CFNAI On The Putative Recession Of 2022H1

Regarding the view, the US economy was in recession earlier this year (e.g., this observer less than a month ago), the CFNAI has the following takes:

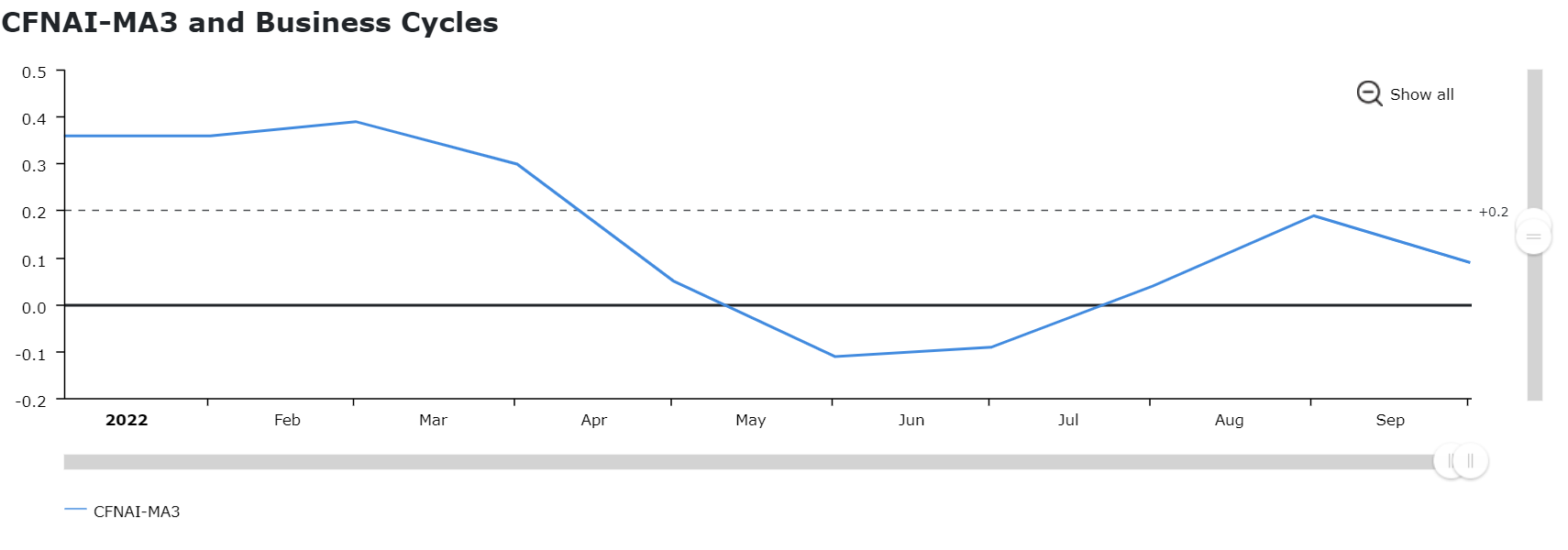

(Click on image to enlarge)

The three-month moving average of the CFNAI dropped below 0 (i.e., dropped below trend growth) in May and June. The notes for the CFNAI indicate “Following a period of economic expansion, an increasing likelihood of a recession has historically been associated with a CFNAI-MA3 value below –0.70.” The CFNAI-MA3 did not breach this threshold.

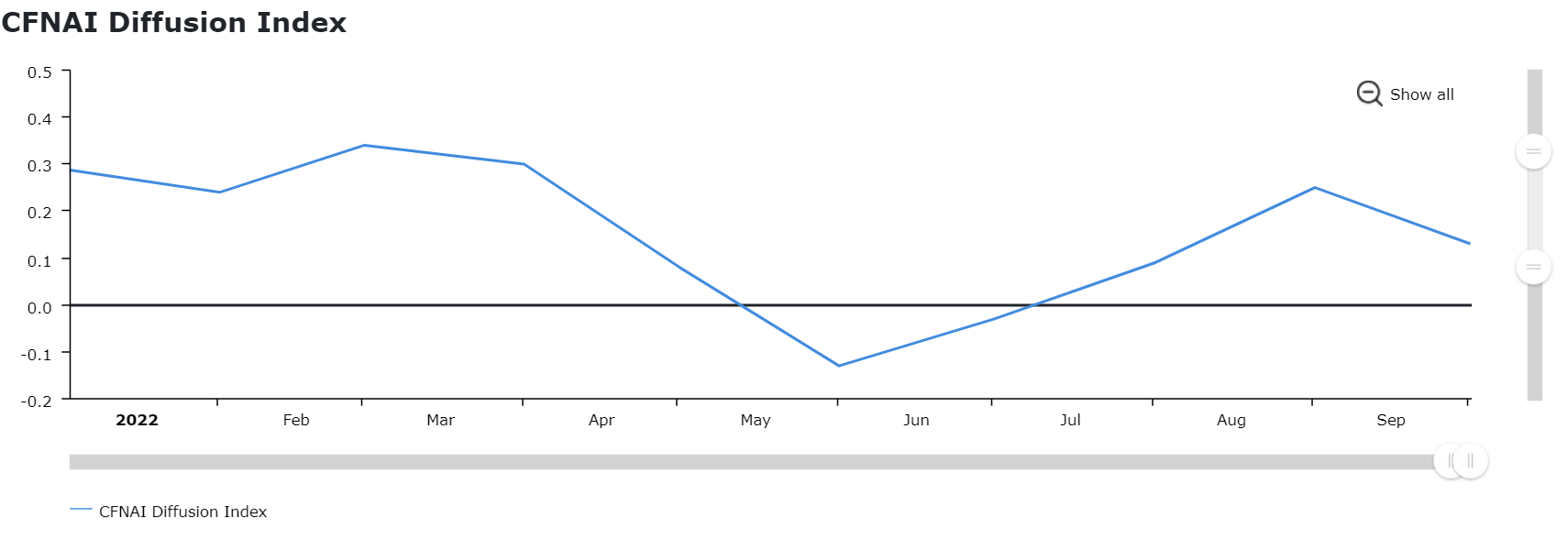

As for the indications from the number of indicators falling or rising (i.e., a diffusion index), we have the following picture.

(Click on image to enlarge)

From the notes:

The CFNAI Diffusion Index represents the three-month moving average of the sum of the absolute values of the weights for the underlying indicators whose contribution to the CFNAI is positive in a given month less the sum of the absolute values of the weights for those indicators whose contribution is negative or neutral in a given month. Periods of economic expansion have historically been associated with values of the CFNAI Diffusion Index above –0.35.

So, I (still) do not see a recession in 2022H1.

More By This Author:

Business Cycle Indicators At Mid-NovemberThe GDP Outlook: Nowcast Vs. Forecast

CPI Inflation Below Expectations – Markets Respond