Commodities Continued Rising Last Week As Global Equities Fell

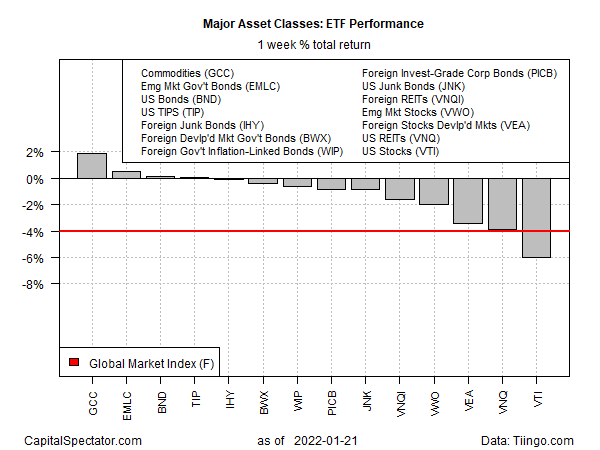

A broad measure of commodities rose for a third straight week as stocks around the world tumbled in trading through Friday’s close (Jan. 21), based on a set of ETFs tracking the major asset classes.

WisdomTree Commodity Index (GCC) rose 1.9% for the trading week. The fund closed at just below its highest level in more than seven years.

The combination of higher inflation and the rising risk of war in Ukraine are key factors in the recent runup in commodities prices, analysts advise.

“As tensions between Russia and Ukraine grow, so does the risk that it spills over into global commodity markets,” ING predicts in an article published on Friday. “Russia is a commodities powerhouse, with it being a key supplier of energy, metals and agri. A conflict against the two nations and/or tough sanctions against Russia has the potential to significantly tighten commodity markets.”

Most of the major asset classes posted losses last week. US shares suffered the biggest decline. Vanguard Total US Stock Market (VTI) tumbled 6.0%, marking the third straight weekly loss and leaving the ETF at its lowest level since last summer.

The Global Market Index (GMI.F) also fell last week. This unmanaged benchmark, which is maintained by CapitalSpectator.com holds all the major asset classes (except cash) in market-value weights via ETF proxies, lost a hefty 4.0%.

Sorting the major asset classes on trailing one-year trend continues to position US real estate in the lead. Vanguard US Real Estate (VNQ) is up 26.5% over the past 12 months, modestly ahead of the 23.5% total return for US stocks (VTI), the second-best one-year performer.

GMI.F’s one-year return: +5.3%.

Profiling markets based on current drawdown shows a widening gap between current prices and previous peaks. US junk bonds (JNK) are currently posting the smallest drawdown: roughly -2%.

The big downside outlier is still commodities (GCC), which ended last week at roughly 24% under its previous peak.

GMI.F is currently 6.3% below its previous peak.

Disclosures: None.