CBO Assessment On A Current Recessionary Environment

From CBO:

The U.S. economy shows signs of slowing, but whether the economy is currently in a recession is difficult to say. It is possible that, in retrospect, it will become apparent that the economy moved into recession sometime this year. However, that is not clear from data that were available at the beginning of August. Some key metrics indicate a decline in economic activity as the first half of this year progressed, whereas others indicate continued growth, though generally at a slower rate than previously.

Real gross domestic product (that is, GDP adjusted to remove the effects of inflation) and industrial production have both declined. In particular, real GDP declined by an average of 1.25 percent (at an annual rate) in the first two quarters of 2022. Industrial production grew from January to April, was essentially unchanged in May, and then declined in June.

Other key indicators of economic activity have continued to increase in the first half of 2022, though generally at a slower rate than they had previously. For instance, real gross domestic income (GDI) increased at an annual rate of 1.8 percent in the first quarter of 2022 after growing by an average rate of 6.3 percent in the second half of 2021.2 (Second-quarter data for GDI are not yet available.) Real personal income minus transfer payments to people by federal, state, and local governments grew at an average annual rate of 0.5 percent in the first half of 2022 versus 3.1 percent in the second half of 2021. And real personal consumption expenditures grew at an average annual rate of 1.4 percent in the first half of 2022 (with somewhat slower growth in the second quarter than in the first), compared with 2.2 percent in the second half of 2021. One reason for the deceleration in personal consumption expenditures is higher inflation, which has eroded consumers’ purchasing power. Another reason is that real disposable personal income has declined in the first half of 2022. Savings accumulated during the coronavirus pandemic, including from transfer payments, have continued to support consumption.

The labor market remains tight, with low unemployment and elevated job vacancies, but both measures have softened in recent months. Net gains in nonfarm payroll employment averaged 375,000 jobs per month in the second quarter of 2022 compared with 539,000 jobs, on net, added per month in the first quarter and 590,000 jobs, on net, added per month in the second half of 2021. In June 2022, the unemployment rate was 3.6 percent (unchanged since March and near its prepandemic low) and there were about 1.8 job vacancies for every unemployed worker (one of the highest readings in the near 22-year history of this series though down from its highest level of 2.0 in March).

Graphical depiction of almost all these series is in this post.

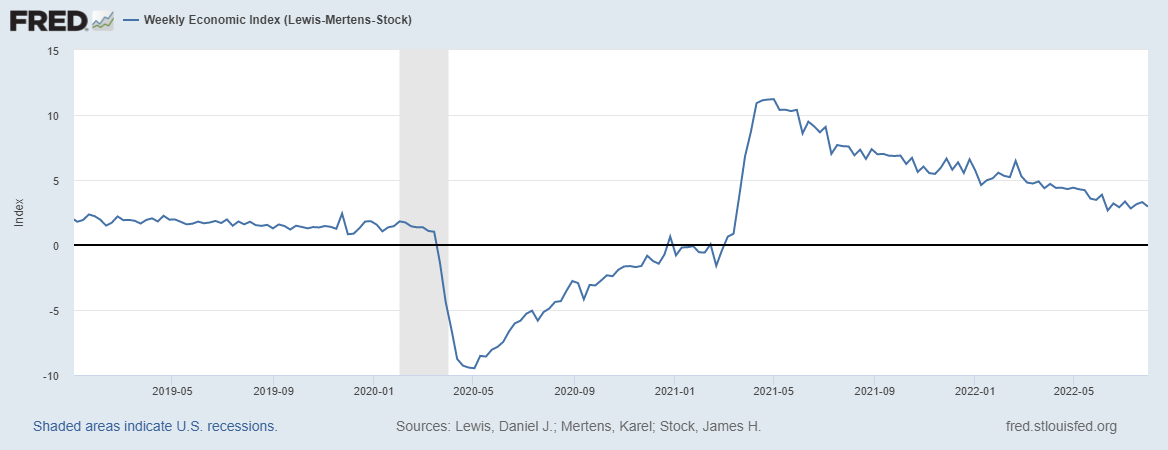

For data through July, we have the Lewis-Mertens-Stock Weekly Economic Index:

(Click on image to enlarge)

Source: NY Fed via FRED, accessed 8/4/2022.

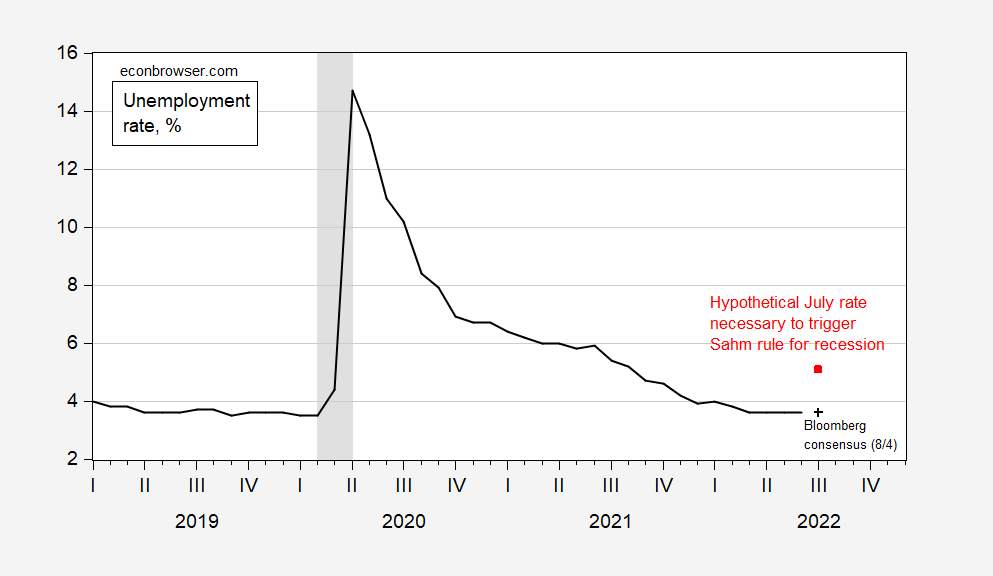

Tomorrow we receive unemployment rate estimates for July. In order to trigger the Sahm Rule for recession, the unemployment rate would need to jump to 5.1% (that is, the 3-month moving average unemployment rate would need to jump by 0.5 ppts above the lowest unemployment rate recorded in the last year. Bloomberg consensus is for the unemployment rate (U6) to stay constant at 3.6 ppts.

(Click on image to enlarge)

Figure 1: Unemployment rate U6 (black), Bloomberg consensus of 8/4 (black +), hypothetical rate necessary to trigger Sahm Rule (red square). NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, Bloomberg, NBER, author’s calculations.

More By This Author:

Heavy Truck Sales And Vehicle Miles Traveled Growth As Coincident IndicatorsSpreads Diverge As Inflation Breakeven Drops

Additional Perspective On The GDP Release

Disclosure: None.