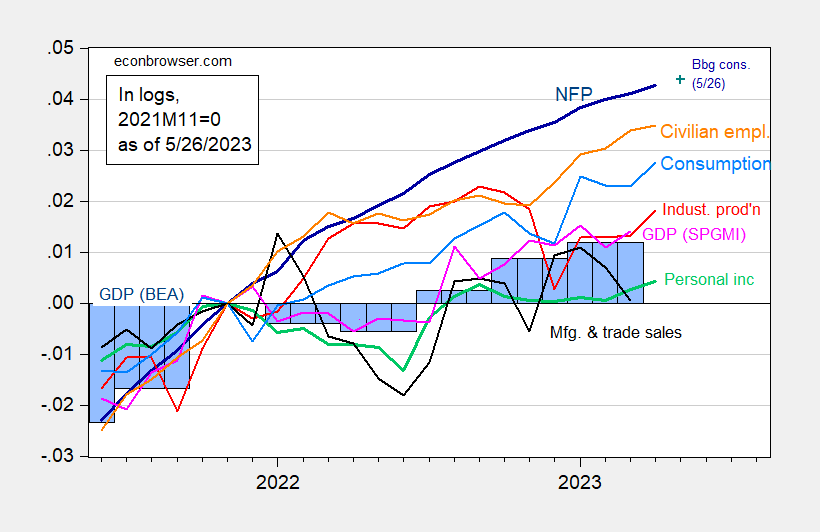

Figure 1: Nonfarm payroll employment, NFP (dark blue), Bloomberg consensus of 5/26 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Bloomberg consensus level calculated by adding forecasted change to previous unrevised level of employment available at time of forecast. Source: BLS, Federal Reserve, BEA 2023Q1 2nd release via FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (5/1/2023 release), and author’s calculations.

Given the NBER Business Cycle Dating Committee’s emphasis on employment and personal income, one would be fairly confident that no recession was in place as of April 2023, of course keeping in mind all these numbers will be revised over time. GDP in particular will be revised numerous times so an increase in this series would not be decisive in ruling out a recession (just as the decline in 2022Q1-Q2 would not be decisive in ruling in a recession).

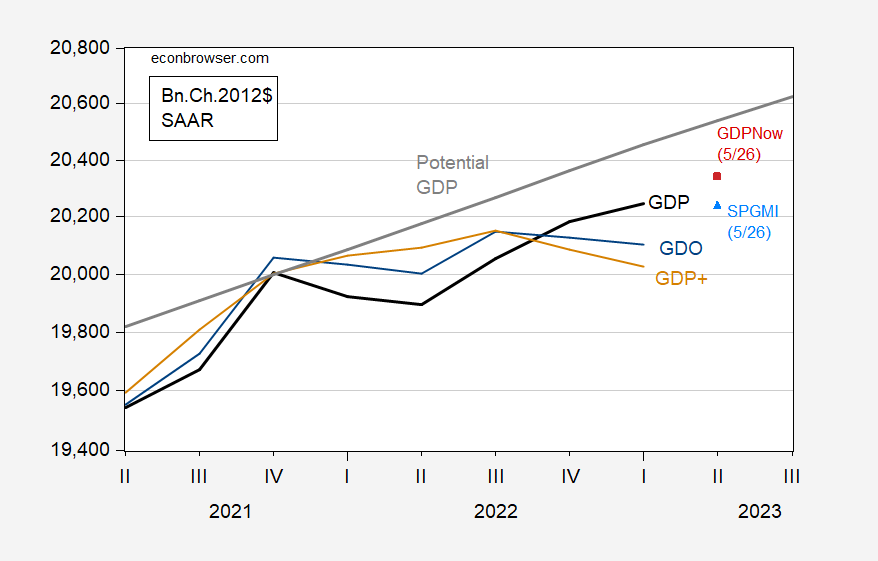

We know that reported GDP is actually not the best indicator of where GDP will eventually be revised to. GDO and GDP+ are two series are more likely to fulfill that condition. Here, we see some troubling signs.

Figure 2: GDP (black), GDO (blue), GDP+, scaled to 2019Q4 (tan), potential GDP (gray line), GDPNow of 5/26 (red square), SPGMI tracking of 5/26 (sky blue triangle) in bn.Ch.2012$ SAAR. Source: BEA, Philadelphia Fed, CBO (February 2023), Atlanta Fed, S&P Global Market Insights, and author’s calculations.

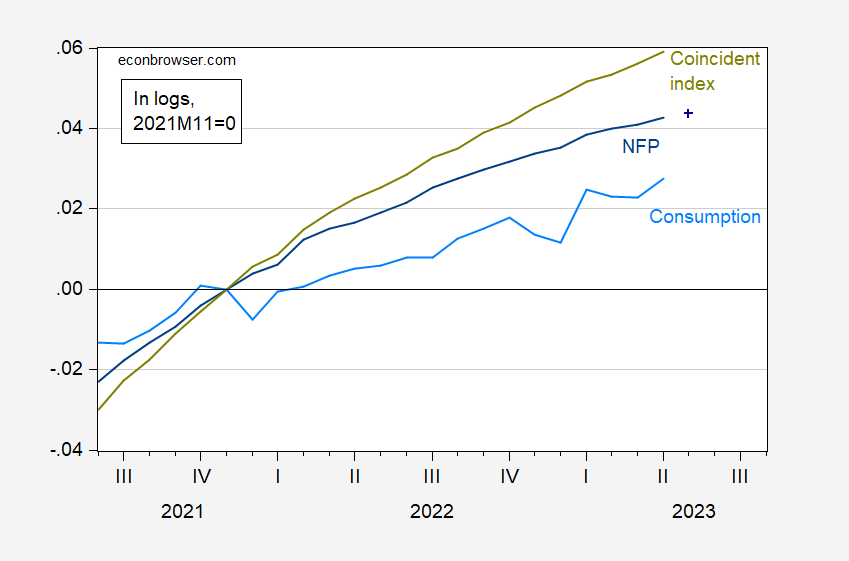

While GDP was revised up to 1.3% SAAR, GDO (the average of GDP and GDI) and GDP+ are at-0.5% and -1.2% SAAR, respectively. As Jason Furman has noted, the discrepancy between GDP and GDI is very large, highlighting the uncertainty we face discerning how economic activity trending. This shows up in a discrepancy in the bean counting exercises As he notes, if these were the only series we observed, we’d look to GDO. But, to stress again, we have lots of evidence regarding the strength of the labor market. One summary measure is the Philadelphia Fed coincident index for the US. In Figure 3, I show the coincident index, compared to nonfarm payroll employment, and to consumption.

Figure 3: Coincident index (chartreuse), nonfarm payroll employment (blue), Bloomberg consensus of 5/26 (blue +), consumption (sky blue), all in logs, 2021M11=0. Source: Philadelphia Fed, Bloomberg, BLS and BEA via FRED, and author’s calculations.

The coincident index is based on mostly labor market indicators, and has continuously increased, even during 2022H1, when some observers argued that a recession had arrived. Consumption, which is mostly sustained by salary and wage payments, has also largely risen over the last year and half, and suprised on the upside in April.

So, in sum, uncertainty reigns!

More By This Author:

Percent Vs. Percentage Points; Exponential Vs. LinearX-Date Estimate – June 5 Or So?

Why Might Firms Raise Prices Faster than Input Prices?