Buy, Babe Buy – Or Maybe Not?

Recently, the US stock markets were able to regain some of their level, but since December 2024 the bulls have been showing a tired side. The thoughts number 58 also pointed out the 17-year cycle, which has always brought a correction of at least 20% since World War II.

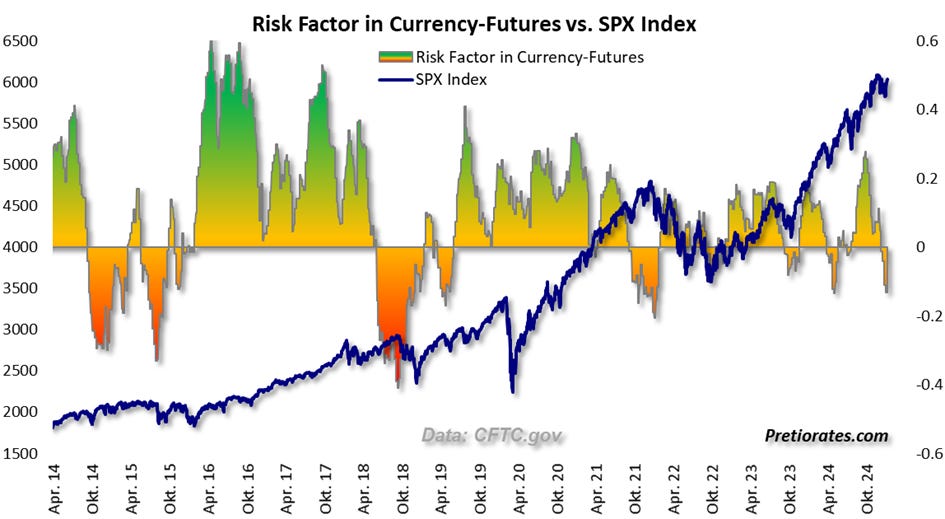

In fact, there are already some scratches on the market picture, growing in number. Another is the ‘Risk Factor’, which measures the futures positions in hard and less hard currencies. The hard currencies include the US Dollar, the Euro, the Japanese Yen, the Swiss Franc and the British Pound. So if investors prefer investments in these currencies, this is also an indication that the willingness to take risks is decreasing (risk off). In the past, these phases were always accompanied by corrections in the stock markets...

(Click on image to enlarge)

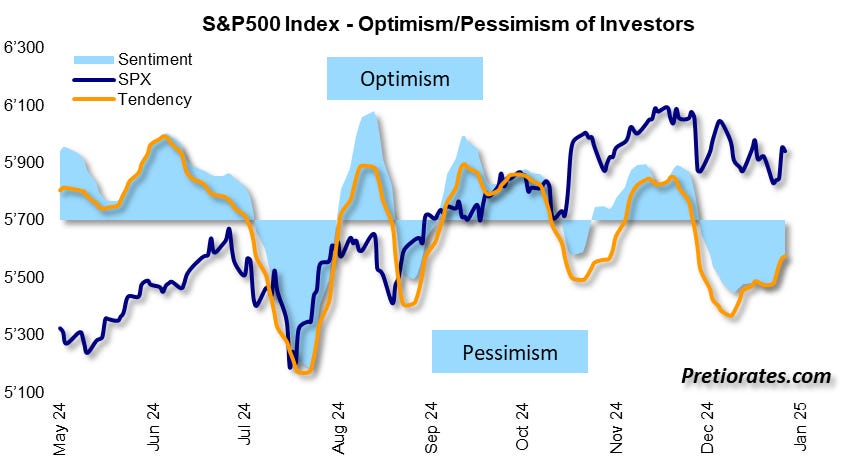

Sentiment in the S&P500 has deteriorated significantly since December 2024 and remains in pessimistic territory...

(Click on image to enlarge)

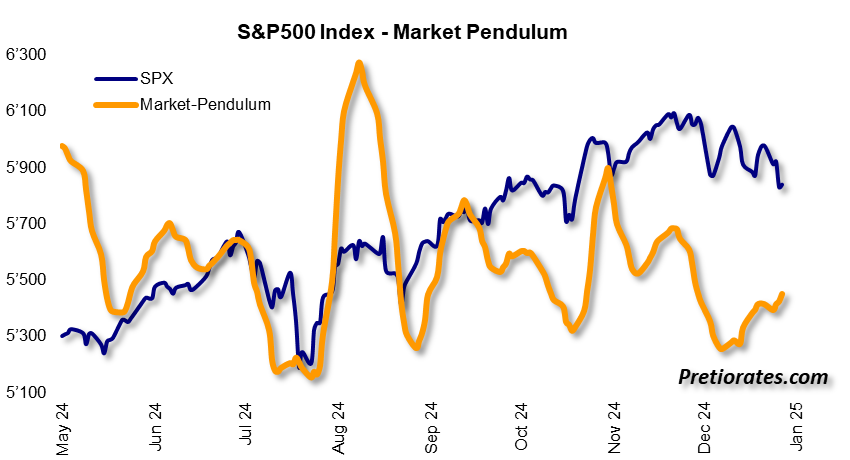

In the short term, however, the ‘Market Pendulum’ indicates that the current technical recovery may continue for a while...

(Click on image to enlarge)

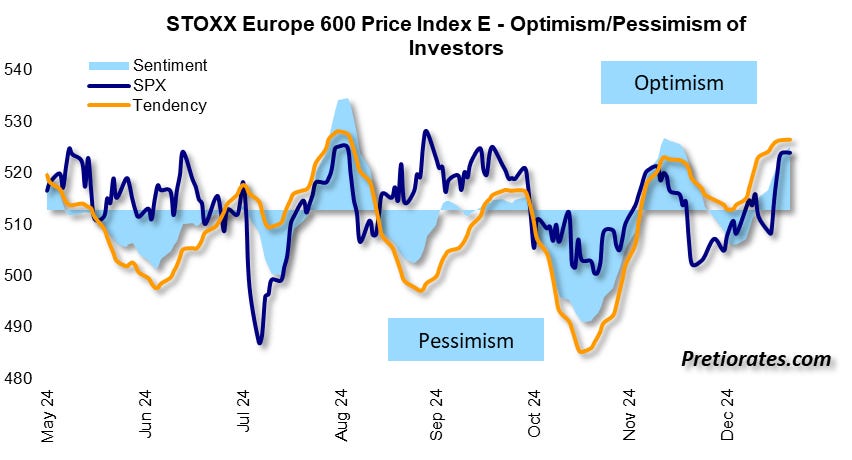

Besides the US stock markets, the other markets are almost forgotten. While US equities still made significant gains in the fall of 2024, the pan-European Stoxx600 Index is actually not making any headway. Currently, it is showing itself from an optimistic side again, but real advances cannot be realized this time either...

(Click on image to enlarge)

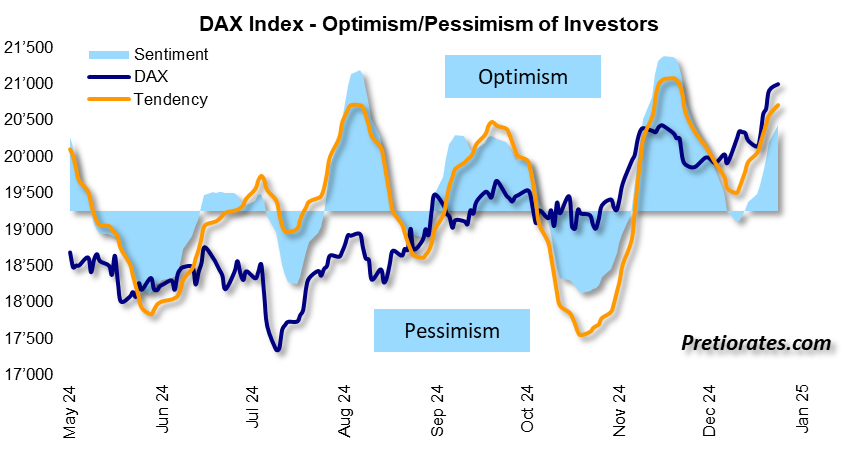

Only the German stock market has been impressing for many months. This is particularly impressive because the political elite is anything but supportive. In any case, the mood in the German stock market is significantly better than that in politics...

But one should not forget: for the large German companies represented in the DAX, domestic business in Germany accounts for perhaps 10-20%, with the rest being generated globally. The IT heavyweight SAP and financial stocks in particular are driving the market...

(Click on image to enlarge)

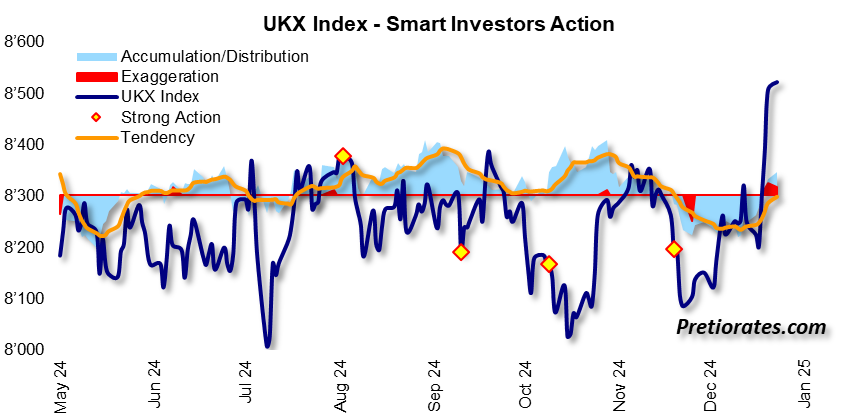

Until a few days ago, the English market was also unable to make any significant advances. This changed with weak economic data, which fueled hopes of lower interest rates. However, the ‘Smart Investors Action’ is already showing an 'exaggeration', so the trend is unlikely to be sustainable...

(Click on image to enlarge)

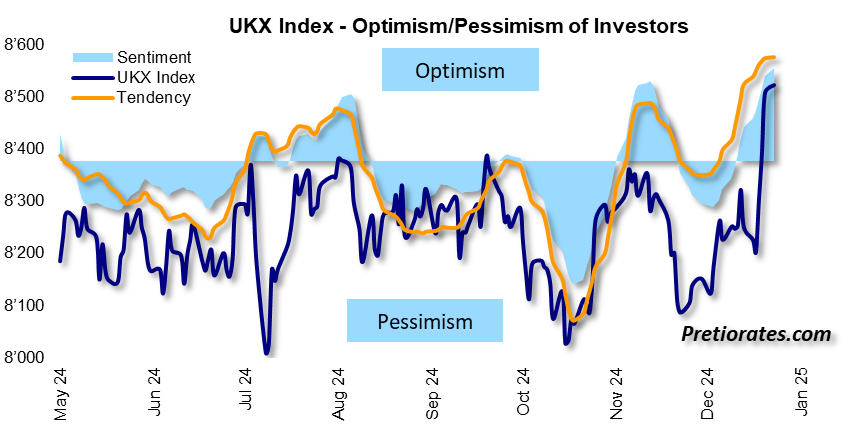

In addition, the sentiment barometer has already reached its zenith in terms of optimism...

(Click on image to enlarge)

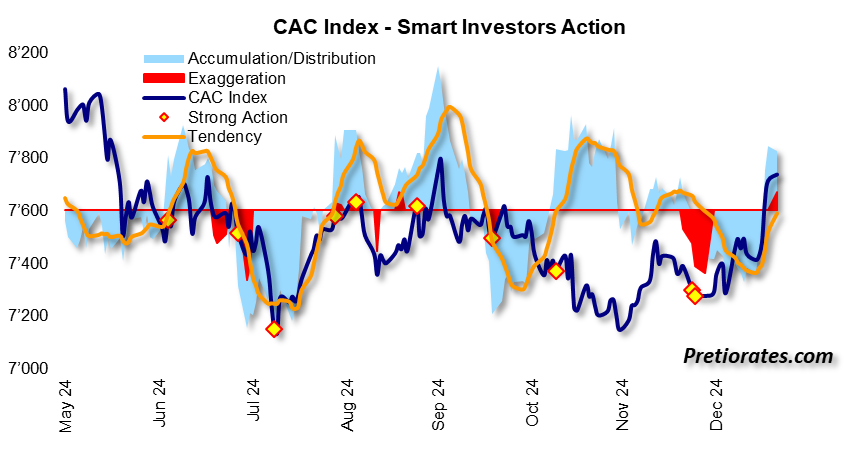

Not much happening with the French either. Here, too, the ‘Smart Investors Action’ is already showing a 'exaggeration' again, which indicates that the last upward trend will soon come to an end...

(Click on image to enlarge)

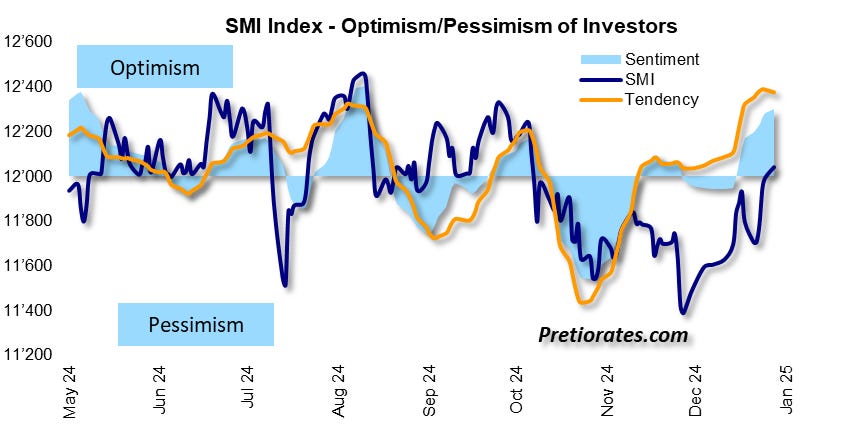

And the Swiss SMI Index, with its defensive heavyweights Nestlé, Novartis and Roche, has also advanced again recently. However, the more optimistic sentiment could soon fade again according to the indicator...

(Click on image to enlarge)

Conclusion: Investors can continue to take it easy at the start of the new year. And should the stock markets climb a little higher, there would probably be more opportunities to sell.

More By This Author:

The Goldbugs Could Be Getting Ready For Another Outing

Somebody's Gonna Get Hurt...

One Of The Surprises In 2025 Could Develop In The Oil Market

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more