Canadian Dollar Fell Against The Greenback After Wildly Mixed NFP

Image Source: Pexels

- The US NFP report on Friday printed a big upswing to expectations, but it also included steep revisions.

- Canadian data was also mixed, as Canada added more jobs than expected but softer wages.

- Next week will feature US CPI inflation numbers, as well as low-tier Canadian data.

The Canadian dollar roiled against the US dollar on Friday after the US Nonfarm Payrolls figures came in mixed, and Canadian employment figures were broadly overshadowed by US data. The Canadian dollar was broadly softer on the day, as it shed weight against all of its major currency peers.

Canada added more jobs than expected in February, but wage growth slowed slightly while the Unemployment Rate ticked a bit higher. On the US side, a big beat on NFP forecasts was overshadowed by a massive downside revision to January’s jobs figure, leaving market sentiment hamstrung.

Next week’s economic calendar is notably light on Canadian releases, and markets will be getting the next update on US inflation when February’s Consumer Price Index (CPI) prints next Tuesday.

Market Movers: Split NFP Print Left Markets Churning on Friday

- The US NFP report for February added 275,000 new jobs during the month versus the forecasted amount of 200,000.

- January’s NFP print saw a steep correction, revised down to 229,000 from the previous 11-month peak of 353,000.

- Annualized Hourly Earnings growth for the year ended February eased to 4.3% versus the expected 4.4%, and the previous print saw a slight downside revision from 4.5%.

- The US Unemployment Rate also rose in February, ticking up to 3.9% compared to the expected steady print at 3.7%.

- Canada added 40.7 thousand jobs in February, over double the forecast of 20,000 and rising slightly from the previous month’s 37.2 thousand.

- The Canadian Unemployment Rate also ticked higher to 5.8% in February from 5.7%, in-line with expectations.

- Canadian Average Hourly Wages printed at 4.9% year-over-year, easing back from the previous period’s 5.3%.

Canadian Dollar Price on Friday

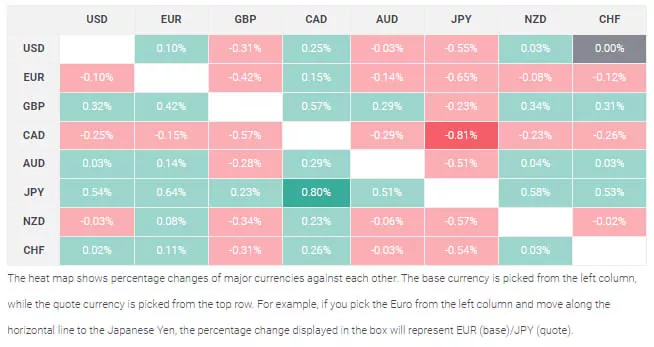

The table below shows the percentage change of the Canadian dollar against other major currencies.

Technical Analysis: Canadian Dollar Softened on Friday, Leaked Recent Gains Against the Greenback

The Canadian dollar appeared to be broadly softer on Friday, as it shed around eight-tenths of a percent against the Japanese yen and fell about half a percent against the pound. The Canadian dollar was also down about a third of a percent against the US dollar and a fifth of a percent against the euro.

The USD/CAD currency pair roiled during the US trading session, as the duo was sent down to the 1.3420 level before it recovered into the 1.3475 region. The Loonie was sharply down from the week’s highs near the 1.3605 mark, but it was seen recovering toward the mid-range as Friday came to a close.

Friday’s post-dip recovery sent the USD/CAD currency cross back into the 200-day Simple Moving Average (SMA) at the 1.3477 mark. The long-term moving average has flat-lined just below the 1.3800 handle for most of 2024, and the pair appeared set to continue struggling in the near-term as it churned within a rough range between the 1.3600 level and the 1.3400 mark.

USD/CAD Hourly Chart

(Click on image to enlarge)

USD/CAD Daily Chart

(Click on image to enlarge)

More By This Author:

EUR/USD Hit A New High Before Falling Back After Mixed US NFP

GBP/USD Grapples With 1.2700 Handle As Markets Bid Into A Hefty Trading Week

Canadian Dollar Trades Into Tight Range With Next BoC Rate Call In The Pipe