EUR/USD Hit A New High Before Falling Back After Mixed US NFP

Image Source: Pixabay

- The EUR/USD currency pair spiked after the US NFP print on Friday, but mixed numbers confounded the markets.

- The US NFP numbers showed more jobs were added, but steep revisions crimped risk appetite.

- Next week: US and EU CPI inflation data are to be released on Tuesday.

The EUR/USD currency pair found some room on the top end on Friday, as the duo climbed to a fresh high for the week near the 1.0980 mark. However, bullish momentum got pulled down after investors realized the US Nonfarm Payrolls (NFP) print was more complicated than the initial reaction.

US NFP job additions came in above expectations, but the previous print was steeply revised lower, taking it down from an 11-month high. European final Gross Domestic Product (GDP) figures broadly came in at expectations, and markets will be pivoting to face next Tuesday’s Consumer Price Index (CPI) inflation prints for both the US and the Eurozone.

Market Movers: Mixed US NFP Confounded Markets

- February’s US NFP data showed that 275,000 new jobs were added during the month, well above the forecasted 200,000.

- The figure was higher than January’s print, which was revised sharply lower to 229,000 from the initial 11-month high of 353,000.

- US Average Hourly Earnings growth in February slowed more than expected to 0.1% month-over-month, below the expected 0.3% and down from the previous month’s 0.5%.

- Annualized Average Hourly Earnings eased to 4.3%, missing the forecast of 4.4%. The previous period also saw a slight downside revision to 4.4% from 4.5%.

- The EU’s final Gross Domestic Product did not change from the preliminary release, with Q4’s quarter-over-quarter GDP staying flat at 0.0%.

- Germany’s year-over-year Producer Price Index (PPI) unexpectedly recovered ground in January, coming in at -4.4% compared to the forecast decline to -6.6% versus the previous month’s -5.1%.

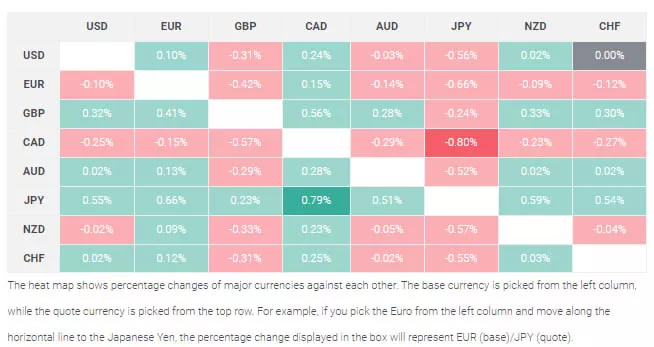

Euro Price on Friday

The table below shows the percentage change of the euro against other major currencies on Friday.

Technical Analysis: EUR/USD Found a New High before Slumping Back

The EUR/USD currency cross rose to a new eight-week high on Friday, climbing to the 1.0981 mark before settling into the day’s range near the 1.0930 figure. The pair appeared to be on pace to finish in the green for a third straight week.

The EUR/USD pair closed bullishly for all but three of the last 17 straight trading days, but that run would be threatened if the pair could close below the 1.0951 level. The euro has recently been trading well above the 200-day Simple Moving Average (SMA) at 1.0833, extending a bullish recovery after catching a firm bounce from a pullback to 1.0800.

EUR/USD Hourly Chart

(Click on image to enlarge)

EUR/USD Daily Chart

(Click on image to enlarge)

More By This Author:

GBP/USD Grapples With 1.2700 Handle As Markets Bid Into A Hefty Trading WeekCanadian Dollar Trades Into Tight Range With Next BoC Rate Call In The Pipe

EUR/USD Rebounded On Friday After US ISM PMI Miss Sparked Risk-On Investor Appetite