“Cash Flow Is The Name Of The Game” Stock Market

Rotation

I had the pleasure of joining David Lin on “The David Lin Report” this week. Our view is that conditions are similar to Oct 2023 where laggards abruptly flipped from non-stop pain to gaining massively in the following few months. I go into detail with David as to why we have this outlook and what are the explicit catalysts for a similar abrupt turnaround. You can watch it here.

Cash Flow

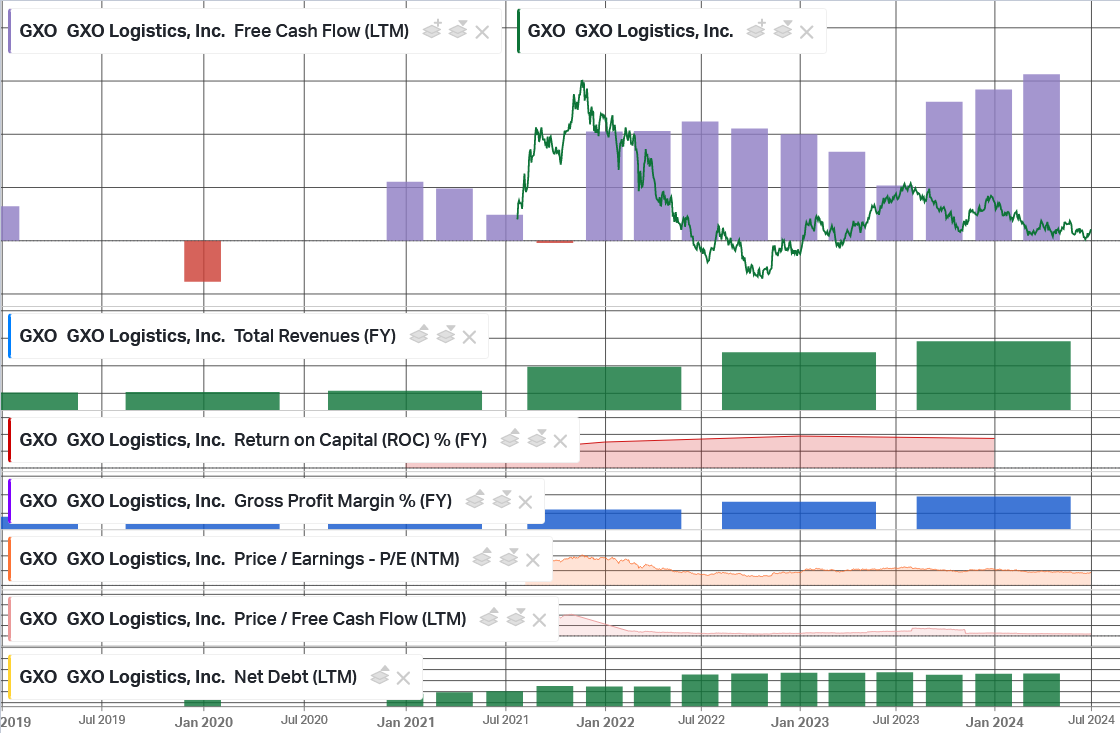

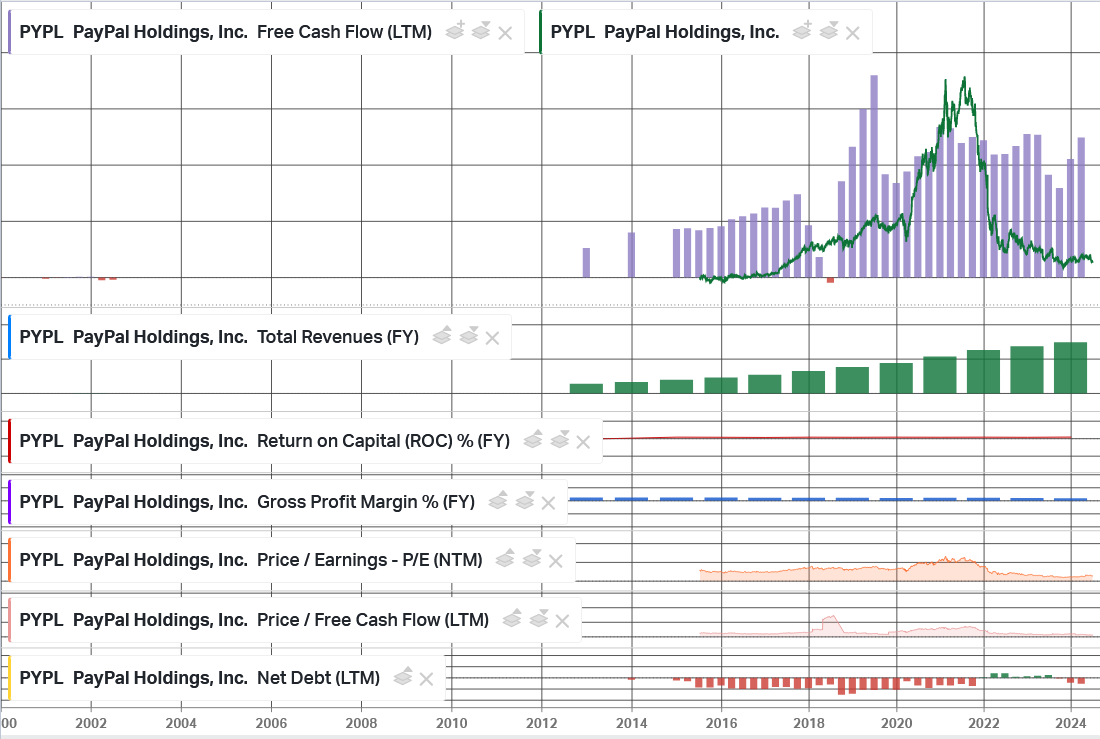

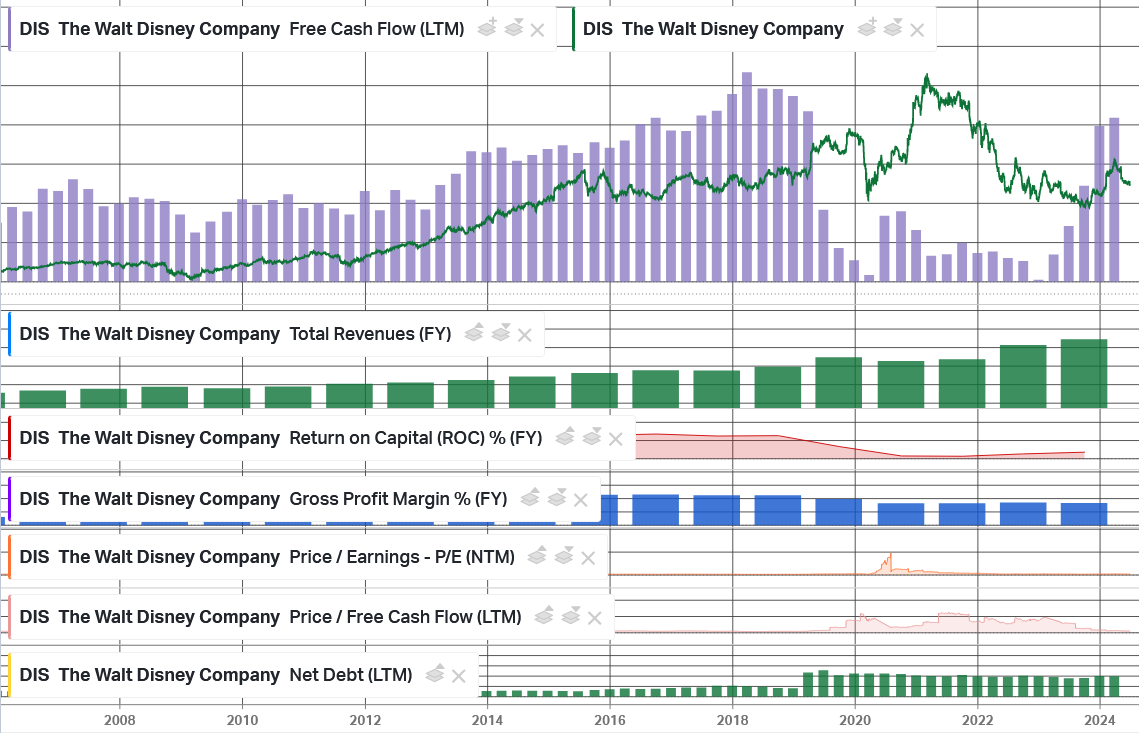

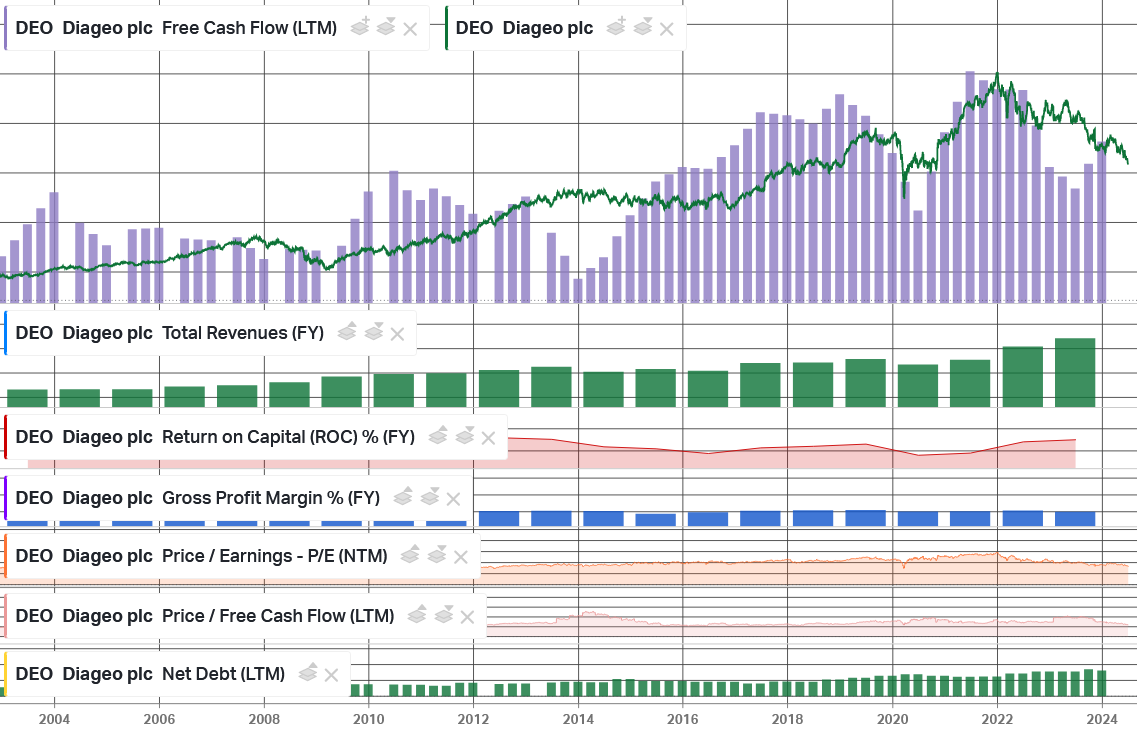

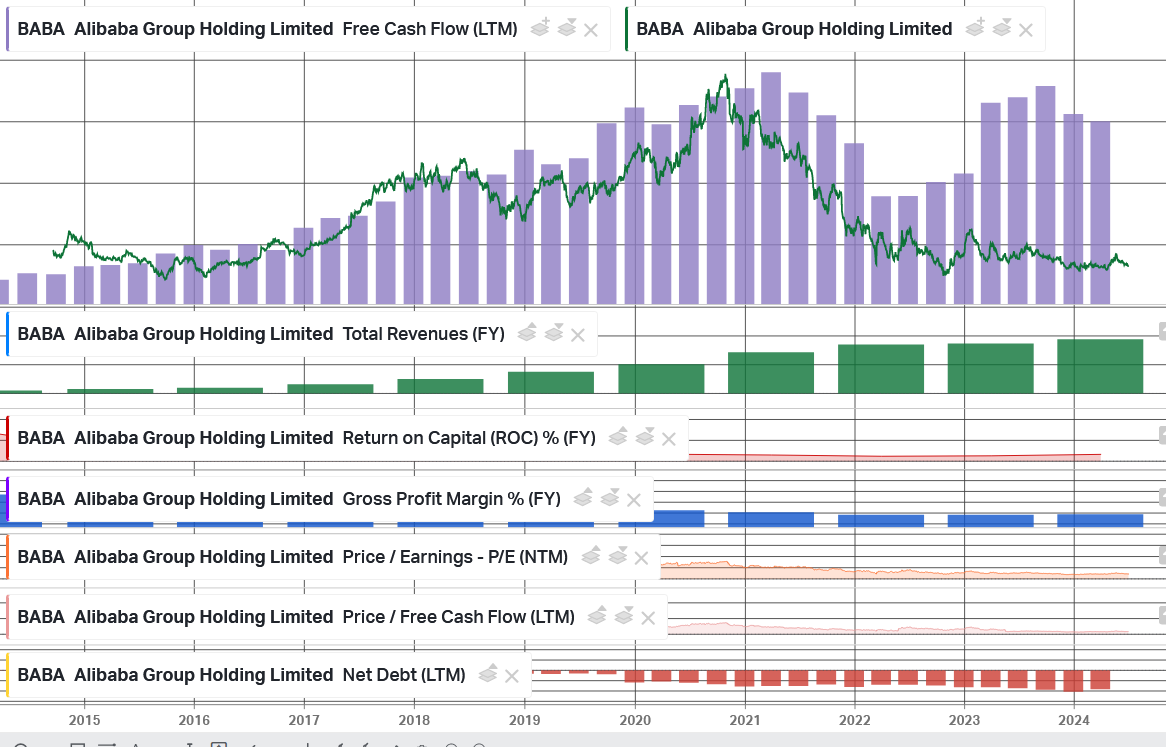

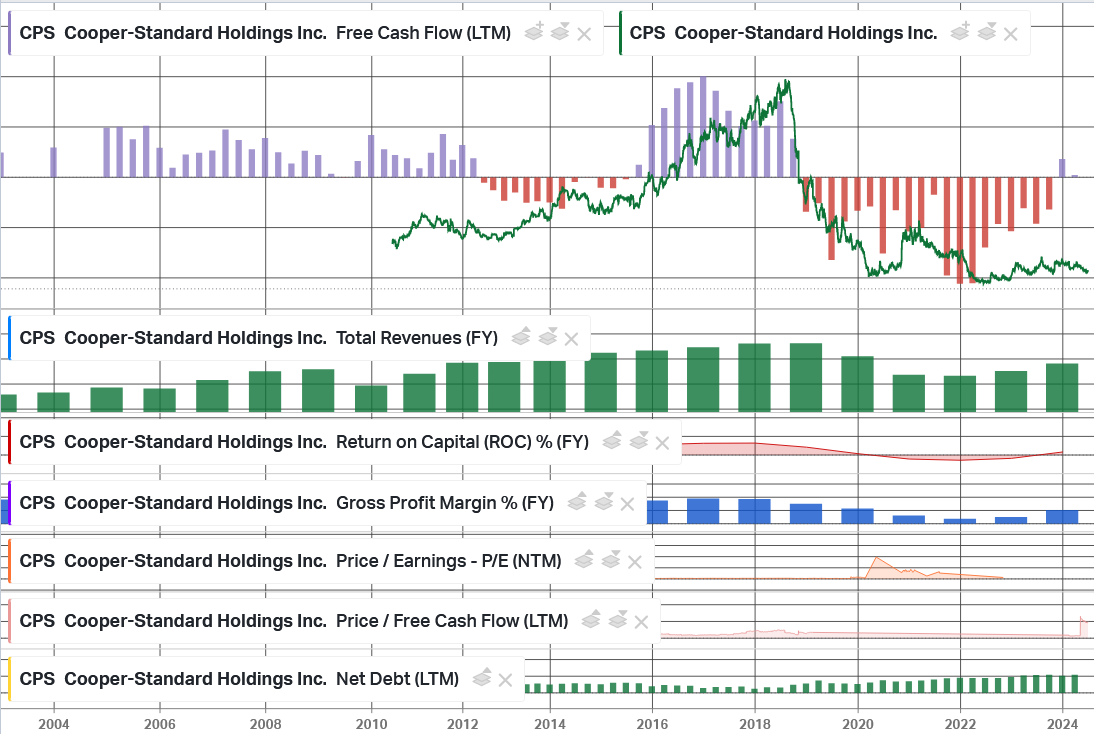

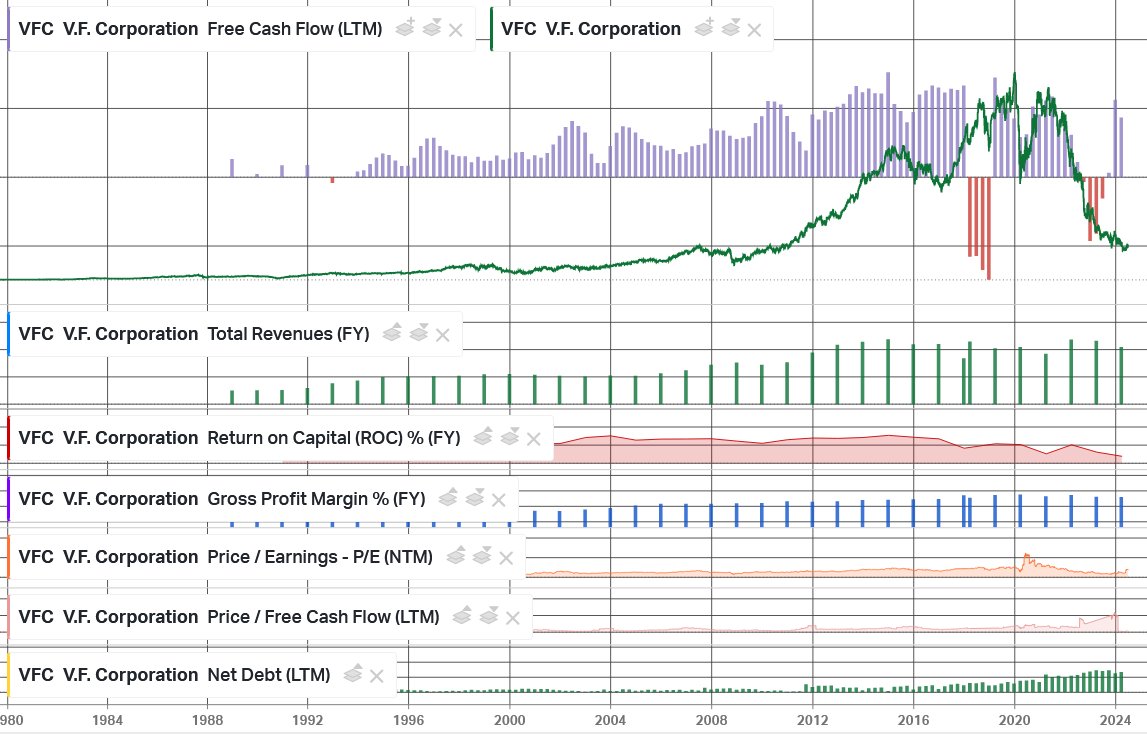

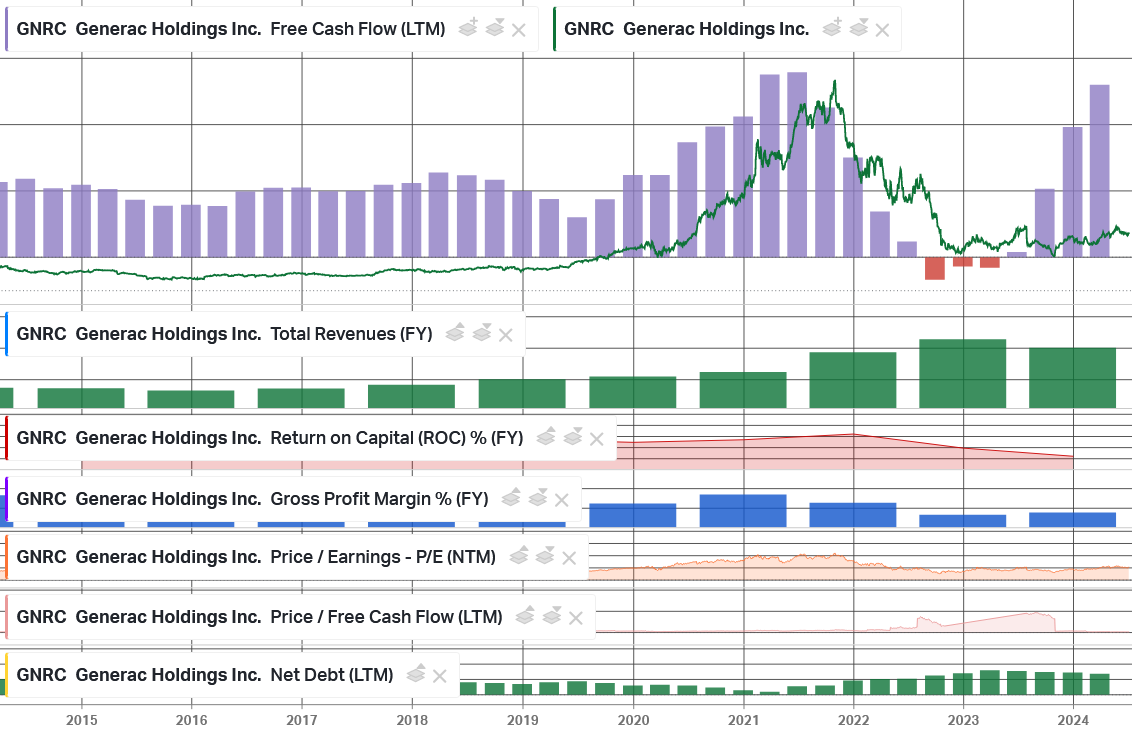

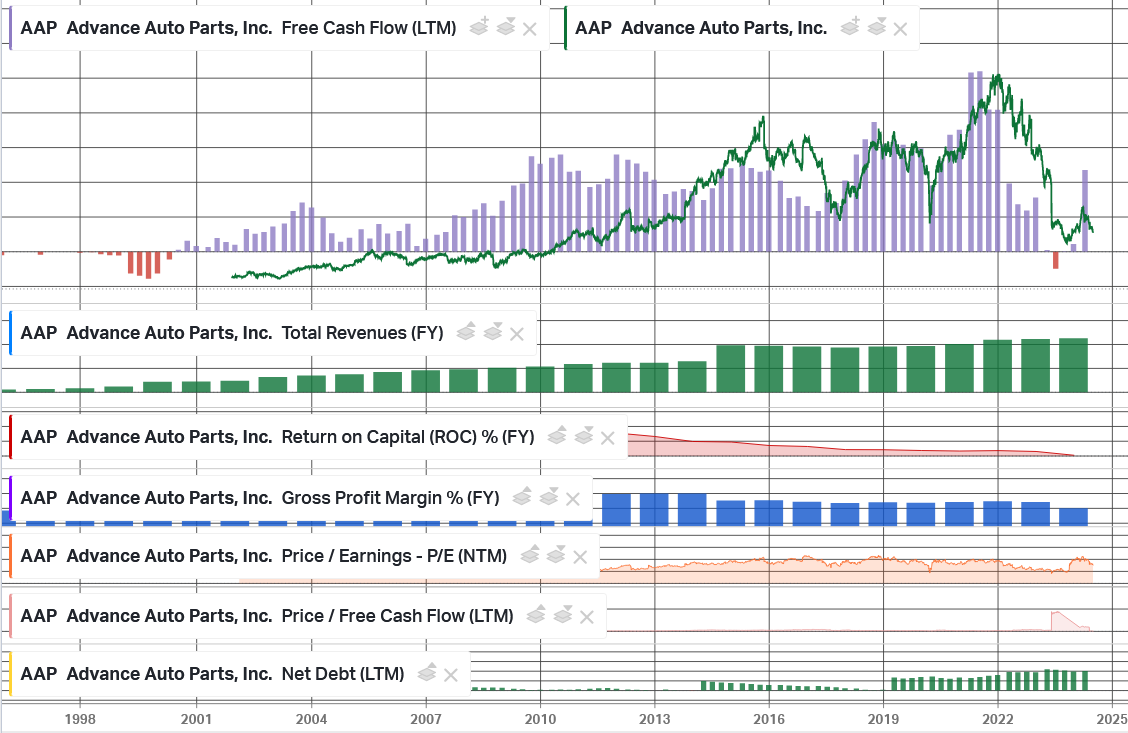

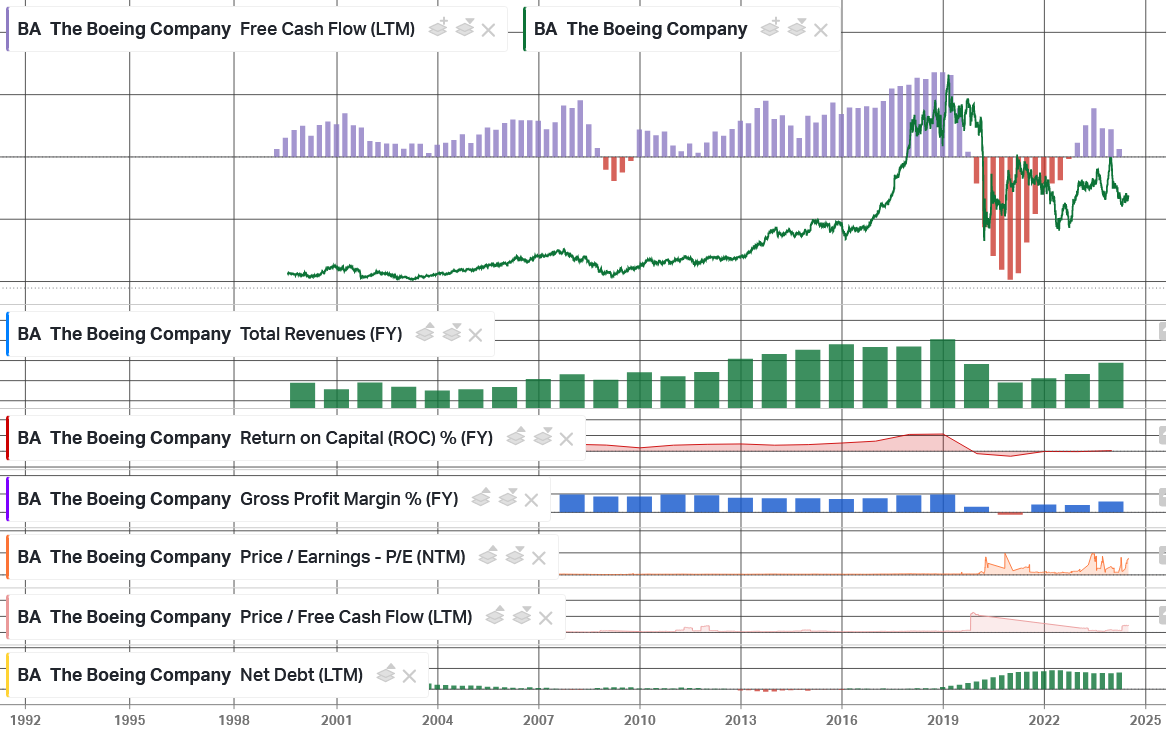

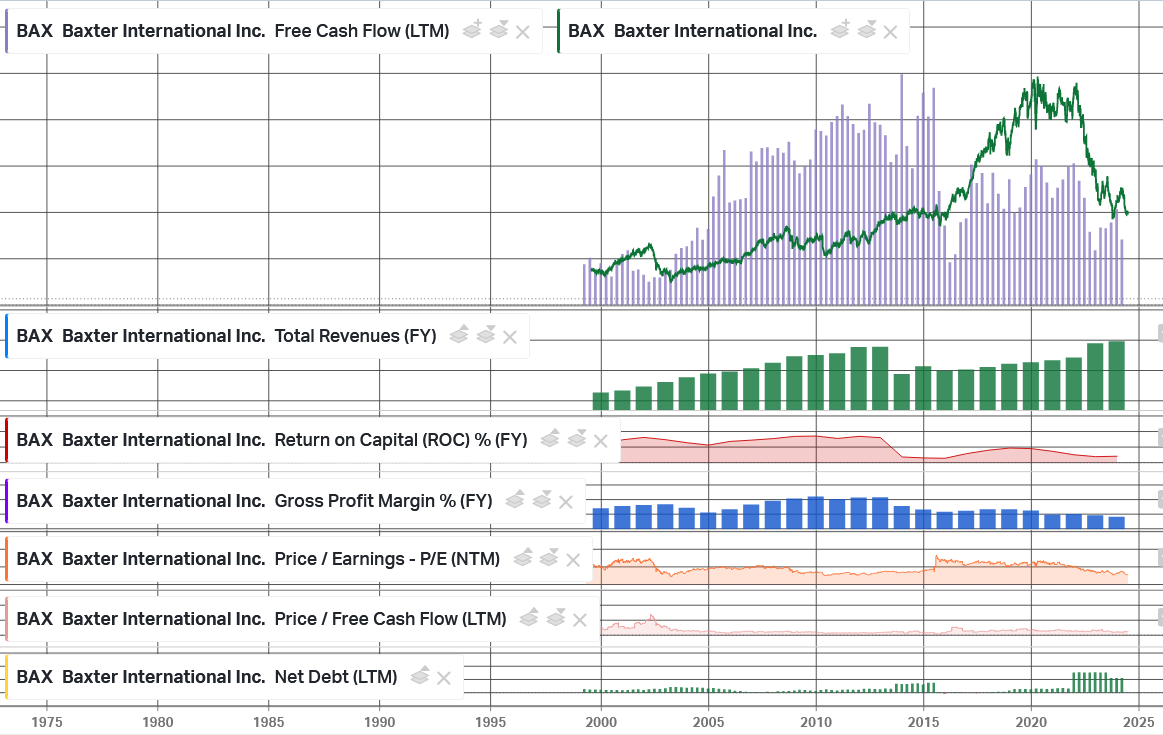

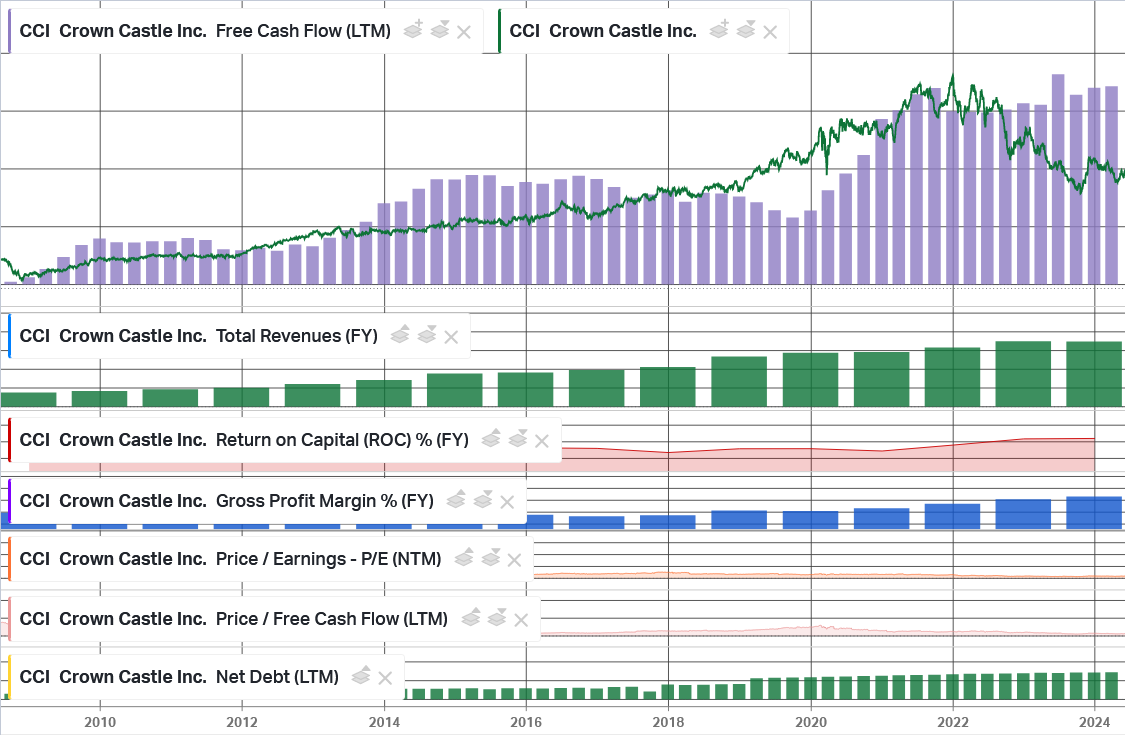

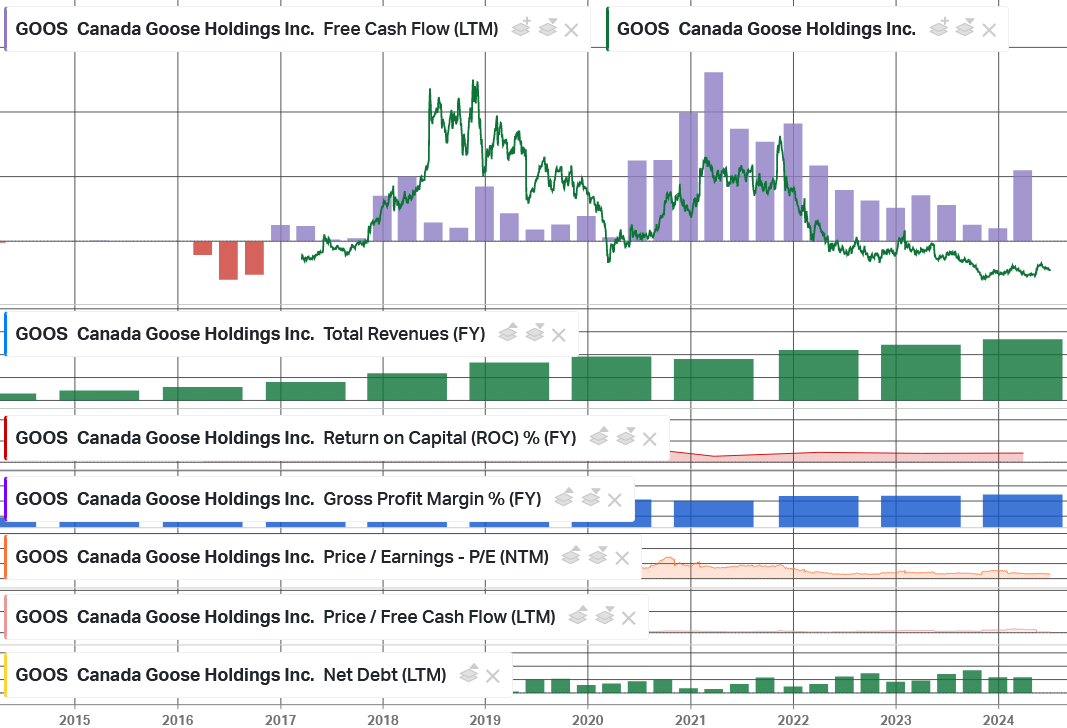

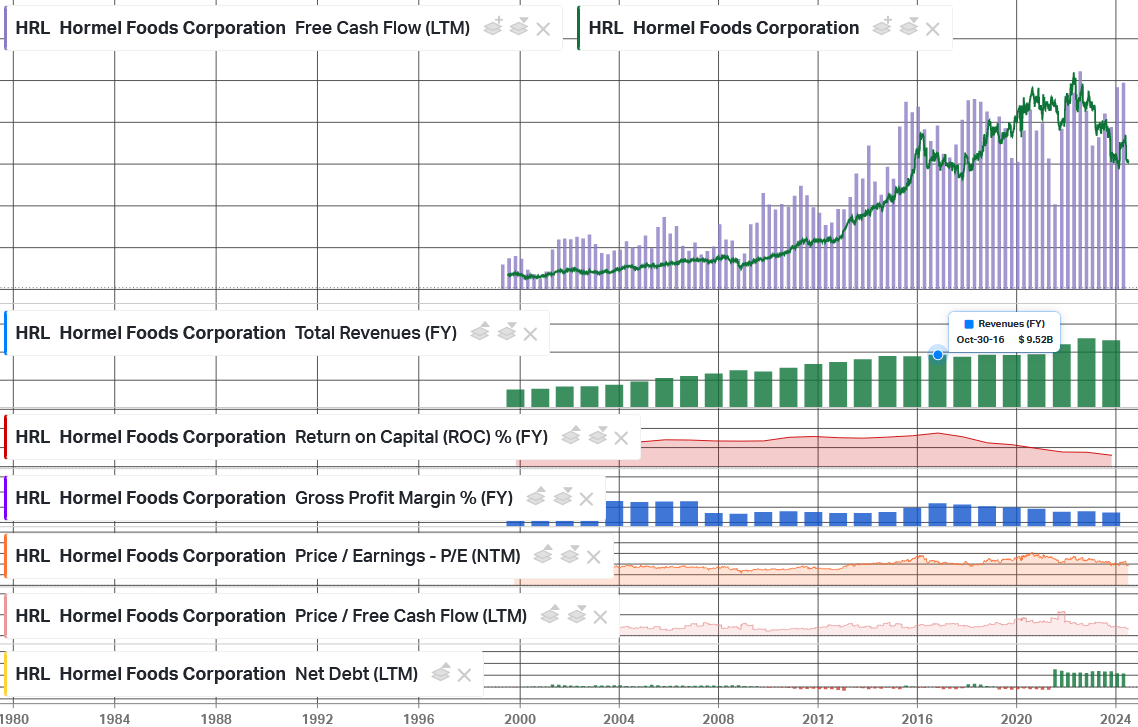

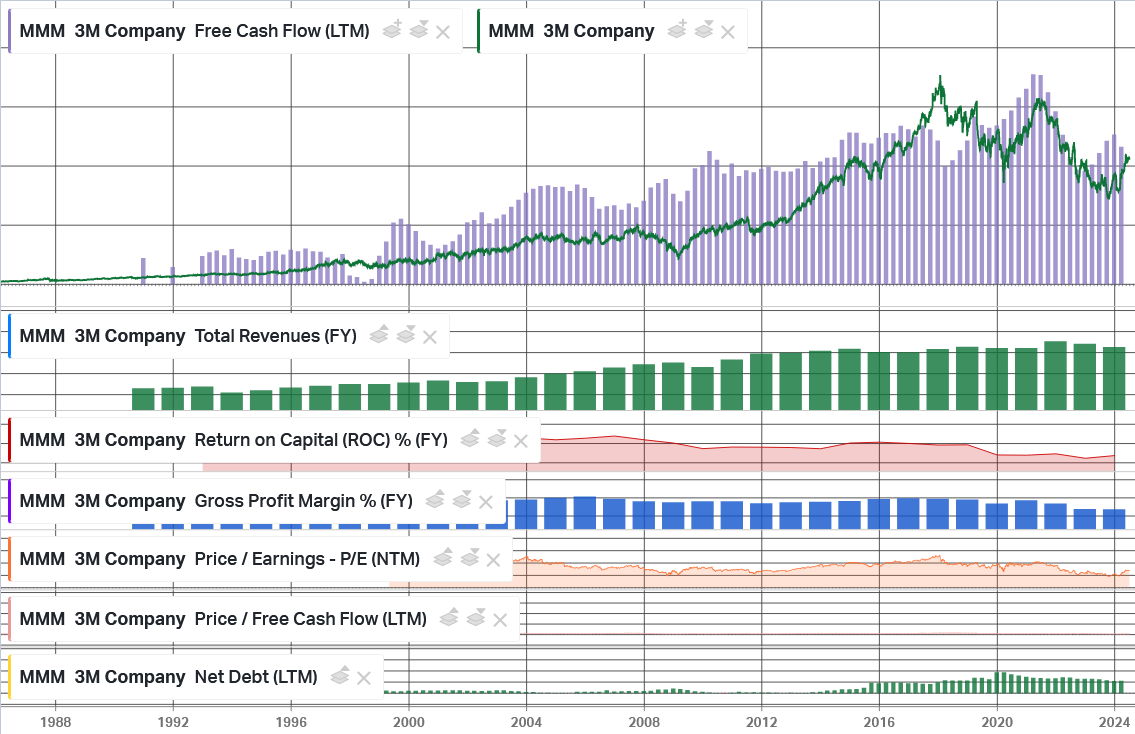

I spent the last weekend going through a number of positions as well as other stocks we have covered in past podcast|videocast episodes. The conclusion I came to is that we don’t own enough of them! I’ve rarely seen periods where price has lagged a turn or recovery in free cash flow to such an extent. The last time I saw anything like this was Oct. 2023. Then we got 2+ years of gains in 2 months! I cover some of the catalysts in the last 2 weeks podcasts (245 and 244). Here are some sample tables to illustrate the point (Free cash flow is the purple bars at top. Stock price is green line):

(Click on image to enlarge)

The Fed

Liquidity is becoming a problem and the Fed (and other Central Bankers) know it. Higher for longer is a luxury they can no longer afford. Chicago Fed President laid out the case this week.

The “Fed Whisperer” (Nick Timiraos) at the WSJ started to lay the groundwork this week:

More By This Author:

The Next Pain Trade – Stock Market

What I’m Thinking About Now – Stock Market (And Sentiment Results)…

Trucks And Towers Stock Market (And Sentiment Results)…

Disclaimer: Not investment advice. For educational purposes only: Learn more at HedgeFundTips.com.