Buy Stocks Now? When It’s Time, You Won’t Want To

Buy stocks in a bear market. It sounds a whole lot easier than it is. Truth be told, when it comes time to buy stocks, you won’t want to.

As discussed previously regarding bonds, when assets are in a bear market, and prices are lower, investors repeatedly don’t buy even though they should. Such is why after three major bull markets since 1980, 80% of individuals are woefully unprepared for retirement.

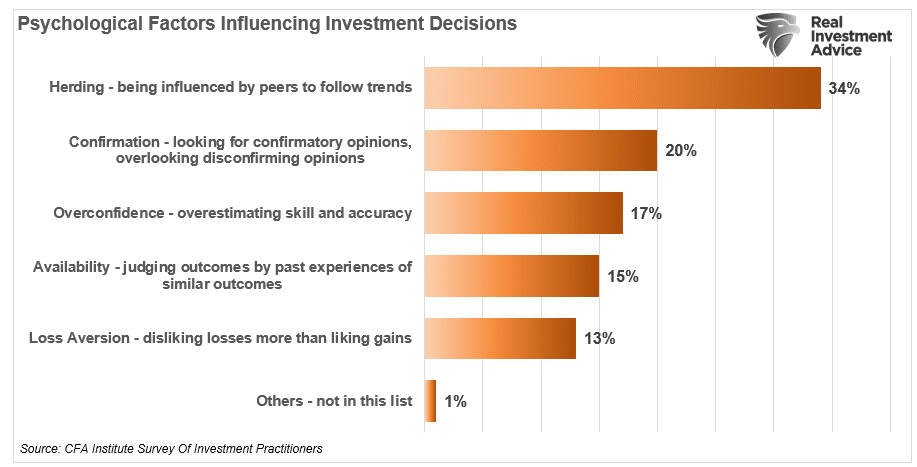

“Loss aversion” is one of the leading factors influencing investment decisions, according to a recent survey from the C.F.A. Institute of investment practitioners.

What is loss aversion?

“Loss aversion is a tendency in behavioral finance where investors are so fearful of losses that they focus on trying to avoid a loss more so than on making gains. The more one experiences losses, the more likely they are to become prone to loss aversion.

Research on loss aversion shows that investors feel the pain of a loss more than twice as strongly as they feel the enjoyment of making a profit.” – Corporate Finance Institute

According to CFI, examples of “loss aversion” include:

- Investing in low-return, guaranteed investments over more promising investments.

- Not selling a stock when your current rational analysis of the stock indicates that it should be.

- Selling a stock that has gone up in price to realize a gain of any amount even though analysis indicates investors should hold the stock.

- Telling oneself that an investment is not a loss because the sell transaction has not occurred.

These are all emotional decisions driven by price declines.

Retail Investors Don’t Buy Real Bottoms.

“It should be emphasized that high stock prices are the enemy of the rationale buyer. Conversely, lower stock prices are the ally of the rationale buyer.” – Doug Kass

As noted in a recent newsletter, and to Doug’s point, many stocks are in significant bear markets despite the S&P 500 index only being in a correction. To wit:

As the table below shows, of the 1380 companies screened with market capitalizations above $7 billion, the 120 companies showed the most price destruction from their 52-week highs. You will notice many of the “meme stock” favorites like Shopify, Docusign, Pintrest, Nvidia, etc. These companies are down 46% or more from their 52-week highs. In anyone’s book, that is a “bear market.”

Digging deeper, we find many of the holdings held by the Ark Innovation Fund (ARKK) are down 40% or more, which is why there is such a performance difference from the S&P 500.

While not every company that is down 20% or more from their respective highs is “fundamentally cheap,” there is opportunity. However, historically speaking, when bear markets sink their claws into investors, it typically takes quite some time for investors to return to their previous speculative ways. Such is because the destruction of wealth, and psychological devastation, are so pervasive that individuals no longer trust themselves to make proper investment decisions.

Such is not the case currently. As seen in last week’s Bed Bath & Beyond (BBBY) debacle, retail investors have yet to learn their lesson. Since the market bottom in July, retail investors piled back into the same “Meme stocks.“ The eventual mauling was not surprising.

Since retail investors tend to be first-level thinkers when the markets finally bottom, it is unlikely that “Meme stocks” will lead the way higher.

First Level Thinking

“Oaktree Capital Management’s Howard Marks’ notion of both first and second level thinking comes to mind and seems appropriate to highlight in this correspondence.

- First-level thinking says, ‘The market faces a host of headwinds; let’s sell the market.’

- Second-level thinking says, ‘There are headwinds, but everyone knows them, and they get partially discounted in market prices; let’s buy the market.’

The issue, of course, is to what degree those concerns have gotten discounted? Unfortunately, the hard part as we will only know for sure with the benefit of hindsight!” – Doug Kass

As shown in the chart below, while the recent selling discounted many stocks, the index, as a whole, remains overvalued and significantly deviated above its long-term growth trend.

As noted by the recent resurgence of speculative mania from the recent lows, we doubt the market has made its final bottom. Such is particularly the case as the Fed hikes rates, reverses its balance sheet, and the economy slows.

Nonetheless, pockets of opportunity do exist currently. The only issue is whether individuals will find the courage to buy when every instinct tells them to sell. Notably, shifting from first to second-level thinking is incredibly difficult to do. Our emotions will push us to react by assuming current market conditions will continue indefinitely. As humans, we seek to avoid pain; therefore, we respond to stop the losses from mounting.

However, at that point of capitulation, the worst decisions get made.

“‘The whole problem with the world is that fools and fanatics are always so certain of themselves, and wiser people so full of doubts.’ – Bertrand Russell

These are uncertain times, and we should be full of doubt, but with that uncertainty comes opportunity.” – Doug Kass.

Buying stocks when there is “blood in the streets” is the hardest thing to do.

It is also the most profitable in the long run.

More By This Author:

Paul Volcker And 1982: Why Now Isn’t ThenS&P 3500 By Year End If QT Continues

Economic Slowdown Now, Recession Coming In 2023

Disclaimer: Click here to read the full disclaimer.