Central Banks Don’t Like To Told When To Cut Rates

Image Source: Pixabay

Central bankers rarely accept any direction from outsiders, even if the markets are behaving as if the central bank were not calling the shots. Take today’s statements from the Federal Reserve and from the Bank of Canada regarding the outlook for rate cuts this year.

Fed Chairman Powell voiced the usual warning that the Fed is concerned about losing the progress to date in bringing down the inflation rate and is dogged by a lot of uncertainty regarding the economic outlook. He won’t concede a start to cutting rates, making everything conditional that if “the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.” Those in the futures markets do not like vague notions of “some point this year”. About as non-committal a statement as one would ever hear from the Fed.

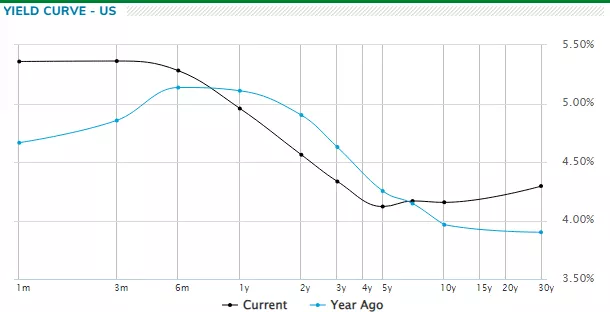

The US bond market is anticipating considerable rate cuts, as evident from the yield curve inversion. The 10-year-2-year spread, the most common measure of the yield curve slope, now stands at minus 0.46 bps. The fact that longer-term money is cheaper than short-term money is a sign that the Fed’s policy is anything but restrictive. The fact that the equities markets and the market for monetary substitutes, such as cryptocurrencies and gold, are at an all-time high reinforces the argument that monetary conditions are far from tight.

Similarly, the Bank of Canada remains unwilling to even allude to cutting rates in any suggested time frame. In its policy statement released today, the Bank cited reasons why it is not yet focussed on rate cuts. It noted that shelter price increases remain elevated, the biggest contributor to inflation. Overall, the underlying inflationary pressures persist, especially since many consumer items are still trending above 3%.

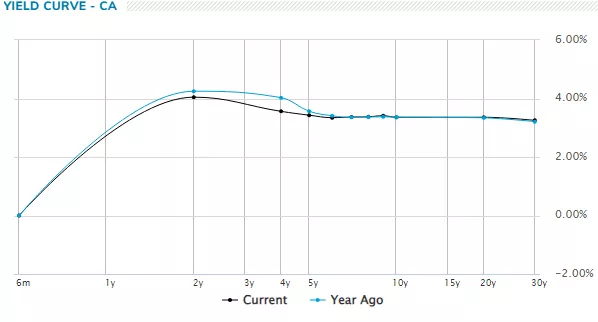

The Canadian yield is even more inverted than its counterpart in the US. The 10yr-2yr spread is minus 0.69bps. Canadian bondholders are expecting even deeper rate cuts, in light of the weaker growth prospects in Canada. Canadian GDP growth has stalled at near zero over the past two quarters. Furthermore, the Canadian economy has yet to be faced with the full impact of thousands of mortgages coming up for renewal in 2024 and 2025. These higher rates will weigh heavily on consumption.

In both countries, there is a high level of frustration on the part of investors regarding the path of rate cuts. To a large degree, it seems that the central banks have chosen such an overly cautious approach, despite what is a clear signal from the bond market that rates need to come down significantly and much sooner than the bankers think.

More By This Author:

Growth Of The Public Sector Keeps The Canadian Economy Above WaterCanadian Recession Is Well Underway According To The Big Bank

Does Canada Have A Productivity Problem?