Busy Week Ahead: All Eyes On The Fed’s Decision & Big Tech Earnings

Image Source: Pexels

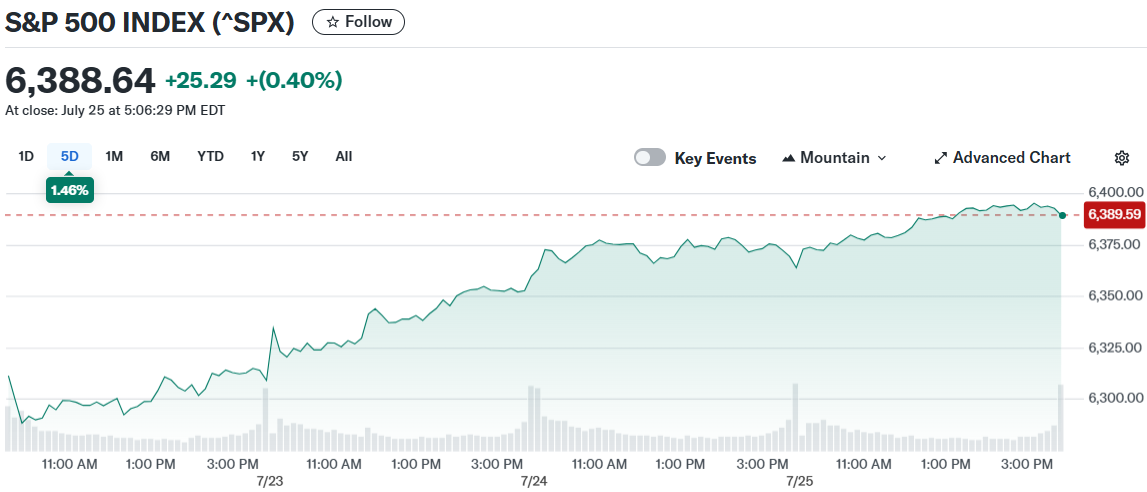

Stock markets closed at record levels as investors prepare for an intense week of economic data and corporate earnings. The S&P 500 gained 1.5% last week with five consecutive record closes.

(Click on image to enlarge)

S&P 500 INDEX (^SPX)

The Federal Reserve will announce its policy decision Wednesday with no rate changes expected. Markets show only a 3% probability of a cut this month according to CME FedWatch data.

Fed Governor Christopher Waller suggested he might support lowering rates at this meeting. However, most analysts expect the central bank to wait until September for any policy changes.

September rate cut odds stand at 64% for at least a quarter-point reduction. JPMorgan’s Michael Feroli predicts attention will focus on potential dissenting votes among committee members.

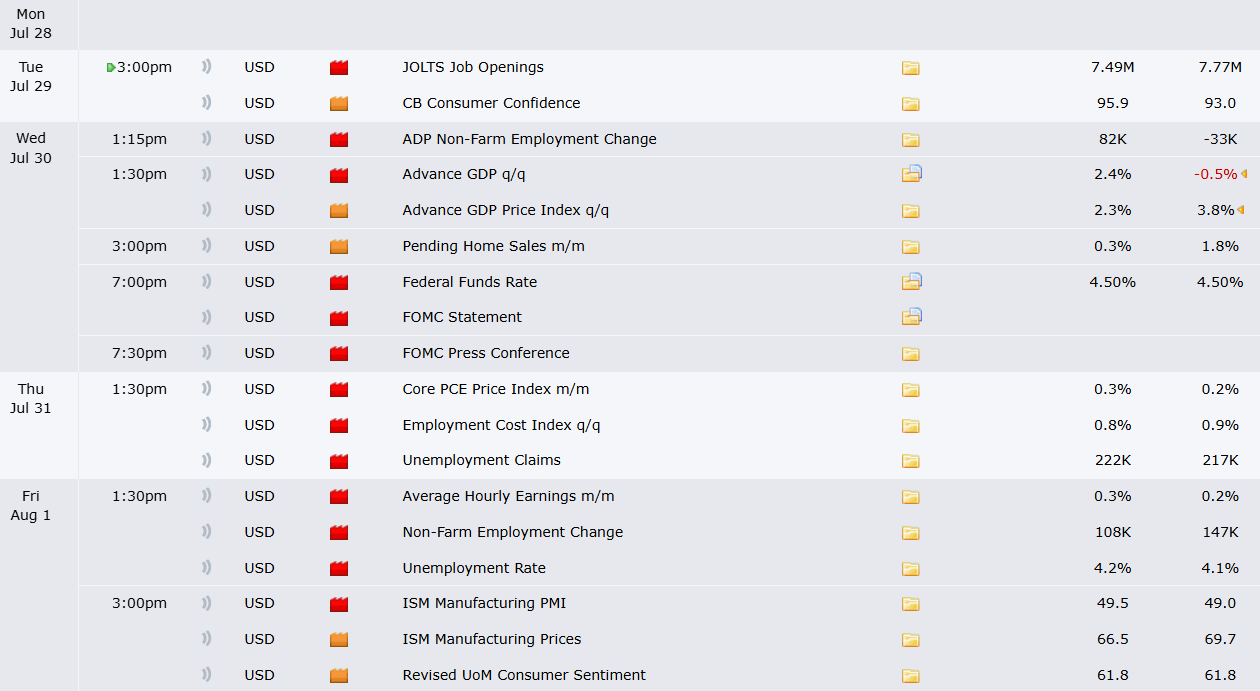

Economic data releases include second quarter GDP figures on Wednesday. Forecasts call for 3% annualized growth following the first quarter’s 0.5% decline.

Employment Data Takes Priority

The July jobs report arrives Friday with expectations for 101,000 new payrolls. Unemployment is projected to rise slightly to 4.2% from June’s 4.1% rate.

(Click on image to enlarge)

Source: Forex Factory

June employment data showed 106,000 jobs added while joblessness unexpectedly dropped. Economic conditions suggest steady labor market trends continuing through year-end.

Thursday’s core PCE inflation reading should show 0.3% monthly growth in June. This represents an acceleration from May’s 0.2% increase while annual inflation holds at 2.7%.

Corporate earnings season continues with 164 S&P 500 companies reporting results. Current earnings growth runs at 6.4% based on companies already reported.

Technology Sector in Spotlight

Apple (AAPL), Amazon (AMZN), Microsoft (MSFT) and META will deliver quarterly results this week. Artificial intelligence spending plans remain the primary investor concern following Alphabet’s (GOOGL) increased capital expenditure guidance.

(Click on image to enlarge)

Source: Earnings Whispers

Google’s parent company raised 2025 spending projections by $10 billion to $85 billion total. Other technology firms face questions about their AI investment strategies and returns.

Additional major companies reporting include Boeing (BA), Coinbase (COIN), Exxon Mobil (XOM), Chevron (CVX) and Starbucks (SBUX). The earnings season shows companies beating estimates while maintaining forward guidance.

This differs from recent quarters where companies reduced future projections after strong results. Citi’s Scott Chronert calls this “beat-and-hold” pattern supportive of continued market gains.

Analyst projections for late 2025 and 2026 earnings continue rising. Current estimates show 13.9% growth expected for 2026, up from 13.8% forecasts one month ago.

Goldman Sachs tracking of speculative trading activity shows elevated levels. Their indicator measuring unprofitable stocks and richly valued companies approaches dot-com bubble and 2021 SPAC levels.

Historical patterns suggest strong near-term market performance but weaker medium-term results following such speculative surges. Trade negotiations also continue with Friday marking another presidential deadline for deal completion.

More By This Author:

Southern Copper Corp. Stock: $2M Fund Buy Signals Confidence Amid Mixed Ratings

Tesla Inc. Stock: Musk’s Robotaxi Dreams Clash With Wall Street Worries

Lyft Bets Big On Autonomy With 2026 Launch Of Self-Driving Shuttles In U.S. Cities