Changing Of The Guard

US Stock indexes made impressive gains this week , +2% ( give or take) , as long as one ignored the Dow industrials which managed to stay positive. Boeing (BA) dragged the Dow down after it reported earnings as it struggles to deal with the debacle regarding two fatalcrashes due to design flaws in its it newest jet.

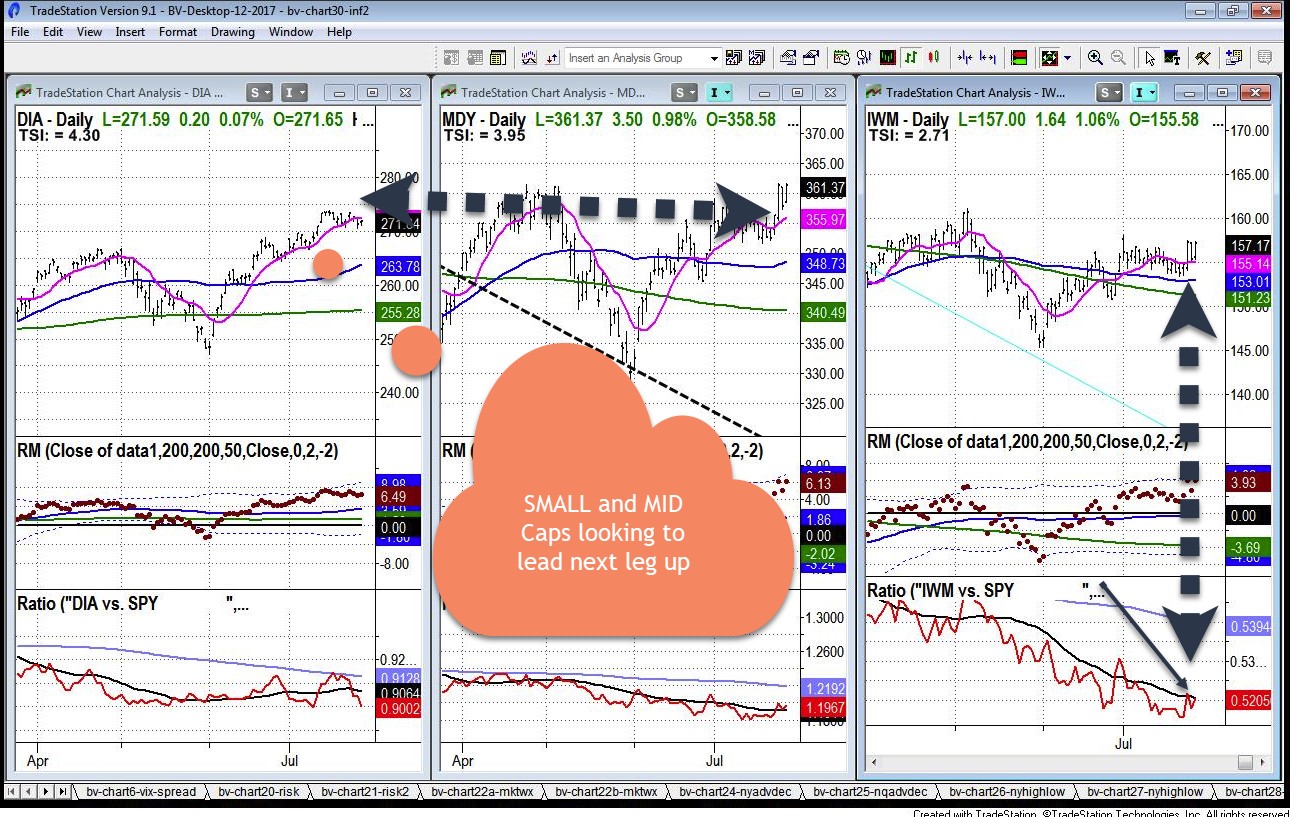

Weekly charts on the key indexes continue to show divergences as momentum lags. Meanwhile , the daily charts don’t seem to care as both the NASDQ 100 and the S&P 500 made all time highs.

Regional banks (KRE otherwise known as the modern families prodigal son) which prefer higher rates to improve operating margins moved up.This could be anticipating a surprise move by the Federal Reserve to keep rates where they are, although that seems counter intuitive as the trade war remains intact and the global economy shrinks.

This week’s highlights are:

- Risk Gauges improved to bullish this week

- Semiconductors and Regional Banks outpaced all other sectors, an improvement overall in sector participation

- S&P 500 regained its 10 DMA and never followed through on a bearish engulfing pattern

- Market Internals are stuck in neutral ignoring the strong price action

- IWM looks poised to move up and out of its recent compression zone which could give a nice boost to equity markets in general.

- Gold Miners retreated this week, down -2.5%, however it is still a leading sector on a 6-month basis up over 28%.

- Emerging and most foreign markets ignored the rally in US stocks and retreated

For this week's video click below.

Video length: 00:08:46

Like to learn more about relative strength methodology? Our most recent free training material can be found more

The market is ok. Given the government budget it is spending stimulus now. The market looks like the summer rally may persist.