Canadian Dollar Hit New Lows After Strong US Inflation Data

Image Source: Pexels

- The Canadian dollar dived while the US dollar rallied after strong US CPI data.

- The Bank of Canada kept rates on hold but hinted at a potential rate cut, probably in June.

- Bets on a Fed cut in June dropped from 50% to 17% following US inflation figures.

The Canadian dollar tumbled nearly 0.8% in Wednesday’s early North American session to reach the lowest levels seen so far this year. US Consumer Prices Index figures for March confirmed that inflation remains stubbornly high, which sent US Treasury yields and the US dollar to fresh multi-month highs.

Price pressure remains sticky at levels well above the Federal Reserve’s 2% core inflation target, as last week’s strong employment and steady price growth data suggested. These figures back the Fed’s hawkish side and practically ditch its plan for three rate cuts, which was devised in January. This is expected to underpin the US dollar in the near-term.

In Canada, the Bank of Canada kept interest rates unchanged, as widely expected, but noted a downward trend in core inflation. The market has observed those comments as a hint toward a rate cut in June, which has increased downside pressure on the Canadian dollar.

Market Movers: USD/CAD Rallied as US CPI Figures Cast Doubt on Fed Cuts

- The Canadian dollar was seen trading at five-month lows, weighed down by strong US CPI data and the dovish-tilted BoC statement.

- US headline inflation rose at a 0.4% pace in March against market expectations of a 0.3% increase. The year-over-year rate accelerated to 3.5% from 3.2% in February.

- Core CPI showed a similar picture with a 0.4% monthly increase, above the market consensus of 0.3%, with the yearly rate steady at 3.8%.

- Treasury yields for the US 10-year note reached the key 4.5% level for first time this year. The 2-year yield jumped 25 basis points to hit levels right below 5%.

- Bets for a Fed cut in June have plunged from about 50% to 17% following the release of US CPI data, according to the CME Group FedWatch Tool.

- The BoC left interest rates unchanged at 5%, but Governor Macklem revealed that the committee discussed the possibility of cutting rates.

The Canadian Dollar's Price Today

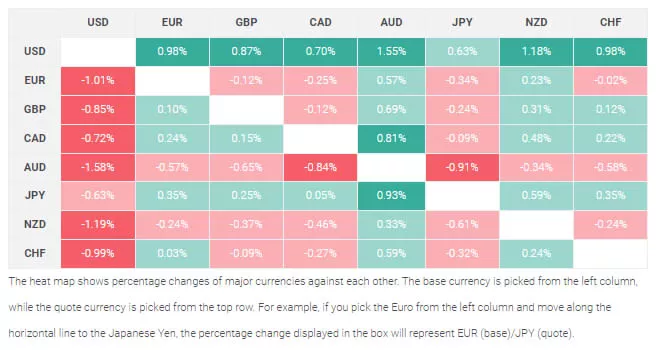

The table below shows the percentage change of the Canadian dollar against other major currencies. The Canadian dollar was seemingly the strongest against the Australian dollar.

Technical Analysis: USD/CAD Broke Above Channel Top, Next Resistance Seen at 1.3740

The US dollar broke above the last two months’ channel top as the strong US inflation data dampened hopes of a rate cut in June. Bulls have seemingly taken control, sending the pair to levels near the 1.3700 mark.

The Relative Strength Index (RSI) appeared to be nearing overbought levels, which may lead to some correction. In that case, the reverse trendline might provide support on the path toward the 78.6% Fibonacci retracement at 1.3740 and 1.3770. The measured target of the broken channel is the mid-November high at 1.3845. Supports are seen at the mentioned channel top, at 1.3650 and 1.3545.

USD/CAD Four-Hour Chart

(Click on image to enlarge)

More By This Author:

EUR/USD Flip-Flops In A Range Prior To US CPI

USD/JPY Pushes Up To Within Touching Distance Of 152.000, Analysts Bullish

Japanese Yen Remains Confined In A Range Near Multi-Decade Low Against USD

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more